E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Anadarko Securing Takeaway, Building Out West Texas Infrastructure as Permian Volumes Up 70%

Anadarko Petroleum Corp. has locked in firm sales for about 80% of its operated natural gas production in the Permian Basin’s Delaware sub-basin and secured “substantial” long-term oil transportation capacity from West Texas to both Gulf Coast and U.S. export markets, the Houston-based producer said.

“Exceptional performance” in the Delaware and Denver-Julesburg Basin and the deepwater Gulf of Mexico (GOM) also drove record quarterly oil production, matching the company’s highest oil output to date, CEO Al Walker said.

Walker led a conference call Wednesday morning with his management team to discuss first quarter results.

The company achieved record divestiture-adjusted oil production of 367,000 b/d and boosted the oil mix to 57%, while generating the highest per-barrel margins since 2014, when oil prices averaged more than $93/bbl West Texas Intermediate.

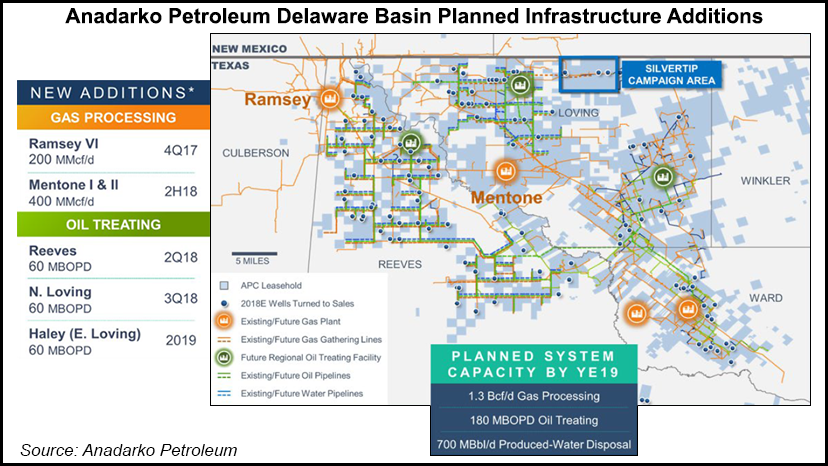

“Looking ahead, our infrastructure buildout in West Texas is on track, with expectations of placing into service our first regional oil treating facility (ROTF) in Reeves County in the second quarter,” Walker said. “This is expected to be followed by an additional ROTF in north Loving County and the first cryogenic train at the Mentone gas processing plant in the third quarter.”

The infrastructure additions “ are key drivers for significant oil growth later this year and next. As the operator for approximately 70% of our Delaware Basin leasehold, we have significant size, scale, control and flexibility to be an anchor tenant on several pipeline projects to ensure hydrocarbon-takeaway from the basin and improve wellhead margins,” Walker said.

“We expect the market could witness the development of ”haves’ and ”have nots’ in the broader Permian Basin for takeaway and basis risk management, and we believe this is a significant looming differentiator…We have been working hard to be among the ”haves’ by proactively aligning our production growth with midstream and downstream solutions with the objective of delivering peer-leading, realized wellhead margins.”

While Anadarko increased 2018 expected capital investments by about $100 million, Walker said the boost isn’t tied to more operated activity but rather it’s because of higher-than-expected activity by leasehold partners in the Delaware.

First quarter sales volumes of oil, natural gas and natural gas liquids (NGL) totaled 58 million boe, or an average of 643,000 boe/d, which was at the high end of guidance.

In the Delaware sub-basin alone, oil sales volumes averaged 52,000 b/d, representing a 70% increase year/year.

Long-term oil transportation capacity commitments secured in West Texas now cover more than half of Anadarko’s expected 2018 operated production and “nearly all” of projected operated production by late 2019.

Anadarko is an anchor shipper on Enterprise Product Partners LP’s planned Midland-to-Sealy pipeline, which would move oil to the Texas coast, and it is an anchor shipper on Plains All American Pipeline LP’s Cactus II Pipeline, which would connect Permian oil volumes to the Corpus Christi area in South Texas.

In addition, the company is covered by “firm transport or firm sales with reliable counterparties controlling basin export capacity” for close to 80% of its operated gas production, Walker said.

Meanwhile, construction on the Reeves County ROTF “is complete and commissioning activities are underway.”

In the Delaware, Anadarko today is operating seven drilling rigs and five completion crews. In the second big onshore target, the DJ Basin in northeast Colorado, Anadarko continued its string of record sales volumes, averaging more than 260,000 boe/d in 1Q2018, an 8% increase from a year ago.

The company is operating four drilling rigs in the DJ, along with three completion crews that feature equipment with noise-reduction technology.

The third major U.S. production area, the deepwater Gulf of Mexico, also saw record oil sales volumes of 128,000 b/d. Growth was driven by a new tieback at the Marlin facility and increased production at Horn Mountain, which is producing at its highest rate since 2006, management noted.

Mozambique LNG Progresses

Overseas, sales volumes from operations in Algeria and Ghana averaged 88,000 b/d of liquids between January and March. Also last month the Mozambique government approved the Anadarko-operated Area 1 Golfinho/Atum development plan that defines the integrated onshore liquefied natural gas (LNG) project from the reservoir to the market.

The Mozambique LNG project also made “good progress on marketing,” with the announcement of a 15-year LNG sale and purchase agreement (SPA) for 1.2 million metric tons/year (mmty) with one of the world’s largest electric utilities, Électricité de France SA.

“The near-term marketing objective has been met with nonbinding key terms agreed with multiple buyers for more than 8.5 mmty. The focus is now on converting these agreements to binding long-term SPAs,” Walker said.

ExxonMobil Corp. and Eni SpA last year sanctioned the separate Coral South LNG project in Mozambique near Anadarko’s, which together could make the southeastern African nation the world’s fourth-biggest gas exporter.

Anadarko also expects to complete a $3 billion share repurchase program by mid-year and “will consider expanding this program further should free cash flow from the current operating environment continue to increase,” said Walker.

In addition, the company has increased its quarterly dividend by 400% from 5 cents/share to 25 cents.

Net income in 1Q2018 was $121 million (22 cents/share), compared with a year-ago net loss of $318 million (minus 58 cents). Net cash provided by operating activities was $1.43 billion, versus year-ago net cash of $1.12 billion. Capital investments, excluding the majority owned midstream partnership Western Gas Partners LP, were $1.37 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |