Permian Riding High in Latest Baker Hughes Rig Count

Oil was king for the week ending May 25 as the number of rigs on the hunt in the United States increased by 15 rigs to 859 over the previous week, according to Baker Hughes Inc. (BHI) data.

Natural gas bulls were not as lucky as the 198 rigs at work for the week represented a two-rig decline from the 200 in action the previous week.

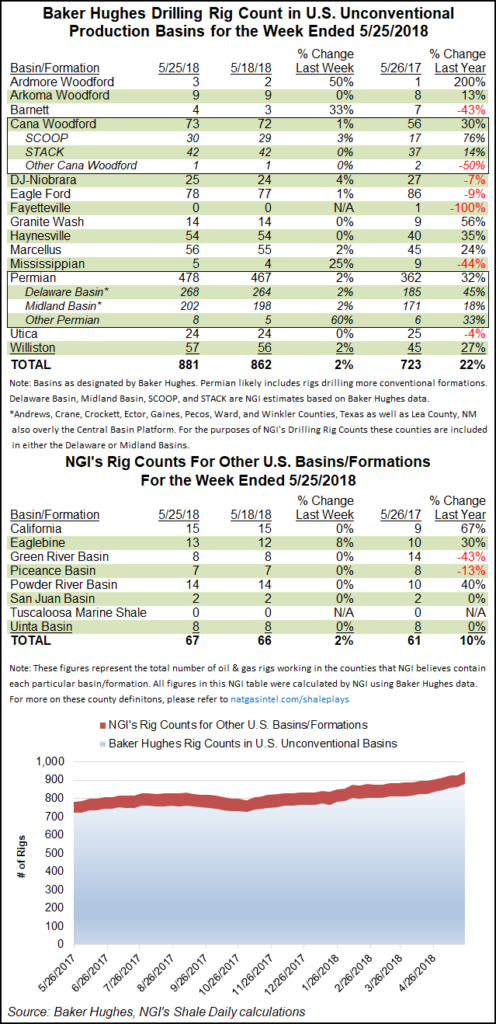

Looking at the unconventional drilling picture, the story of the week was once again focused on the prolific Permian Basin. Every other individual U.S. unconventional play — from the Williston down to the Eagle Ford and across to the Marcellus — either stood pat or gained a single rig.

Turning attention back to the Permian, 478 rigs were recorded in action for the week ending May 25, which is 11 more than the previous week. To put into perspective just how hot the Permian Basin is currently, the weekly rig total for the play is 116 higher than the same week one year ago.

Breaking down the Permian’s sub-plays, the Delaware and Midland each added four rigs to 268 and 202, respectively. Under BHI’s “Other Permian” category, three rigs were added for the week for a total of eight.

The growth in Permian activity can be measured by other metrics as well. According to the Texas Workforce Commission (TWC), 3,400 upstream oil and gas jobs were added in April, making it the 17th consecutive month of upstream job growth in the state.

Texas has recovered 33% of jobs lost between the high point in employment in December 2014 and the low point in September 2016, TWC data show. During that time, employment in the Texas upstream sector has grown by 38,400 jobs.

“Record production in the Permian Basin is driving sustained job growth in Texas,” said Todd Staples, president of the Texas Oil & Gas Association. “Investment and innovation in the oil and natural gas industry are not only creating good jobs for Texans but also securing our economy, our environment and our future.”

In fact, Permian oil production is increasing at such a rate, some analysts say the associated, or free gas coming out of the play could push more gas-focused plays such as the Marcellus and Haynesville out of the picture.

Earlier in the week, Sanford C. Bernstein & Co. LLC. analyst Jean Ann Salisbury and her colleagues wrote that associated gas is making up an increasingly larger share of supply, enough to take care of domestic demand for years.

From 2021-2025, associated gas from the Permian alone could meet most domestic demand, “leaving little room for gas-driven basins like the Marcellus or Haynesville,” according to Bernstein.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |