E&P | Infrastructure | NGI All News Access

U.S. Adds Three NatGas Rigs; Oil Still Setting Pace

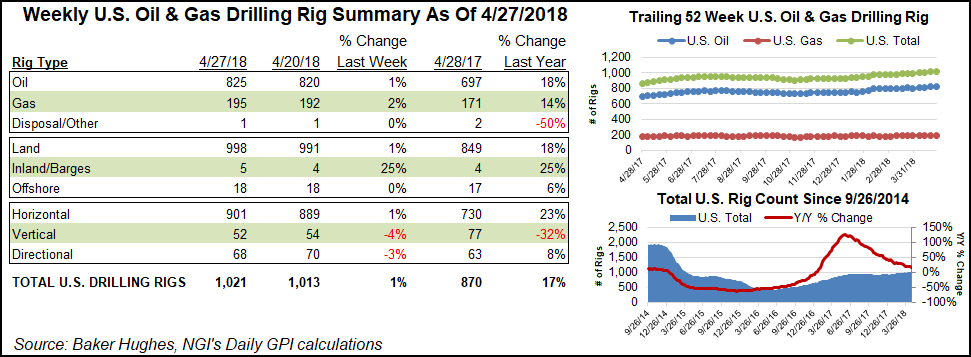

The United States added three natural gas rigs for the week ended Friday, while gains in oil-directed drilling continued to set the pace for the domestic rig count’s march higher, according to data released by Baker Hughes Inc. (BHI).

The United States added eight rigs, five oil-directed and three gas-directed, to finish the week at 1,021, up from 870 units a year ago. Seven units were added on land to go with one in inland waters, while the Gulf of Mexico’s rig count held steady at 18, according to BHI.

Canada, meanwhile, dropped eight rigs during the week — five oil and three gas — to finish at 85, exactly even with its tally at this time last year.

The combined North American rig count ended the week unchanged at 1,106, up from 955 units in the year-ago period.

Among major basins, the Cana Woodford posted a sharp increase for the week to lead all plays, adding nine rigs to grow its tally to 70 from 55 a year ago.

NGI Shale Daily’s more detailed breakdown of BHI data showed most of these gains occurring in the SCOOP (South Central Oklahoma Oil Province), which added seven rigs to grow its tally to 29. The STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties) added two rigs, the data shows.

Other gainers included the Williston Basin (up three) and the Utica Shale (up two), as well as the Ardmore Woodford, Arkoma Woodford and Haynesville Shale, which each saw one rig return to the patch during the week.

The Denver Julesburg-Niobrara saw the largest decrease for the week after dropping two rigs, while the Eagle Ford and Fayetteville shales each dropped one rig, as did the U.S. onshore’s most active play, the Permian Basin.

Among states, with all the activity in the Cana Woodford, Oklahoma led the way with a net increase of six rigs for the week. Texas wasn’t far behind, notching a four-rig increase to bring its combined tally to 513 from 437 a year ago. Other gainers included North Dakota (up three), Louisiana (up two), Ohio (up two) and California (up one), according to BHI.

New Mexico and Alaska each saw three rigs exit the patch during the week, while Wyoming dropped two rigs. Colorado, Kansas and Pennsylvania each dropped one rig.

The week saw West Texas Intermediate prices push up above $68/bbl, while various companies in the industry have been sharing their outlook on the U.S. onshore as 1Q2018 earnings season heats up.

Leading fracture sand provider U.S. Silica Holdings Inc. is “completely sold out” and “literally selling everything that we can make,” CEO Bryan Shinn said during an earnings conference call Tuesday.

Business has never been better, but with the increase in activity, particularly in the Permian Basin, it’s a two-edged sword, said Shinn. U.S. Silica provides sand for all types of commercial endeavors, but the demand for sand used by exploration and production companies to fracture wells “is probably the strongest that I’ve seen, in terms of demand,” Shinn said. “The market is as tight as I’ve seen it in my several years in the industry.”

Meanwhile, super independent ConocoPhillips had a strong start to 2018, with production for 1Q2018 excluding Libya over 1.2 million boe/d, a 4% increase compared with 1Q2017 after adjusting for dispositions, the company said Thursday.

“We are seeing the earnings power of our unconventional engine driving the bottom line results, with our Lower 48 earnings breakeven now at less than $45/bbl,” CFO Don Wallette said during a conference call with analysts.

The production increase was primarily due to the ramp up of the Houston-based company’s Big Three unconventional assets. Year-over-year production in the Eagle Ford, Bakken and Permian Basin Delaware grew 20%, with 163,000 boed/d out of the Eagle Ford, 68,000 boe/d from the Bakken and 19,000 Boe/d from the Delaware sub-basin.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |