Markets | NGI All News Access | NGI Data

EIA Storage Build Close to Estimates as Natural Gas Futures Keep Climbing; Spot Prices Mixed

Natural gas futures bulls continued to gain ground Thursday after government storage data showed a weekly injection only large enough to make a small dent in deficits. In the spot market, prices were mixed as forecasters see Lower 48 cooling demand increasing over the weekend and into next week; the NGI National Spot Gas Average dropped 2 cents to $2.51/MMBtu.

The June contract settled at $2.940 Thursday, 2.6 cents higher on the day and continuing to build on Tuesday’s sharp rally. July added 1.6 cents to settle at $2.971

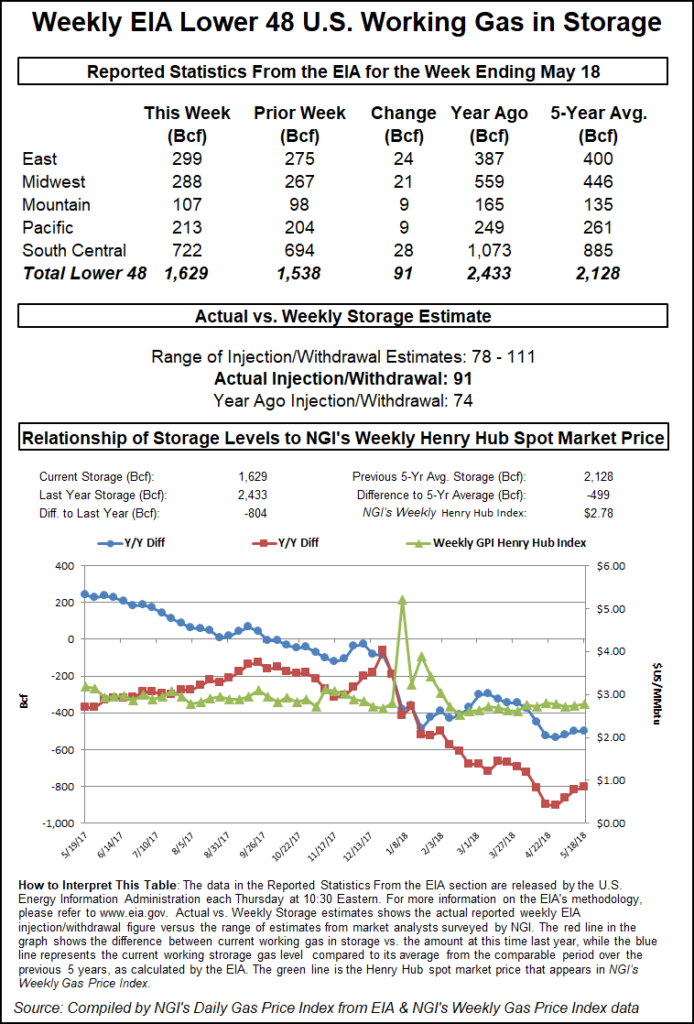

The Energy Information Administration (EIA) on Thursday reported a 91 Bcf injection into Lower 48 gas stocks, right in line with surveys and larger than the 74 Bcf build recorded last year and the five-year average 89 Bcf injection.

In the minutes following the 10:30 a.m. ET release of EIA’s report, the June contract climbed steadily from around $2.910 to just shy of $2.940. By 11 a.m. ET, June was trading around $2.933, up about 2 cents from Wednesday’s settle.

Prior to the report, the market had been looking for a build close to the actual number, according to major surveys. A Reuters survey of traders and analysts on average had predicted a 92 Bcf injection, with responses ranging from 85 Bcf to 100 Bcf. A Bloomberg survey had produced a median 91 Bcf injection, with responses from 78 Bcf to 111 Bcf. ION Energy had predicted a 90 Bcf build, while Genscape Inc. had predicted a 94 Bcf injection. Intercontinental Exchange EIA futures settled Wednesday at an injection of 91 Bcf.

Total working gas in underground storage as of May 18 stood at 1,629 Bcf, versus 2,433 Bcf last year and five-year average inventories of 2,128 Bcf. The year-on-year storage deficit decreased week/week from 821 Bcf to 804 Bcf, while the year-on-five-year deficit narrowed slightly from 501 Bcf to 499 Bcf, EIA data show.

By region, the South Central region saw the largest injection for the week at 28 Bcf, with EIA reporting 19 Bcf injected into nonsalt and 10 Bcf into salt. The East saw a build of 24 Bcf, while 21 Bcf was injected in the Midwest. The Mountain and Pacific regions each saw 9 Bcf refilled for the week, according to EIA.

“After a cool April that saw an aggregate gas withdrawal for the month, the first three May injections have been above average,” analysts with Jefferies LLC said Thursday. “…Due to the current storage deficit, we estimate that” roughly 5 Bcf/d of incremental injections year/year (y/y) will be needed to reach 3.8 Tcf by the end of injection season based on roughly 8.4 Bcf/d injected last summer. Because liquefied natural gas (LNG) exports, “power burn and industrial demand are likely to be higher y/y, we believe that production needs to average about 8 Bcf/d higher y/y in order to reach average storage by the end of the refill season.”

Bespoke Weather Services said weather data Thursday trended hotter in the medium-term but with gas-weighted degree days (GWDD) leaning closer to average past the first week of June.

“This is a market that is indicating it is almost entirely weather-driven, with a supportive strip advertising there is room for still more upside if we can increase heat risks in the long-range, which would put $2.97-3.00 in play,” Bespoke said. “However, at current levels we are seeing increasing reversal risks, as prices post-settle are declining on European guidance that confirmed earlier” Global Ensemble Forecast System “guidance in showing cool risks from the Midwest into the East by the second week of June.”

Meanwhile, as National Oceanic and Atmospheric Administration (NOAA) officials issued their 2018 Atlantic hurricane season outlook Thursday they were watching the possibility of a subtropical or tropical depression building in the northwestern Caribbean by early next week. A broad surface low drifting slowly over the Yucatan Peninsula Thursday had a 70% chance of becoming a tropical cyclone over the Memorial Day weekend, according to NOAA’s National Hurricane Center (NHC).

NOAA said there is a 70% likelihood of 10-16 named storms forming in the Atlantic Basin during the June 1-Nov. 30 hurricane season, with five to nine becoming hurricanes, including one to four major hurricanes (Category 3 or higher). An average hurricane season produces 12 named storms, of which six become hurricanes, including three major hurricanes.

Last week, forecaster Radiant Solutions in its prediction for the 2018 Atlantic hurricane season said it could be almost as active as 2017, which brought a series of powerful and damaging storms including Harvey, Irma and Maria.

“With last year’s devastating hurricane season still fresh for many, there is high interest in how the upcoming season will play out,” the firm said. “Radiant Solutions projects that the 2018 Atlantic hurricane season will be another active one, yielding 16 named storms, including nine hurricanes, four of which are expected to become major hurricanes. This is slightly less active than last season…but more active than normal.”

Turning to the spot market, prices in the Midwest pulled back after several days of gains as forecasts show the mercury rising into legitimate cooling demand territory across much of the country over the weekend and into next week.

Chicago Citygate shed a nickel to $2.69, still up around 30 cents since last week as Radiant Solutions was forecasting highs in Chicago to climb into the 90s over the weekend, about 17 degrees hotter than normal.

“Lower 48 demand is on track to touch the 60 Bcf/d mark by week’s end,” Genscape analyst Rick Margolin said. “Demand actually posted several plus-60 Bcf/d days back in April,” but that followed “persistent” heating degree days. This week’s run finally should be driven by cooling degree days and “hold into next week with NOAA’s six- to 10-day outlook calling for above-normal temperatures in all regions across the country.”

Genscape data showed power burns Thursday at an estimated 27.4 Bcf/d, rising to 30.2 Bcf/d by Friday and approaching 32.8 Bcf/d by the end of next week. Exports to Mexico have been flat around 4.5 Bcf/d, while total LNG sendouts have been down to around 2.8 Bcf/d, according to Margolin.

“On the supply side, production keeps bouncing within a 2.5 Bcf/d range this month,” he said, noting that Genscape affiliate Spring Rock’s top day estimate Thursday showed Lower 48 volumes down 1.12 Bcf/d day/day (d/d). “Northeast declines continue leading the way, down about 0.6 Bcf/d d/d primarily due to maintenance on the Tennessee Gas Pipeline system in Tioga and Susquehanna counties in northeast Pennsylvania.

“Texas production is down more than 0.32 Bcf/d d/d. Permian (Texas and New Mexico) volumes have been in modest retreat the past few days with maintenance constraining northbound takeaway capacity. Estimated production out of the basin is right around 8 Bcf/d, about 0.3 Bcf/d off last weekend led primarily by a 160 MMcf/d drop in flows on NGPL out of its Permian Zone. Rockies volumes are off about 0.13 Bcf/d d/d due to declines west of the Continental Divide.”

Points in West Texas strengthened Thursday, with Waha adding 11 cents to $1.91, while El Paso Permian added 11 cents to $1.90.

Elsewhere in Texas, Radiant Solutions was calling for highs in Dallas to reach triple digits by next week. A few East Texas points approached the $3 mark. Houston Ship Channel added a nickel to $3.00, while Katy tacked on 2 cents to $2.99.

In Appalachia, prices were mixed, with Dominion South giving up 6 cents to $2.17 as Millennium East Pool added 7 cents to $1.29.

The Rover Pipeline declared a force majeure this week for its Seneca Lateral that’s expected to shut in the Seneca, Berne and Madison locations on Friday, according to Genscape analyst Vanessa Witte.

“These three locations have cumulatively averaged 700 MMcf/d of scheduled receipts since the beginning of May,” Witte said. “Antero is the only producer that has subscribed capacity at the three impacted locations.” Berne has a reroute option on Texas Eastern (Tetco), “while Seneca has reroute options onto either Tetco” or Rockies Express. The Seneca line is expected to be back in service by Saturday’s gas day.

In Canada, NOVA/AECO C added C5 cents to C$1.83/GJ after surging C57 cents on Wednesday. NOVA/AECO C forwards also gained Wednesday, with fixed prices for July climbing 19% to average $1.119, according to NGI’s Forward Look.

Wednesday’s gains came as the National Energy Board (NEB) authorized conversion of the previously approved but dormant North Montney Mainline (NMML) into an addition to TransCanada’s British Columbia (BC) and Alberta supply collection network, Nova Gas Transmission Ltd. (NGTL), a move with long-term implications for AECO, according to analysts.

The decision revives a C$1.4 billion ($1.1 billion) project that stalled in mid-2017, when cancellation of Pacific Northwest LNG killed its original role as a feeder for overseas tanker exports. The new 206 kilometer-long (124-mile), 42-inch diameter pipe would span the liquids-rich heart of the Montney formation west of the Alaska Highway in the Fort St. John region of northern BC.

“The project, which has initial capacity of 0.9 Bcf/d and ramps to 1.5 Bcf/d over a two-year timeframe, will increase gas supply into the AECO market,” analysts with Tudor, Pickering, Holt & Co. (TPH) said in a note prior to the NEB’s ruling. “The original in-service date was planned for April 2019, however, with a roughly 12-month build time, we’re modeling a June 2019 start-up.

“More importantly, of the 0.9 Bcf/d of initial capacity, we see only 0.5 Bcf/d of new gas, as we believe the macro environment has curtailed growth plans,” the TPH analysts said. “Under our base assumptions we see the 0.5 Bcf/d of incremental supply bringing the AECO market back into balance and, with inventories expected to be low entering 2019, we believe the market could absorb up to 0.7 Bcf/d, without causing a price collapse.”

According to TPH, “several major shippers on the line will hold space on both NMML (into AECO) and T-South (into Westcoast Station 2), with the ability to swing flows in either direction. As a result, we expect AECO and Station 2 to trade within a tight band once NMML comes on and provides a relief valve for AECO if the market is looser than expected.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |