Mexico | NGI All News Access | NGI Mexico GPI

Mexico’s CNH Postpones Round 3.2, 3.3 Auctions on Lukewarm Interest

What are likely to be the last upstream auctions of the current Mexican administration were postponed last Friday by the regulator, the National Hydrocarbons Commission (CNH) amid signs of lack of interest from potential bidders.

The postponed auctions were the second and third of Round Three — 3.2 and 3.3 — of the series launched by the 2013-14 energy reform. They feature onshore blocks that include natural gas and non-conventional sources, particularly shale.

Mexican officials have frequently emphasized the need to reduce the current massive dependence on imports of natural gas from the United States and the importance of developing what the EIA regards as some of the world’s leading resources in shale and tight oil.

Auctions of unconventional sources were pencilled in for Rounds One and Two of the reform, but the proposals were never realized, mostly on the need to develop adequate regulations for practices such as hydraulic fracturing.

Juan Carlos Zepeda, president of the CNH recommended Friday’s meeting to postpone the 3.2 auction of conventional onshore blocks from July 25 to September 27.

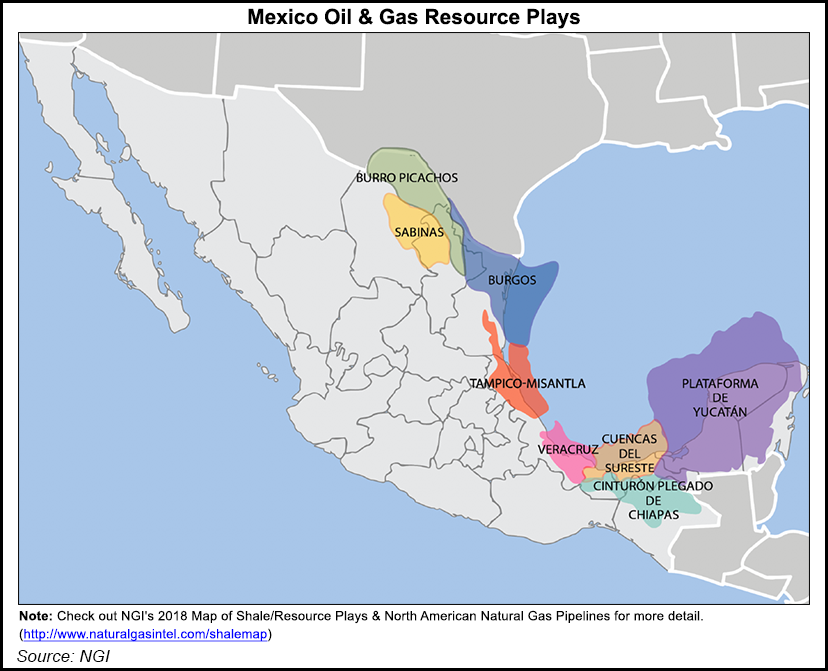

Most of the Round 3.2 blocks are in Tamaulipas in the Burgos Basin, near the Texas border. Burgos is Mexico’s leading producer of non-associated gas, though production has been halved in recent years. Others are further south in the Tampico-Misantla Basin, while further south are blocks in the southeastern basins onshore from the highly prolific areas in the Sound of Campeche that generated the Mexican oil boom of the late 1970s.

Zepeda said that the 3.3 unconventional sources auction should also be held September 27; previously it had been scheduled for September 5.

Zepeda’s proposal to change the dates was agreed to unanimously by the other members of the commission.

In a press statement, the commission said that “with this decision the CNH will consolidate a tender that takes advantage of the interactions among conventional and unconventional resources in order to have access to gas potential of the cluster located in the Burgos area.”

But whatever that might have been the case, interest in 3.2 and 3.3 has been scarce to say the least. Of the 37 blocks in 3.2, the majority are in the border state of Tamaulipas, regarded by U.S. government travel advisories as a no-go zone for American visitors. The others are in the Tampico-Misantla-Veracruz area further south and in southeastern Mexico around the state of Tabasco.

The 3.3 blocks are all grouped together in Tamaulipas. Only two companies have shown any interest in the 3.3 auction, but neither has taken the first step of seeking access to the data room.

The 3.2 auction has sparked some interest. Ten companies have checked it out, four have applied to get into the data room, and three have launched the pre-qualification process.

Shale in particular can clearly be a hard sell in Mexico, with its tight state control on mineral rights and land holding, not to mention such basic items as the state of the roads.

But security must also be of great concern to the pioneering companies of the US shale revolution, few of which have any operational experience in their homeland.

The most recent of several reminders of the dangers of living and traveling in Tamaulipas came at the weekend.

Jaime Juarez, a 20-year veteran of state owned Petroleos Mexicanos (Pemex) was shot dead. Carlos Trevino, the director-general of Pemex, said on his official account that he “condemned the brutal attack”. Juarez had been working, Trevino said, on efforts to combat organized criminals that are behind a rapidly growing black market in stolen gasoline as a sideline to drug-trafficking.

The rescheduled 3.2 and 3.3 auctions will be held after the July 1 Mexican president election that coincide with a renewal of Congress as well as various state and municipal polls.

The inauguration of Mexico’s next president is due on December 1. Mexican presidents serve six-year terms and there is no re-election.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 |