Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin | Utica Shale

Appalachia, Permian Natural Gas Constraints Looming Over Projected E&P Forecasts

U.S. natural gas producers are guiding toward 4.2 Bcf/d in output gains this year versus 2017, based on a survey of 50 of the largest onshore operators, but the biggest question is whether there will be enough takeaway capacity in the country’s two largest producing regions.

The survey by UK-based Energy Aspects Ltd. (EA) represents more than half of the firm’s total year/year (y/y) U.S. projected growth forecast of 7.0 Bcf/d.

“Our sample of 50 major publicly traded U.S. producers posted output of 33.8 Bcf/d in 1Q2018, representing 43% of total U.S. dry production of 78.3 Bcf/d,” analyst David Seduski said. “This ratio is relatively unchanged from 2017, when our sample group comprised 43-45% of the total.”

Exploration and production (E&P) companies sampled increased production sequentially, or quarter/quarter (q/q), at a rate of 2%, or 0.6 Bcf/d, and by 6% (1.9 Bcf/d) y/y.

The increase by the 50 E&Ps is in line with total U.S. sequential growth of 2% (1.3 Bcf/d), but it trailed the U.S. y/y projected gains of 10% (7.0 Bcf/d).

“In our balances, we are currently projecting 7.0 Bcf/d in total U.S. y/y production gains in 2018,” Seduski said. “Of that, 4.2 Bcf/d is projected to come from our sample based on the group’s published production guidance for the year. That leaves the 57% of production not in our sample to account for 2.8 Bcf/d in growth y/y.”

EA’s sample outpaces the rest of U.S. producers because of the inclusion of EQT Corp., now the largest U.S. gas producer, which is forecasting 1.1 Bcf/d growth y/y to 4.2 Bcf/d from its Appalachian-focused drilling.

Several E&Ps sampled also reevaluated their full-year 2018 production guidance after the first quarter results were finalized. The updates came after 2017 “saw a number of firms in our sample miss the guidance they had published at the start of that year,” Seduski noted.

Misses largely were by Appalachian heavies EQT, Chesapeake Energy Corp., Southwestern Energy Co., Cabot Oil & Gas Corp., Antero Resources Inc. and Range Resources Corp. which “all missed their targets in 2017.”

Delays to Appalachian gas takeaway projects, including the first phase of Rover Pipeline and the late startup of Leach XPress and Rayne XPress, which each slipped into the first quarter, “likely contributed to production coming in under forecast amounts,” Seduski noted.

Some factors that contributed to missed first quarter projections are unlikely to affect the entire year, takeaway constraints should continue through 2018, “potentially placing the 4.2 Bcf/d y/y uplift from our sample in jeopardy.”

Barnett Output Slumping

The biggest gas production revisions made during 1Q2018 from previous guidance were by Devon Energy Corp., “which produced only 1.0 Bcf/d of the 1.15 Bcf/d it had projected for 1Q2018,” Seduski said. “This comes after the company also missed its 2017 guidance by 0.54 Bcf/d that year.”

The Oklahoma City-based independent’s “underwhelming performance” followed declining returns in the once mighty and first great onshore gas formation, the Barnett Shale, where Devon’s output declined y/y by 28 MMcf/d to 0.47 Bcf/d. However, Devon also recorded a “near 50% drop” y/y in Eagle Ford Shale gas from 0.12 Bcf/d to 63 MMcf/d. The E&P reduced its 2018 gas guidance from a midpoint of 1.18 Bcf/d to 1.03 Bcf/d as a result.

Other U.S. E&Ps adjusted their guidance after smaller production misses.

Appalachia stalwart Eclipse Resources Corp. cut its full-year guidance midpoint from 0.24 Bcf/d to 0.23 Bcf/d “after it failed to clear a backlog of wells needing completion in the Utica,” Seduski noted. “EQT lowered its midpoint for 2018 guidance as well, by 14 MMcf/d, though this represents less than 1% of the producer’s 4.2 Bcf/d in projected output.”

Gulfport, Ultra Adjust Higher

Positive adjustments to full-year gas guidance also were seen in EA’s sample group, notably by Gulfport Energy Corp., which revised up to 1.2 Bcf/d from 1.15 Bcf/d from higher output expected in the Utica and Oklahoma reservoirs. Ultra Petroleum Corp. also “rode growing production in Wyoming’s Green River Basin to post y/y growth of 91 MMcf/d,” and it raised its midpoint for guidance by 14 MMcf/d to 0.79 Bcf/d as a result.

Small upward revisions to guidance also were prevalent among Permian Basin operators, notably, Apache Corp., which was encouraged by 1Q2018 gas volumes, which jumped 57% y/y. Apache joined Permian competitors QEP Resources Inc. and Concho Resources Inc. in raising projected 2018 gas production midpoints by 1-2%.

Appalachia again led domestic gas production gains in the first quarter, posting 4.5 Bcf/d in y/y growth, according to EA. Chesapeake posted gains of 60 MMcf/d in the Utica to 0.44 Bcf/d, and of 35 MMcf/d in the Marcellus to 0.87 Bcf/d. Southwestern’s Appalachian output climbed 0.4 Bcf/d y/y to 1.8 Bcf/d, while CNX Resources Corp. more than tripled its Utica volumes to 0.46 Bcf/d from 0.13 Bcf/d.

Constraints Potential Issue

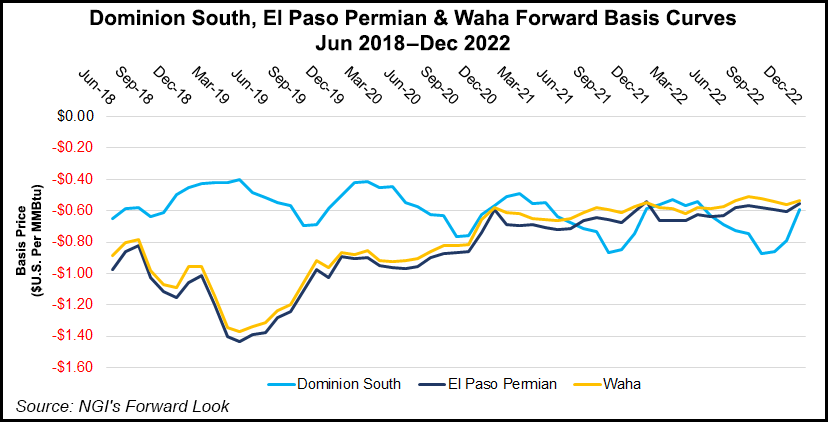

The biggest uncertainty looming for Appalachian and Permian E&Ps is takeaway capacity Seduski said.

Lots of questions during first quarter calls also centered around Permian gas constraints, which E&P executives noted are linked to oil takeaway rather than gas infrastructure.

Anadarko Petroleum Corp. CEO Al Walker during the 1Q2018 conference call said of the Permian, “The ability to extract that gas into any market at a reasonable price is an objective of ours, in order to evacuate the liquids at the most economically available way we can.”

Permian heavyweight Chevron Corp. also noted capacity challenges in Permian gas takeaway.

However, not every Permian gas producer expressed alarm about potential constraints.

Pioneer Natural Resources Co. and Apache each claimed to have enough gas transport options from the basin but stressed the need for more infrastructure to keep up with growth.

When asked during the first quarter call whether ConocoPhillips had concerns about Permian capacity constraints, CFO Don Wallette said, “No. We’re really not, and we don’t expect to either.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |