E&P | NGI All News Access | NGI The Weekly Gas Market Report

Kimbell to Acquire Haymaker Assets for $404M, Boosting Position in Permian, Midcontinent

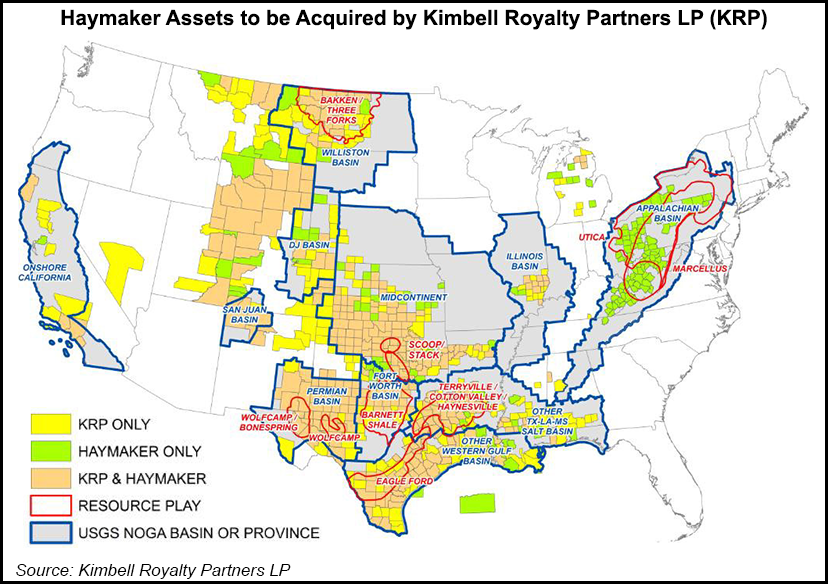

Kimbell Royalty Partners LP plans to solidify its position in the Permian Basin and the Midcontinent by acquiring all mineral and royalty interests held by Haymaker Resources LP and Haymaker Minerals & Royalties LLC in a deal valued at $404 million.

Fort Worth, TX-based Kimbell said Tuesday its position pro forma would be boosted to about 11.1 million gross (114,000 net) acres across 28 states in the contiguous United States, giving it access to every major producing basin in the Lower 48. Following the acquisition, Kimbell said it would have 73 active rigs on its properties, representing 7% of total active rigs in the United States. Of those, 95% of the rigs in the Lower 48 would be deployed in counties where it holds interests.

“The acquisition further solidifies Kimbell’s position in the Permian by adding mineral interests in the Midland Basin and further bolstering its Midcontinent position,” Kimbell management said. The Midcontinent properties include stakes in Oklahoma’s SCOOP (aka the South Central Oklahoma Oil Province) and STACK (aka the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties) plays.

“Going forward, Kimbell will remain a liquids-focused company with oil and natural gas liquids accounting for approximately 67% of estimated pro forma 1Q2018 production.”

The boards of Haymaker and Kimbell unanimously approved the acquisition, which is expected to close in 3Q2018. The deal, subject to customary closing conditions, would have an effective date of April 1.

Kimbell currently holds 5.7 million gross (71,276 net) acres in total, with a well count of 50,464 and 25 active rigs. Haymaker currently holds 5.4 million gross (42,759 net) acres, with 33,800 wells and 51 rigs. Three rigs overlap between Kimbell and Haymaker. Pro forma, Kimbell would hold 20,232 net royalty acres in the Permian; 38,686 acres in the Midcontinent; 5,468 acres in the Haynesville Shale; 5,174 acres in the Bakken Shale; 3,527 acres in the Eagle Ford Shale; 8,896 acres in the Appalachian Basin; and 564 acres in the Rockies.

Broken down by play on a 25-to-1 basis using 1Q2018 production by basin for Kimbell and the most recent complete month of production for Haymaker production from the so-called “most economic areas” of the Permian was 1,243 boe/d and 694 boe/d in the Midcontinent. Elsewhere, production totaled 568 boe/d in the Haynesville, 337 boe/d in the Bakken, 292 boe/d in the Eagle Ford, 274 boe/d in Appalachia and 229 boe/d in the Rockies.

Kimbell is led by co-founders Bob Ravnaas, CEO, and Davis Ravnaas, CFO, as well as Executive Vice Chairman Brett Taylor and COO Matt Daly. Bob Ravnaas is a former president of Cawley Gillespie & Associates Inc., a petroleum consulting firm, while Davis Ravnaas previously worked at Crestview Partners as an associate investment professional. Taylor co-founded the Fort Worth Royalty Partners Group with Bob Ravnaas and Ben Fortson in 1999. Daly is a former manager of energy investments for Kleinheinz Capital Partners Inc. and Hirzel Capital Management LLC.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |