E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Pioneer Touts Takeaway Security for Permian Oil, Natural Gas

Pioneer Natural Resources Co. is working to assuage investor concerns about Permian Basin pipeline constraints, noting that oil contracts to the Gulf Coast have insulated the company from price differentials, while three-quarters of its natural gas production is under firm contract to sell in Southern California.

The management team hosted a conference call on Thursday to discuss the quarterly performance, and most of the commentary, as expected, centered around the Permian, where the independent is the largest acreage holder in the Midland sub-basin.

Concerns about a lack of takeaway capacity, both for oil and gas, have pressured operators to give some assurances that production can profitably make it to markets.

Pioneer CEO Timothy Dove offered insight into how the firm transportation contracts from West Texas are shielding the company.

“Our oil contracts to the Gulf Coast not only expose us to Brent-related pricing, but also insulate us from the recent widening of the Midland-Cushing oil price differential,” Dove said. “Pioneer’s firm transportation contracts for gas provide flow assurance, with more than 75% of our production being sold in Southern California.”

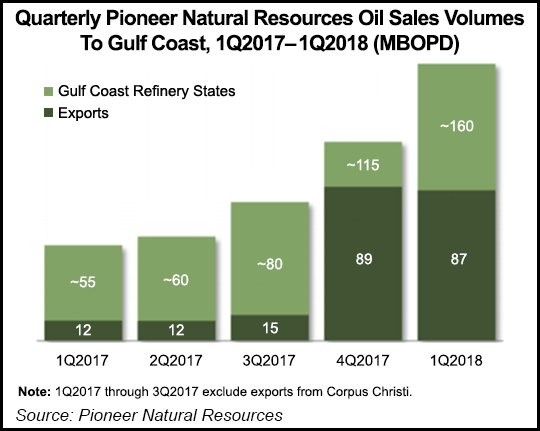

The company has firm pipeline commitments to deliver about 160,000 b/d, or 95% of current Permian net oil production, to Gulf Coast refineries and export markets. Of the 160,000 b/d delivered to the Gulf Coast, 87,000 b/d was exported.

As a result of Brent pricing, Gulf Coast refinery and export sales added $16 million of incremental cash flow in1Q2018.

Pioneer’s oil volumes under firm transportation contracts increase through 2021 commensurate with the forecast Permian oil production growth. Pioneer plans to transport more than 90% of its long-term Permian net oil output to the Gulf Coast for refinery sales and exports.

During the second half of 2018, export volumes are expected to grow as Pioneer’s export capacity is increased to 150,000 b/d from 110,000 b/d.

On the natural gas side of the equation, Dove said Pioneer also is protected, with three-quarters of the Midland sub-basin’s output transported under firm pipeline transportation agreements to the Southern California market where it is sold. The remainder is primarily sold under term contracts at Waha.

Additional firm gas pipeline transportation has been secured on Kinder Morgan Inc.’s 2 Bcf/d Gulf Coast Express Pipeline Project, which is anticipated to be online in the second half of 2019.

“Firm transportation on the Gulf Coast Express pipeline will provide access to liquefied natural gas exports, refineries, petrochemical facilities and Mexican markets,” management noted. The company’s 2018 revenues from gas sales are expected to be less than 5% of forecast 2018 Permian oil, natural gas liquids (NGL) and gas revenues.

Pioneer produced a total of 260,000 boe/d from the Permian in 1Q2018, a 3% sequential increase, even though freezing weather in early January led to production losses of about 6,000 boe/d. In addition, about 2,000 boe/d of output was lost because of a compressor station fire in the West Panhandle field. Production resumed from the field in early April at about 8,000 boe/d.

Oil production from the Permian increased to 170,000 b/d in the quarter, and 63 horizontal wells were placed on production.

The company was running 20 operated horizontal rigs in the Permian at the end of March, and it expects to place 250-275 wells on production this year. Management also is evaluating whether to add more rigs later this year.

Total production is forecast this year to average 312,000-322,000 boe/d. Permian production growth in 2018 would make up the bulk of output and increase year/year by 19-24% to 268,000-276,000 boe/d.

“Our transition to a Permian Basin pure play is progressing according to plan,” Dove said. “The sale of selected Eagle Ford Shale acreage has been completed. The data room for our remaining Eagle Ford Shale and other South Texas assets has been active. We are making progress on the other assets and expect to have all the data rooms open by mid-May.”

Sales volumes in the first quarter averaged 312,000 boe/d. Oil sales averaged 183,000 b/d, while NGLs averaged 66,000 b/d and gas averaged 379 MMcf/d.

Pioneer’s first quarter average realized price for oil was $61.64/bbl, with NGL pricing of $27.74/bbl and gas at $2.59/Mcf.

Pioneer said it plans to fund its 2018 capital spending from forecast cash flow of about $3.2 billion using current strip prices for the remainder of the year, with oil priced at $66/bbl and gas at $2.80/Mcf. The 2018 capital budget of $2.9 billion is expected to be increased because of additional enhanced, or “Version 3.0+” completions in the Permian and potential late-year rig additions.

Net income was $178 million ($1.14/share) in 1Q2018, compared with a year-ago loss of $42 million (minus 25 cents). Without the effect of one-time hedging losses of $106 million (62 cents/share) in 1Q2018, adjusted income was $284 million ($1.66).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |