April Natural Gas Prices Rise in Five of Mexico’s Six Trading Regions

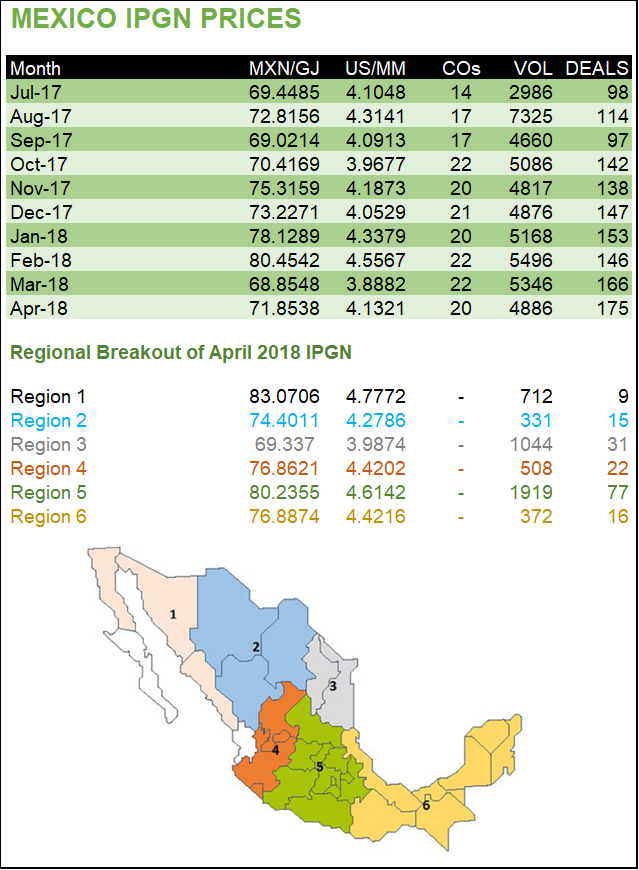

The price of natural gas in Mexico rose by nearly 3 pesos in April compared to the previous month, averaging 71.854 pesos/gigajoule (GJ), or $4.132/MMbtu, according to the federal energy regulator.

Prices also increased across five of Mexico’s six gas trading regions during April, the Comision Reguladora de Energia (CRE) reported.

Year/year comparisons are not yet available for the national index, known as the IPGN, since the CRE only started releasing it in August last year. The IPGN is based on the monthly post-transaction reports that are mandatory for all gas marketers billing trades within Mexico.

The total volume of reported deals in April was 4.86 Bcf/d, down by some 460 MMcf/d compared to 5.35 Bcf/d in March.

National demand in Mexico is closer to 8 Bcf/d, but the CRE reports do not capture gas used in upstream activities by state oil company Petroleos Mexicanos (Pemex) and other oil and gas operators in the country.

In April, 20 gas marketers reported a combined 180 transactions to the CRE. The regulator screened out five statistically atypical trades before calculating the final national index.

Most trades in the Mexican gas market are currently priced with U.S. indexes like Henry Hub and Houston Ship Channel, plus transport costs. The CRE indexes are intended to be indicative and temporary, to be replaced by third-party indexes once the market is able to develop them on its own.

CRE also began reporting a regional breakout of the IPGN two months ago, utilizing six trading areas that together cover the Federal District and all but two of Mexico’s 31 states.

Prices were up sequentially in five regions, ranging from a 1.271-peso uptick in Region 5 to a 6.702-peso boost in Region 3. The exception was Region 1, where prices fell by an average of 17.531 pesos to 83.071 pesos/GJ ($4.777/MMbtu) in April.

The northwest Region 1 contains two isolated systems, the state-run Naco-Hermosillo in Sonora state and the privately owned Rosarito pipeline on the Baja California Peninsula. It also includes a new network of private pipelines that extends south from the Arizona border to the city of Mazatlan in Sinaloa.

Region 1 has reported the highest price of all six areas for all three months that CRE has released regional indexes. Marketers in the region reported nine deals in April for a total volume of 712 MMcf/d, up 165 MMcf/d from March.

Most trading activity in Mexico’s natural gas market is concentrated in regions 3 and 5, which accounted for 61% of all volumes reported during April, according to the CRE data.

As in the previous two months, the northeast Region 3 reported the lowest price for April, averaging 69.337 pesos/GJ ($3.9874/MMbtu), compared to 62.635 pesos/GJ ($3.537/MMbtu) in March. Most U.S.-to-Mexico pipeline exports currently flow through Region 3, which contains the industrialized states of Nuevo Leon and Tamaulipas.

Gas traders in Region 3 reported 33 deals during April with a total volume of 1.04 Bcf/d, down by 667 MMcf/d compared to March. This was the month’s largest drop in trading volume, although the gains in Regions 1, as well as Region 2, helped offset the final national result.

The April trading volume for Region 5, in turn, was relatively stable at 1.92 Bcf/d from 81 transactions, compared to 1.94 Bcf/d in March. The area encompasses some of Mexico’s most densely populated states, including the Federal District.

Region 5 reported the second highest price for April at 80.236 pesos/GJ ($4.614/MMbtu), versus 78.965 pesos/GJ ($4.459/MMbtu) in March.

The Altamira liquefied natural gas (LNG) terminal sits on the Gulf Coast near the boundary between Region 3 and Region 5.

Mexico’s other active LNG terminal is located on the Pacific Coast at the port of Manzanillo in Colima state, which is part of Region 4. Gas prices in this region averaged 76.862 pesos/GJ ($4.420/MMbtu) in April, compared to 75.401 pesos/GJ ($5.193/MMbtu) in March.

The Manzanillo terminal has operated at or near full capacity since last year. The April trading volume for Region 3 was 508 MMcf/d.

The remaining two regions — 6 and 2 — reported the lowest volumes for the month. Marketers billed 372 MMcf/d in Region 6, which covers southeast Mexico and the Yucatan peninsula. Gas prices in this area averaged 76.887 pesos/GJ ($4.422/MMbtu) in April, versus 74.515 pesos/GJ ($4.208/MMbtu) in March.

In Region 2, April volumes were 331 MMcf/d, while prices averaged 74.4011 pesos/GJ ($4.279/MMbtu) versus 68.9135 pesos/GJ in March ($3.892/MMbtu).

Several private pipelines running through Region 2 would carry U.S. gas exports from the Waha hub in the Permian Basin to Mexican consumers in this area and farther south. Delays to downstream pipeline infrastructure in Mexico have curtailed flows at these border-crossings, but most of the pending projects are expected to come in-service later this year or early 2019.

The startup of these and other pipelines is expected to gradually reduce Mexican demand for LNG.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |