Infrastructure | E&P | NGI All News Access

U.S. Adds One Natural Gas Rig, With Oil Drilling Still Ramping Up

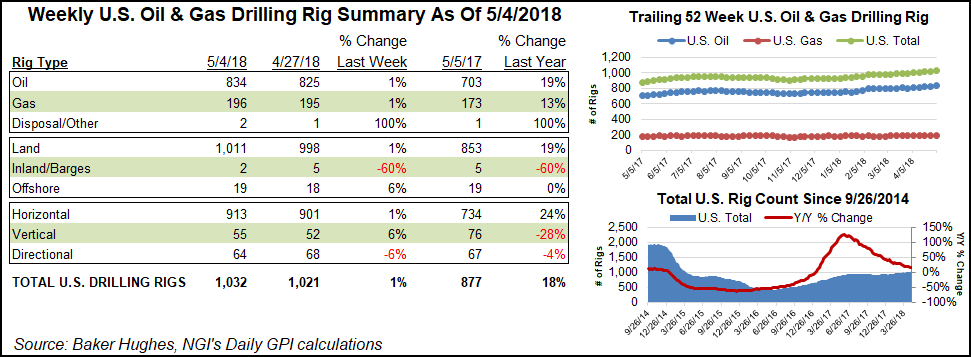

The United States added one natural gas rig for the week ended Friday, as oil drilling drove an 11-rig increase in the overall domestic tally, according to data from Baker Hughes Inc. (BHI).

The return of nine oil-directed rigs and one miscellaneous rig helped grow the U.S. count to 1,032, up from 877 a year ago. BHI’s U.S. rig count has now increased for 11 straight weeks.

Three vertical units and 12 horizontal units were added, while four directional units packed up shop, according to BHI. Land units rose by 13 for the week, offsetting the departure of three units from inland waters. The Gulf of Mexico added one unit to finish the week at 19 from 18 a year ago.

Canada saw its tally increase after falling for past 12 weeks. Canada added four oil units to offset the departure of three gas units, finishing one higher for the week at a combined 86 rigs.

The North American rig count grew by 12 for the week to 1,118 rigs, up from 959 at this time last year.

Among major basins tracked by BHI, the Permian stood in a class by itself, adding six units to bump its total up to 458, a whopping 109-rig increase year/year. The Denver Julesburg-Niobrara, Williston Basin and Eagle Ford and Haynesville shales each added one rig.

In the Cana Woodford, meanwhile, a more detailed breakdown of BHI data by NGI’s Shale Daily showed one rig departing in the SCOOP (South Central Oklahoma Oil Province). The Green River Basin fell by three rigs for the week, to end at eight units from 13 a year ago.

Among states, New Mexico, whose southeastern corner overlies the Permian, led with an increase of six rigs for the week, while Texas and Oklahoma each added two. Alaska, Louisiana and North Dakota added one a piece.

Colorado, meanwhile, fell by one rig for the week, ending at 27, down from 30 a year ago.

The continued growth in oil drilling supports the bearish natural gas thesis delivered earlier in the week by analysts with Raymond James & Associates Inc., who lowered their 2019 price forecast from $2.75/Mcf to $2.25 based on a robust supply outlook. The analysts said growth in associated gas production — especially from the Permian — has created an inverse relationship between gas and crude prices.

“As higher oil prices spur growth in oil production, they also drive an increasing supply of associated gas. Put simply, the better things get for oil prices, the worse the read-through for gas prices,” analysts J. Marshall Adkins and Pavel Molchanov said in a note Monday.

New York Mercantile Exchange West Texas Intermediate crude oil futures were approaching $70/bbl as of Friday afternoon.

Raymond James analysts are projecting a 3 Bcf/d year/year increase in associated gas supply growth this year and in 2019.

During the first three months of this year, U.S. drilling activity slightly outpaced the Raymond James model, with 966 actual rigs versus 955 forecast, with the biggest increase in the Permian basin with 46 more rigs.

“The Permian alone should provide as much as 5.3 Bcf/d of gas production growth by 2020,” according to Adkins and Molchanov. “Additionally, gas supply uplift from the Eagle Ford Shale — 1.8 Bcf/d from 2017 to 2019 — is also substantial.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |