Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Adds Three Natural Gas Rigs as Oil Count Surges

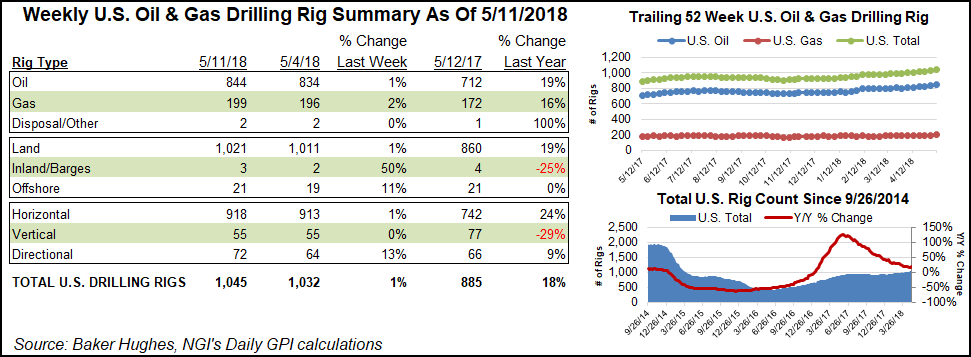

The United States added three natural gas rigs for the week ended Friday but was overshadowed once again by a big jump in oil-focused drilling, according to data from Baker Hughes Inc. (BHI).

Against a backdrop of rising crude prices, recent oil-driven growth in the U.S. onshore showed no signs of letting up during the week as the United States added 10 oil-directed rigs to finish the week with a combined 1,045 units, up 18% from a year-ago tally of 885. Eight directional units were added, along with five horizontal units. Ten rigs were added on land for the week, along with two in the offshore and one in inland waters, according to BHI.

Canada saw its count fall by seven, finishing at 79 active rigs, down one from last year’s total of 80. The combined North American rig count ended the week at 1,124, up from 965 a year ago.

Among the major basins tracked by BHI, the Permian Basin — overlying West Texas and southeast New Mexico — led all gainers for the second straight week. The Permian added five rigs to grow its tally to 463, a 30% increase year/year. A more detailed breakdown of BHI data by NGI’s Shale Daily shows the week’s gains focused in the Permian’s Midland sub-basin, with the Delaware sub-basin flat week/week and one “Other Permian” rig departing.

Other gainers among plays included the Denver Julesburg-Niobrara, the Eagle Ford Shale and the Granite Wash, which each added two rigs. The Cana Woodford, Marcellus Shale and Mississippian Lime each added one rig for the week, according to BHI.

Among states, Texas added eight rigs during the week, while Colorado and Oklahoma each added three and Alaska saw two rigs return. Louisiana and West Virginia each added one.

Meanwhile, the new Permian rigs this week apparently weren’t added in New Mexico, which saw its tally fall by four week/week. Wyoming dropped one rig.

Among the biggest news in the energy space during the week was President Trump’s decision to withdraw the United States from the Iran nuclear deal.

Genscape Inc. natural gas analyst Rick Margolin noted earlier in the week that the president’s announcement helped lift West Texas Intermediate crude prices above $70/bbl “for the first time since November 2015.”

June New York Mercantile Exchange crude oil futures finished the week above the $70/bbl mark Friday, settling at $70.70/bbl.

Meanwhile, analysts with Bank of America Corp. made headlines Thursday with a particularly bullish forecast predicting global crude prices could reach $100/bbl by next year.

And higher crude prices will lead to more associated gas from the U.S. onshore, according to analysts.

“These rallies in crude keep lifting our Spring Rock production forecasts” for natural gas, with forecasts during week showing a “year-on-year increase of more than 7.5 Bcf/d for the calendar strip,” Margolin said. “The crude rally’s impact on gas production resonates in liquids-rich plays” like the Permian Basin, Denver-Julesburg and Bakken Shale. “Even in areas like the Eagle Ford, which — just a few months ago — was priced to show declining gas production is now poised to add more than 0.3 Bcf/d year-on-year.”

EBW Analytics Group CEO Andy Weissman called the proposition of reinstating U.S. sanctions on Iran “a distressing development” for natural gas producers.

“Over the next 12-24 months, a large gap is likely to develop in global oil supplies, pushing global prices up sharply,” Weissman said. “To fill this gap, it will be necessary to grow U.S. production at a record rate. Due to infrastructure constraints, it is possible that the full impact of this rapid growth may not be apparent until Q3 or Q4 of next year. From that point forward, however, production of associated gas is likely to soar — potentially constraining natural gas prices for several years.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |