April’s U.S. Natural Gas Injections Lowest in 35 Years, Says EIA

April natural gas storage injections could prove to be the lowest for the fourth month of the year since 1983, the Energy Information Administration (EIA) said Tuesday.

In its latest Short-Term Energy Outlook, EIA estimated a total net injection of 22 Bcf for the month, leaving inventories 27% below the five-year average for the end of April.

“If confirmed in the monthly data, the April 2018 injection would be the smallest April injection since 1983,” EIA said, attributing the lean monthly build to what it said was the coldest April in 21 years based on preliminary data.

EIA continued to report net storage withdrawals into the third week of April, the longest the withdrawal season has extended into April going back to at least 1994, the agency said.

“Despite inventories falling to more than 500 Bcf below the five-year average by end of April, natural gas prices have remained relatively flat. Similar to price movements in March, natural gas futures prices in April traded in the narrowest range since 1995, with a difference of just 22 cents/MMBtu between the high and low prices,” EIA said.

“In comparison, natural gas futures prices traded in a 41-cent range on average each month in 2017. EIA expects that higher natural gas production during the injection season will offset current low storage levels and keep price movements moderate.”

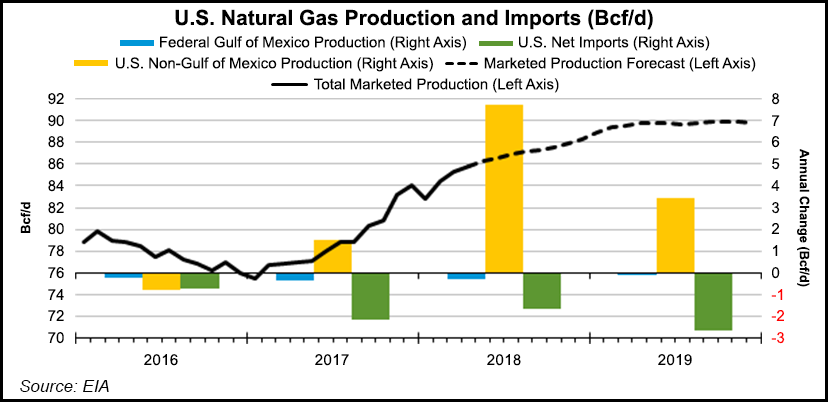

Thanks to rising production, now projected to average a record 80.5 Bcf/d in 2018 and increase further to 83.3 Bcf/d in 2019, EIA expects inventories to refill at a faster rate than the five-year average through the remainder of the current injection season, leaving inventories at more than 3.5 Tcf by Oct. 31, or about 8% below the five-year average for end-of-October inventories.

EIA also has slightly revised its 2018 natural gas price forecast Tuesday and now expects Henry Hub spot prices to average $3.01/MMBtu this year and $3.11 in 2019, up from an April forecast of $2.99 for 2018 and $3.07 for 2019.

Stronger production should support a growth in natural gas exports for 2018 and 2019, with net exports expected to average 2.0 Bcf/d this year and 4.6 Bcf/d next year from 0.4 Bcf/d in 2017, according to EIA.

Meanwhile, with the summer cooling season just around the corner, EIA’s latest forecast shows the total share of U.S. utility-scale electric generation fueled by natural gas rising from 32% in 2017 to 34% for 2018 and 2019. Coal is expected to see its share slip from 30% last year to 29% in 2018 and 2019. EIA expects nonhydro renewables to account for 11% by 2019, up from just under 10% in 2017.

EIA also noted higher demand for ethane driving a “widening spread between ethane spot prices and natural gas futures prices, which averaged $1.04/MMBtu in April 2018.”

The wider spread incentivizes processors to extract more ethane from the natural gas stream, EIA said, noting that ethane production has increased to an estimated 1.6 million b/d in April from 1.3 million b/d in September 2017. EIA projects ethane production to average 1.7 million b/d for 2018 and 1.9 million b/d in 2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |