Natural Gas Futures Retreat as Larger-Than-Average EIA Storage Injection Expected

Natural gas futures fell Wednesday as the market looked ahead to a potentially pivotal shoulder season storage report expected to show a larger-than-average build. In the spot market, forecasts for moderate temperatures in the East and falling demand in the Midwest headlined a day of declines across most of the Lower 48; the NGI National Spot Gas Average dropped 4 cents to $2.35/MMBtu.

The June contract slid 2.1 cents to settle at $2.815 Tuesday after trading as high as $2.844 and as low as $2.809. The July contract settled at $2.837, down 1.7 cents on the day.

“It looks like the market, after running up on the weather and last week’s bullish storage report, seems to be taking a pause” ahead of this week’s report, Price Futures Group Senior Analyst Phil Flynn told NGI Wednesday. “And I do think the report’s going to be important.”

Estimates for Thursday’s Energy Information Administration (EIA) storage report show the market expecting a triple-digit injection for the week ending May 11.

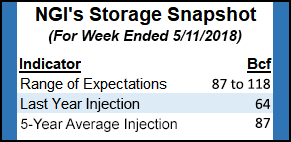

A Reuters survey showed traders and analysts on average anticipating a 105 Bcf build for the period, with responses ranging from 99 Bcf to 118 Bcf. A Bloomberg survey produced a median build of 107 Bcf, with responses ranging from 87 Bcf to 110 Bcf.

Last year, EIA recorded a 64 Bcf build for the period, and the five-year average is an 87 Bcf injection.

ION Energy called for a 103 Bcf build, while Price Futures Group estimated an injection of 105 Bcf. Intercontinental Exchange EIA storage futures settled Tuesday at an injection of 104 Bcf, 1 Bcf lighter than the previous settle.

“The bulls and the bears have a lot riding on this report,” Flynn said of the EIA data, set for release at 10:30 a.m. ET Thursday. “Because if you get a bigger-than-anticipated injection, that’s going to ruin the narrative that we can’t build back supply fast enough” even with record-level production.

On the other hand, a smaller-than-expected build could help the bulls make their case that making up current storage deficits will be more difficult than previously thought, he said.

As for the weather outlook, NatGasWeather.com said it saw “no surprises” in the midday data “as the second half of May is still expected to play out mostly comfortable across the northern U.S., with highs of upper 60s to 80s. The southern U.S. will be very warm to hot with highs of 80s to lower 90s, locally 100s over the Southwest, but also with areas of heavy showers, especially over the Southeast.”

Warmer-than-normal conditions should continue into early June but with limited impact on demand in May given that it’s too early in the season, the firm said.

“If early June starts hotter than normal, it’s a strong sign this summer will be hotter than normal as well, as we prefer,” NatGasWeather said. “Again, for the first time in many years we see the pressure on production reducing deficits instead of weather patterns increasing them. The onus will shift back to weather at the start of June and will need to show signs of increasing heat over the South and East. Also of considerable importance will be the size of builds the next three to four weeks, with the pressure on them to not disappoint,” starting with Thursday’s EIA report.

On the supply side, shoulder season maintenance has contributed to a 2.6 Bcf/d drop in production since Monday, according to Genscape Inc. analyst Rick Margolin.

Genscape affiliate Spring Rock’s daily pipe production estimate as of Wednesday showed “Northeast volumes down more than 1.6 Bcf/d from Monday with large maintenance-induced disruptions in northeastern and southwestern Pennsylvania,” Margolin said. “…Texas production is estimated to be down nearly 0.5 Bcf/d since Monday, followed by nearly 0.3 Bcf/d of additional disruptions to Gulf of Mexico supplies.”

That’s in addition to about 0.7 Bcf/d of supply held back due to disruptions affecting offshore platforms since the start of the year, he said.

“Rockies volumes are down more than 0.2 Bcf/d since Monday, with the bulk of the drops out of the Powder River area,” according to Margolin. “Processing volumes around the Opal Hub are getting shuffled around with cuts in tailgate deliveries to Ruby being made up for by increased deliveries to neighboring eastbound pipes.”

Turning to the spot market, prices fell across the East Coast as Radiant Solutions was calling for moderate to slightly cooler-than-normal temperatures along the I-95 corridor Thursday and Friday. Temperatures in Boston and New York were expected to average in the mid to low 60s Thursday before dropping a few degrees Friday and Saturday. Washington, DC, was expected to see temperatures average in the upper 60s Thursday and lasting into the weekend.

Transco Zone 6 New York gave up 17 cents to $2.32, while further south, Transco Zone 5 dropped 6 cents to $2.82.

“Much of the eastern U.S. will stay in a persistent, wet and stormy pattern over the next few days as a wavy frontal boundary sags southward into a moist and unstable air mass,” the National Weather Service (NWS) said Wednesday. “The most favorable region for excessive rainfall will be along the eastern stretch of the Ohio River to the Chesapeake Bay and along the Central Appalachians.”

Appalachian prices continued to trade in a volatile pattern Wednesday with a number of pipeline maintenance events impacting the region. Following recent reports of restrictions this week on the Millennium Pipeline, Millennium East Pool tumbled 28 cents to $1.54 Wednesday, while Dominion South shed 13 cents to $2.19.

Adding to the recent list of shoulder season disruptions to pipeline flows in the Northeast, EQT is expected to cut around 0.6 Bcf/d of deliveries to Tetco Thursday, according to Genscape analyst Molly Rosenstein.

“Citing downstream pipeline construction, EQT is capping nine Tetco interconnect meters to a net delivered capacity of 785 MMcf/d, a 591 MMcf/d reduction from seven day average volumes,” Rosenstein said. “Depending on intrasystem flexibility, EQT has capacity at other interconnects with Columbia and Dominion that can help reroute production, decreasing the likelihood of upstream production impact.”

Elsewhere in the region, ANR announced a one-day maintenance event at the Defiance Compressor Station expected to limit deliveries from the Rover Pipeline to 800 MMcf/d Thursday, according to Genscape analyst Vanessa Witte.

“Deliveries from Rover at Westrick have steadily averaged 1.2 Bcf/d for the prior 30 days,” Witte said. “ANR anticipates the maintenance to conclude by midday and will update capacity restrictions at that time. It is likely reroutes onto REX at Tetco will occur rather than shutting in production to compensate for the delivery restriction, though with limited maintenance history this is difficult to gauge.”

After broad gains Monday and Tuesday, prices pulled back across the Midwest and Midcontinent Wednesday. Chicago Citygate dropped 13 cents to $2.48, while Northern Natural Ventura fell 18 cents to $2.37.

Genscape was forecasting demand in the Midwest region to fall to just under 11 Bcf/d Thursday versus a recent seven-day average of 12.29 Bcf/d. Midcontinent demand was expected to fall to around 1.8 Bcf/d Thursday and Friday, down from a recent seven day average of just over 3 Bcf/d, according to the analytics firm.

“Scattered to widespread showers and thunderstorms will likely develop over the central/northern High Plains, with favorable conditions to become severe,” NWS said. “The greatest chance for storms should shift farther north to a frontal boundary setting up over North Dakota and Minnesota. The Storm Prediction Center has a slight risk covering this area Thursday and Friday. Heavy rainfall will also be likely within this area of convection.”

In the West, the volatile SoCal Citygate shed 16 cents to average $3.03 as Southern California Gas was forecasting system demand to ease slightly Thursday and Friday to around 2.1-2.2 Bcf/d, versus actual demand of close to 2.3 Bcf/d on Tuesday. SoCal Border Average finished a penny higher at $1.99.

Radiant Solutions was forecasting slightly below-normal temperatures in Burbank, CA, Thursday and Friday, including highs in the low 70s and lows in the mid 50s.

In Canada, NOVA/AECO C surged C90 cents Wednesday to average C$1.80/GJ, continuing its wild ride this month as maintenance restrictions have created plenty of volatility — and even some negative spot prices — in the region. Earlier in the month, AECO set an all-time low when it averaged minus C1 cents/GJ.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |