Markets | NGI All News Access | NGI Data

April Cold Fades; So Do Weekly Natural Gas Spot Prices

The unusually cold temperatures that persisted well into April couldn’t last forever, a fact borne out in natural gas spot prices during the week ended Friday. Led by sharp declines in the Midwest and Northeast, the NGI Weekly Spot Gas Average tumbled 36 cents to $2.43/MMBtu.

Coming off weather-driven cash gains the week before, Northeast points posted heavy losses for the week, especially in New England. Algonquin Citygate plummeted $3.26 on the week to $2.70, with Maritimes & Northeast giving up $3.09 to $3.74. Further south Transco Zone 6 New York shed 39 cents to $2.51.

It was a similar story in the Midwest, where Chicago Citygate tumbled 55 cents on the week to average $2.60, while Dawn fell $1.07 to $2.66.

In West Texas, Waha finished 25 cents lower at $1.51 after setting lows earlier in the week not seen since the late 1990s, according to Daily GPIhistorical data. Waha’s day-ahead average of $1.34 on April 23 marks the lowest average price at the hub since Dec. 4, 1998, when Waha traded as low as 95 cents on the way to averaging $1.03.

As NGI’s Shale Dailyreported during the week, with Permian Basin crude oil basis widening recently to as much as $8.00/bbl off of West Texas Intermediate (WTI), and as Waha natural gas capacity appears to be tapping out, producers working the widest and deepest stretch of land in the U.S. onshore are likely to face a lot of questions during earnings season, according to analysts.

Turning to the futures market, after a strong finish for the May contract Thursday, June natural gas pulled back Friday, giving up the previous day’s gains as the market remained torn between bullish storage deficits and bearish production growth. The June contract, taking over as the front month, fell 6.8 cents Friday to settle at $2.771. That’s close to even week/week, with June settling at $2.767 the Friday before.

“There’s a little bit of jockeying back and forth to align things” because June is “now the spot month,” Powerhouse CEO Al Levine told NGIFriday. “But even if you look at that, you just see Friday’s business essentially reversed Thursday’s business, and unfortunately we’re still caught in this range.

“We have a market that’s quite uncertain,” given conflicting bullish and bearish signals, “and so I think traders are generally unwilling to make a move.”

After recently concluding that the bulls would need to achieve a “decisive weekly close above $2.800” to make a case for a move higher, ICAP Technical Analysis analyst Walter Zimmermann noted Friday that “over the past two days, natural gas retreated from a $2.839 high to close the week well below the pivotal $2.800 level.

“So these past two days gave a failed breakout attempt that paid a great deal of attention to the pivotal $2.800-2.850 resistance zone,” Zimmermann said. “To further the case for a top natural gas bears now need a decisive close below $2.765. If the bears can quickly accomplish a close below $2.765 then room will open down to the $2.650-2.600 zone.”

Otherwise, Zimmermann said the bulls will have an opportunity to continue testing resistance from $2.800-2.850.

Natural gas futures got a bump Thursday after the Energy Information Administration (EIA) reported a rare April storage withdrawal that came in tighter than expected.

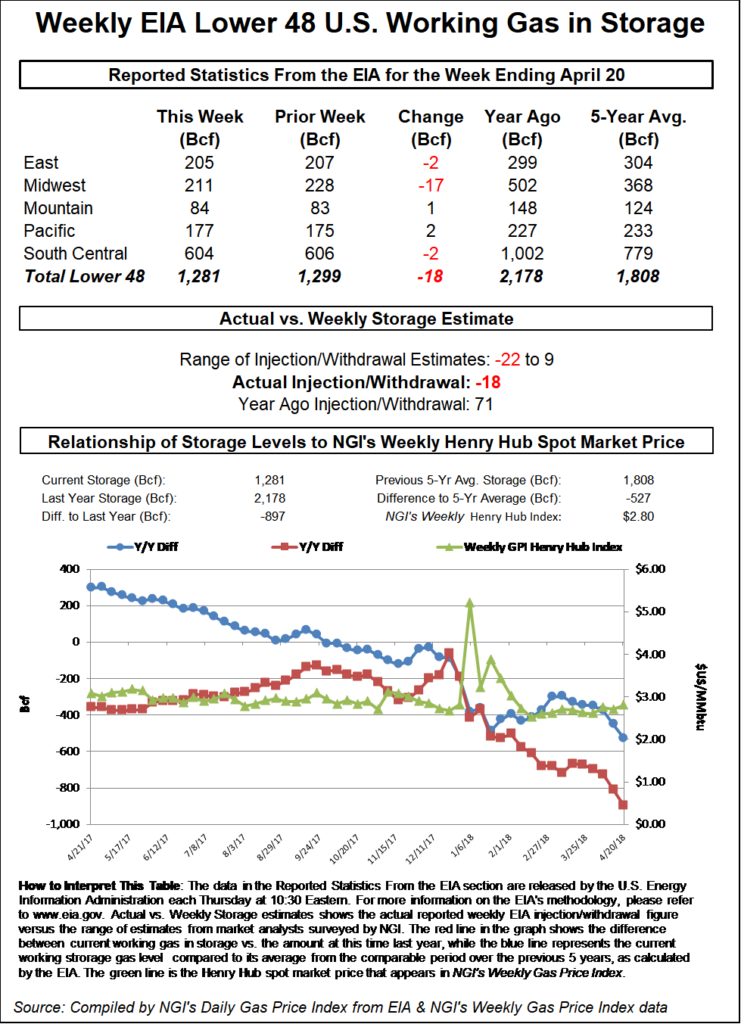

EIA reported an 18 Bcf withdrawal from Lower 48 gas stocks for the week ending April 20, an unusual pull from inventories weeks into the typical start of injection season. Last year, EIA recorded a 71 Bcf build, while the five-year average is a build of 60 Bcf.

The figure beat most estimates to the bullish side, and immediately following the 10:30 a.m. ET release of the number, the expiring May contract shot up around 2 cents to as high as $2.814, while June jumped a couple cents to as high as $2.839. By 11 a.m. ET, May was trading about 3.5 cents above Wednesday’s settle at $2.821, while June was up about 3.2 cents at around $2.839.

Prior to the report, the market had been expecting a withdrawal somewhat looser than the actual figure, with estimates calling for a small injection.

A Reuters survey of traders and analysts on average had predicted a 12 Bcf withdrawal, with responses ranging from a pull of 22 Bcf to a 9 Bcf injection. A Bloomberg survey had produced a median withdrawal of 11 Bcf, with responses ranging from a 22 Bcf pull to a 5 Bcf build.

OPIS PointLogic had predicted an 11 Bcf withdrawal. IAF Advisors analyst Kyle Cooper had called for an 18 Bcf withdrawal, while Price Futures Group senior analyst Phil Flynn had called for an injection of 5 Bcf. Intercontinental Exchange EIA storage futures settled Wednesday at a withdrawal of 14 Bcf.

Total working gas in underground storage stood at 1,281 Bcf as of April 20, according to EIA. That’s versus 2,178 Bcf a year ago and five-year average stocks of 1,808 Bcf.

Week/week, the year-on-year storage deficit increased from 808 Bcf to 897 Bcf, while the year-on-five-year deficit widened from 449 Bcf to 527 Bcf, EIA data show.

By region, the largest net withdrawal came in the Midwest at 17 Bcf, while 2 Bcf was pulled in the East. The Mountain and Pacific regions saw small injections for the period at 1 Bcf and 2 Bcf, respectively. In the South Central, 3 Bcf was pulled from salt for the week, while nonsalt finished flat, according to EIA.

“Weather-adjusted the market was around 1.0-2.0 Bcf/d undersupplied,” analysts with Tudor, Pickering, Holt & Co. (TPH) said Friday. “Expect the market to remain undersupplied next week with colder than normal weather across the East Coast. However, the six-to-14 day forecasts continue to predict warmer-than-normal temperatures, signaling that injection season is right around the corner.

“U.S. natural gas production rebounded back to 80 Bcf/d, while Mexican exports have stabilized at around 4.3 Bcf/d,” the TPH analysts said. Liquefied natural gas exports “remain volatile week/week with April exports averaging around 3.5 Bcf/d (plus 150 MMcf/d month/month).”

Genscape Inc. analyst Eric Fell said the 18 Bcf withdrawal figure came in tighter than his firm’s 15 Bcf estimate.

“Compared to degree days and normal seasonality, the reported 18 Bcf withdrawal appears tight by minus 0.7 Bcf/d versus the five-year average,” Fell said.

As for the latest forecast, NatGasWeather.com said the midday weather data Friday “was slightly warmer for the next two weeks,” with the loss of only a few heating degree days. “Overall, a comfortable pattern is expected over most regions of the country the first three weeks of May, with the exception being slightly cool across the Midwest, especially around May 5-6.”

After colder than normal conditions in April, milder May weather “will result in much larger builds in supplies, although likely not that much larger than five-year averages, at least initially,” NatGasWeather said. “This should begin to reduce deficits that will soon exceed 540 Bcf” following the next storage report, “but at a slow pace. The battle continues between bullish storage deficits and record/bearish production with neither being able to take control” during the week.

In the spot market, gains in New England and West Texas countered declines across most other regions, and the NGI National Spot Gas Average gave up nine cents to $2.35/MMBtu.

“An area of low pressure moving through the Mid-Atlantic states and New England is expected to spread clouds and moderate to heavy rain northeast through the region over the next couple of days,” the National Weather Service (NWS) said Friday. “This system coupled with the arrival of a fairly strong cold front from the Midwest and Great Lakes region will allow for cooler temperatures, with daytime temperatures generally below normal across much of the Eastern U.S. going into the weekend.

“The coldest temperatures will be across the Great Lakes and Ohio Valley, where high temperatures will be as much as 10-15 degrees below normal,” NWS said. Record lows were possible Sunday “across portions of the Midwest and lower Ohio Valley within the chilly air mass.”

In the Northeast, Algonquin Citygate tacked on 4 cents to average $2.63 for weekend and Monday delivery, while Iroquois Zone 2 climbed 4 cents to $2.76.

The Algonquin Gas Transmission Pipeline (AGT) “has been a focal point” in terms of determining ISO New England prices, according to a recent note from Energy GPS.

During periods of high heating demand, “AGT is pushed to its limits…as the pipeline reaches binding constraints at the Stony Point Compressor,” forcing generators to switch to more expensive fuel oil, the firm said.

“With the heating demand off the board, capacity along the pipeline is freed up, historically allowing generators to nominate at will,” Energy GPS said. “The demand has not been nearly enough to bind the pipeline, however the electric grid’s dependence on natural gas generation is growing. As fundamentals begin to take shape for this summer, power burns may cause the pipeline to reach constraints for short periods of time.”

If the lost daily generation from recently retired coal capacity were replaced with gas-fired generation, during July and August total New England gas demand would have been enough to exceed Stony Point capacity 12 times over the past three summers, the firm said.

Based on this calculation, “only four days should create a binding constraint at Stony Point” this summer under normal weather conditions,” Energy GPS said. “While we are likely to run into these constraints for a few days, it will not have nearly the same effect as the winter.”

In the Midwest, Radiant Solutions was calling for temperatures to fall to as low as 10-12 degrees below normal over the weekend in Chicago and Cincinnati, with Minneapolis also expected to see below-normal conditions, including lows in the mid-30s.

But the chilly temps weren’t enough on Friday to spark spot price gains in the region. Chicago Citygate fell 9 cents to $2.52. In the Midcontinent, Northern Natural Ventura dropped 9 cents to $2.31.

In the West, SoCal Citygate and SoCal Border Average sold off sharply as demand on the Southern California Gas Co. (SoCalGas) system was projected to decline over the weekend. SoCalGas was forecasting system demand of around 2.1 Bcf/d Saturday and Sunday, versus demand closer to 2.3 Bcf/d on Thursday. Receipts on the import-constrained utility’s system were forecast to approach 2.4 Bcf/d over the weekend.

SoCal Citygate tumbled 39 cents to $2.62 after averaging as much as $4.38 early in the week. SoCal Border Average dropped 28 cents to $1.81.

Further upstream in West Texas, Waha surged 22 cents to average $1.80, establishing some distance from lows set earlier in the week.

Permian Basin producers have faced brutal basis differentials recently as the region’s oil and associated gas output has grown and takeaway capacity has filled up.

A recent capacity increase on Enterprise Product Partners LP’s Midland-to-Sealy pipeline helped temporarily relieve crude constraints and narrow the spread between Midland and Houston prices, “but in just a few short days the spread has shot up to $10.60/bbl, signaling the path between West Texas and Houston has once again filled,” East Daley Capital’s Justin Carlson, vice president of research, said in a note to clients Friday.

“Another interesting observation is while the Houston to Midland spread blew out in the fourth quarter, Cushing to Midland did not,” Carlson said. “Now Midland has clearly disconnected from both Houston and Cushing. This implies Permian takeaway is completely full going to both destinations.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |