E&P | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Chevron Bullish on Asian LNG Demand as Gorgon, Wheatstone Deliver

Chevron Corp. is hitting the sweet spot for natural gas exports in Australia, in close proximity to thirsty Asian markets, and is in no hurry to look elsewhere for opportunities to expand, including on the U.S. Gulf Coast, the midstream chief said Friday.

During the first quarter conference call Friday morning, Vice President Mark Nelson shared a microphone with CFO Pat Yarrington to discuss results and share some insight on oil and gas projects in North America and overseas.

Nelson, who handles midstream, strategy and policy, said most of the questions he gets these days are centered around the Permian Basin, where Chevron is a legacy producer, and about liquefied natural gas (LNG).

Chevron is helming two of the largest LNG export projects in Australia, Gorgon and Wheatstone, whose cargoes are destined for thirsty Asia Pacific markets. There may be opportunities to export gas from the Permian, but at this point, the Gulf Coast just can’t compete, Nelson said.

“From a macro perspective…you’ll start to see people consider further investments” to carry Permian gas to the Gulf Coast. However, “the Gulf Coast has to compete with landed prices in Australia or in Asia.

“And from our perspective, we’ve got such an advantaged position taking care of that Asian growth from our base assets in Gorgon and Wheatstone that we’ll watch what others do. We certainly have other LNG options around the world, but all of it has to compete with landed price in Asia.”

Gorgon and Wheatstone each delivered “strong and reliable performance in the first quarter,” Yarrington said. “First quarter net production was 202,000 boe/d from Gorgon and 67,000 boe/d from Wheatstone.

“We shipped 69 LNG and four condensate cargoes and were able to take advantage of rising oil-linked prices, as well as strong Asia LNG spot prices, which averaged over $10/boe for the quarter.”

The Australia facilities continue to be fine tuned to ensure reliability and boost capacity, with Gorgon’s 1Q2018 output more than 5% higher than the previous best quarter, and the first Wheatstone train running well, she said.

“We have a planned pit-stop on Gorgon Train two next month to replicate performance improvement modifications that we have made in the other two trains,” she added. “And work on Wheatstone Train two is progressing well and commissioning activities are ongoing.”

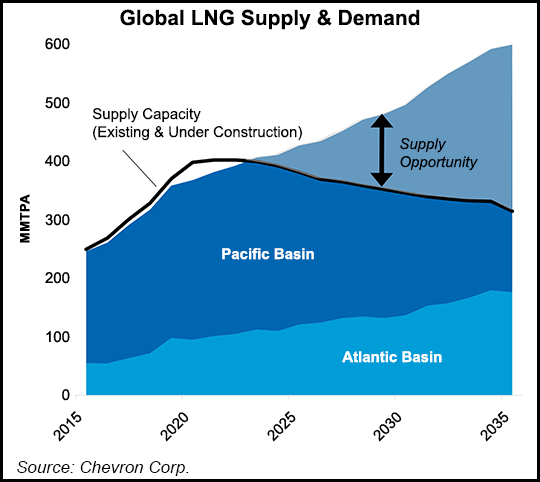

Nelson, who offered more insight on LNG, gave a nod to a recent Wood Mackenzie forecast that said the market is becoming oversupplied in the short term as new projects ramp up in the Pacific and Atlantic basins.

“North Asian LNG demand, however, especially in China, was stronger last winter than the market anticipated,” Nelson said. “In fact 2017 Chinese gas demand was up 15% year/year, with LNG imports up 46%.

“While this growth rate may moderate, the demand drivers appear mostly sustainable, with coal-to-gas switching in residential and industrial applications mandated by the Chinese government to reduce air pollution.”

The global LNG market “should rebalance with a supply gap expected to open before the middle of the next decade,” according to Nelson. “And this is where Gorgon and Wheatstone capacity creep and debottlenecking opportunities will fit very nicely. Only the most cost competitive projects will be able to move forward in this space, and we will be very disciplined with our investment and will fund only those projects that will generate top returns.”

From an Asia LNG perspective, “the most exciting thing for us, of course, is the amount of demand that we are seeing in that part of the world,” Nelson told investors.

It is premature to discuss expanding the Australia facilities yet, “as we have considerable opportunity moving from both ramp up to debottlenecking.” But with most of his career spent in the refinery end of the oil and gas business, Nelson said, “I wouldn’t underestimate the opportunity there and the size of the prize.”

Both Gorgon and Wheatstone “are about 90% committed under long-term contracts,” Yarrington noted. Earlier this month Chevron pulled the trigger on stage two for Gorgon to drill 11 more wells so that it can produce a targeted 15.6 million metric ton/year (mmty) of LNG.

Chevron operates Gorgon with partners ExxonMobil Corp. (25%), Royal Dutch Shell plc (25%), Osaka Gas (1.25%), Tokyo Gas (1%) and Jera (0.417%). The first Gorgon cargo departed in March 2016, and since then more than 250 cargoes have been loaded and sent to Asian markets.

Worldwide net production in the first quarter was 2.85 million boe/d, versus year-ago output of 2.68 boe/d.

In the United States, upstream operations earned $648 million, sharply ahead of year-ago profits of $80 million, primarily from higher realizations and production, partially offset by higher exploration expenses. Average sales price for crude oil and natural gas liquids was $56/bbl from $45 a year earlier, while natural gas fetched $2.02/Mcf from $2.39.

U.S. net production was 733,000 boe/d, 61,000 boe/d higher year/year, from gains in the Permian Basin in Texas and New Mexico, where output climbed 65%, and from the base business in the Gulf of Mexico.

The net liquids component of U.S. output increased 13% to 567,000 boe/d while net natural gas production decreased 1% to 993 MMcf/d.

Net income for 1Q2018 climbed to $3.6 billion ($1.90/share) from year-ago profits of $2.7 billion ($1.41). Sales and other operating revenues were $36 billion, compared with $32 billion in the year-ago period. Cash flow from operations was $5.0 billion in 1Q2018, compared with $3.8 billion a year ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |