Eagle Ford Shale | E&P | NGI All News Access

More Frack Sand Headed to Eagle Ford with Black Mountain Expansion

Black Mountain Sand is expanding its operations into the Eagle Ford Shale with the acquisition of 2,400 acres in South Texas.

The acquisition in Atascosa County would allow the Fort Worth, TX-based operator to construct its third fracture (frack) sand mine in the Eagle Ford, with commercial production anticipated by the end of the year.

Once fully commissioned, the Eagle Ford mine is expected to employ 75 people and produce 2.2 million tons of sand annually. Total annual capacity already is sold out under long-term contracts, management said.

Eagle Ford producers “are eager to gain cost savings and reduce lead time with in-basin frack sand delivery,” said CEO Rhett Bennett, who founded the company with private equity support from Natural Gas Partners.

“With the region currently producing approximately 12% of the U.S. total oil production and growing, the need for local sand has become paramount for our customers.”

Until recently, most frack sand consumed by Texas operators was shipped by rail from out-of-state mines in the Midwest, adding logistics costs and inefficiencies to the supply chain, he noted.

According to Black Mountain, current estimates indicate using in-basin sand would reduce the total cost of drilling and completing a well by up to 10%. “which can amount to over $500,000 in savings per well. With drilling activity projected to grow in the Eagle Ford Shale, the aggregate potential cost savings are significant.

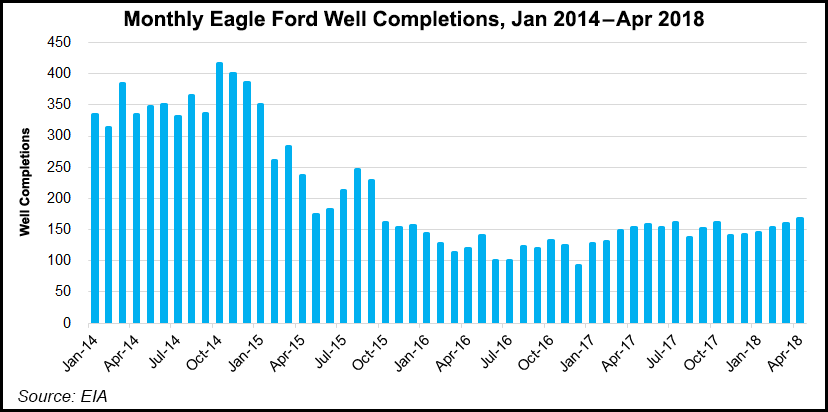

“In 2017, 2,123 total drilling permits were issued, and 2018 numbers are anticipated higher, with 582 permits issued in 1Q2018.

Black Mountain also operates two mines in the Permian Basin that are approaching nameplate capacity of 10 million tons/year. To help meet growing demand for its proprietary Winkler White sand, the company is considering whether to add a fifth dryer at each location, which would enable it to increase production to a combined total of 12 million tons/year, or the equivalent of more than 520,000 truckloads of sand/year.

Other frack sand providers are reporting strong demand for products. Emerge Energy Services LP raised prices for contracted and spot sand customers by 3-5% beginning in the second quarter on record market demand for proppant in the U.S. onshore.

Emerge subsidiary Superior Silica Sands LLC recently began shipping sand directly to the Eagle Ford from a newly opened facility in San Antonio.

“We do not see the tightness in the market slowing down, as many of the in-basin plants continue to fall behind schedule, and the railroads have not fully corrected the service shortfalls,” Emerge’s Rick Shearer, CEO of the general partner, said during the first quarter conference call.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |