Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Marathon Oil Raises Production Guidance, Enters Louisiana Austin Chalk

Marathon Oil Corp., which is working the Permian Basin, Eagle Ford and Bakken shales, in Oklahoma and the emerging Louisiana Austin Chalk, has raised 2018 production guidance by 5% to to 25-30% while maintaining the $2.3 billion capital budget.

The Houston heavyweight, which also works overseas, said total output averaged 398,000 boe/d net in the first three months, excluding Libya.

U.S. production carried the day, up 9% sequentially, averaging 284,000 boe/d net, with domestic oil output averaging 164,000 b/d.

“Our returns-focused investment program, coupled with outstanding execution across our multi-basin portfolio, drove production above the top end of our U.S. guidance in the first quarter,” said CEO Lee Tillman.

Eagle Ford production in South Texas maintained flat production of 104,000 boe/d net boed in the quarter; 11 wells in Atascosa County had average 30-day initial production (IP) rates of 1,615 boe/d, 76% weighted to oil.

Thirty-four gross Eagle Ford wells, all company-operated, were put online during the quarter with average 30-day IP rates of 1,750 boe/d (64% oil).

In the Bakken, output increased 7% from the fourth quarter to 74,000 boe/d net. The Arkin well in Hector set a new basin Three Forks 30-day IP record with 3,040 b/d, while the June and Chauncey wells in West Myrmidon set new basin Middle Bakken records with 3,470 b/d averaged over 30 days.

The company brought online 11 gross Bakken wells that were company-operated, six of which were in core Hector with average 30-day IP rates of 2,600 boe/d (81% oil).

Oklahoma production climbed 17% sequentially to 75,000 boe/d net. Leasehold drilling in the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, i.e. the STACK, was largely completed in the first quarter.

Oil production in Oklahoma climbed 25% sequentially, mostly from carry-in performance from the nine-well Tan infill that came online late in the fourth quarter. The company brought 17 gross operated wells to sales, primarily focused on Meramec leasehold activity in the STACK.

In the Permian Basin, northern Delaware sub-basin output jumped to 16,000 boe/d net. Seven wells in New Mexico’s Eddy and Lea counties had average 30-day IP rates of 1,460 boe/d, 69% oil.

The company brought to sales nine gross operated wells across the Malaga, Red Hills and Ranger areas in New Mexico’s Permian, seven of which had average 30-day IP rates of 1,460 boe/d (69% oil). A two-well 3rd Bone Spring/Upper Wolfcamp pad in Red Hills achieved average 30-day IP rates of 1,830 boe/d (68% oil), and an Upper Wolfcamp well in Malaga had an average 30-day IP rate of 2,095 boe/d (69% oil).

In the last six months, the company has added 165 risked gross operated locations in the Northern Delaware, with an average working interest of 65%, through trades and a small bolt-on acquisition.

“The company is currently benefiting from its Midland-Cushing basis swaps,” management noted. “Open positions include 10,000 b/d hedged at a discount of less than $1 to West Texas Intermediate for the second half of 2018 and all of 2019.”

The swaps “will help protect over half our forecasted oil production for the remainder of the year on takeaway,” Tillman told investors during a conference call to discuss results. “It is important to stress that today.

“Northern Delaware accounts for only about 4% of our overall production mix. However, while we anticipate no flow assurance issues, we are planning for future growth and have expanded our oil gathering agreements and are assessing both gas gathering and firm transportation commitments for the longer term, we are also transitioning our water to pipe throughout the year, which will reduce unit operating cost for the basin.”

Taking Another Look at the Austin Chalk

Meanwhile, Marathon captured more than 250,000 net acres in multiple new plays in the last year, including a “largely contiguous position” in the emerging Louisiana Austin Chalk at a cost of less than $900/acre, Tillman said.

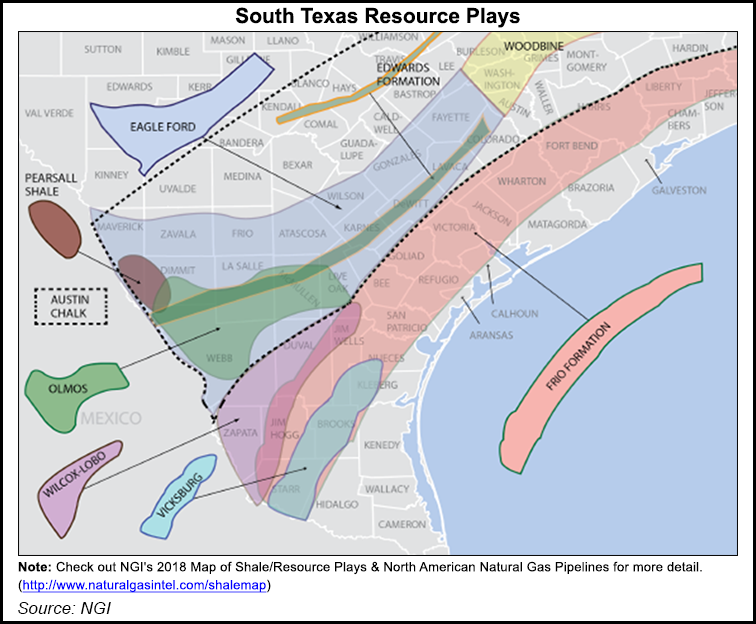

The Austin Chalk, particularly in South Texas, was in the mid-2000s an emerging area for producers, but many abandoned the play for other prospects. Tillman was asked about what made the play a good purchase.

“Obviously, the Louisiana Austin Chalk…did go through a bit of a development phase” with “very early technology designs on the completion size side and relatively short lateral links as well,” he said. “We see this as…a natural extension of kind of this Austin Chalk mega trend that goes from Mexico across South Texas all the way over to Louisiana, and having been one of the leaders in the development of the Austin Chalk in South Texas, we think we’re well equipped to get in here and appraise and understand the potential of this.

“But I want to stress again, this is exploration,” in early development, he said. There’s still plenty to do before Marathon Oil is ready to issue any preliminary estimates of what it may have.

First quarter U.S. exploration and production unit production costs were $5.89/boe and are expected to moderate through 2018 as the company implements plans to access additional infrastructure. The company expects 2Q2018 U.S. production overall to average 280,000-290,000 boe/d net.

Net income in 1Q2018 was $356 million (42 cents/share), versus a year-ago loss of nearly $4.6 billion (minus $5.84). U.S. exploration and production income rose to $125 million from a loss in 1Q2017 of $79 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |