May Natural Gas Rallies into Expiry on Another April Storage Withdrawal

Natural gas futures settled higher for the fifth straight session Thursday after the Energy Information Administration (EIA) reported a rare April storage withdrawal that came in tighter than expected, although analysts see downside for prices with May injections ahead.

In the spot market, most points posted small changes as the chilly temperatures that have characterized much of April appear to be giving way to more seasonal conditions; the NGI National Spot Gas Average was unchanged at $2.44.

The May contract rolled off the board Thursday 3.5 cents higher at $2.821, settling above the previous front-month high of $2.811 set March 13. June, taking over as the prompt month, settled at $2.839, up 3.2 cents.

June is approaching its previous reactionary high of $2.873 reached on March 13, and if it can break through that, it faces secondary resistance at the $2.975 high it posted on January 30, according to NGI’s Patrick Rau, director of Strategy & Research. However, breaking through that first technical hurdle may be a challenge.

“June followed May higher a bit Thursday, on the coattails of the May settle, but June is clearly in overbought territory,” Rau said. “Slow stochastics are at 82, which is overbought in mostly anyone’s view. Furthermore, while June did pierce above its 20-day Bollinger Band, the contract has a history of retreating almost immediately thereafter.”

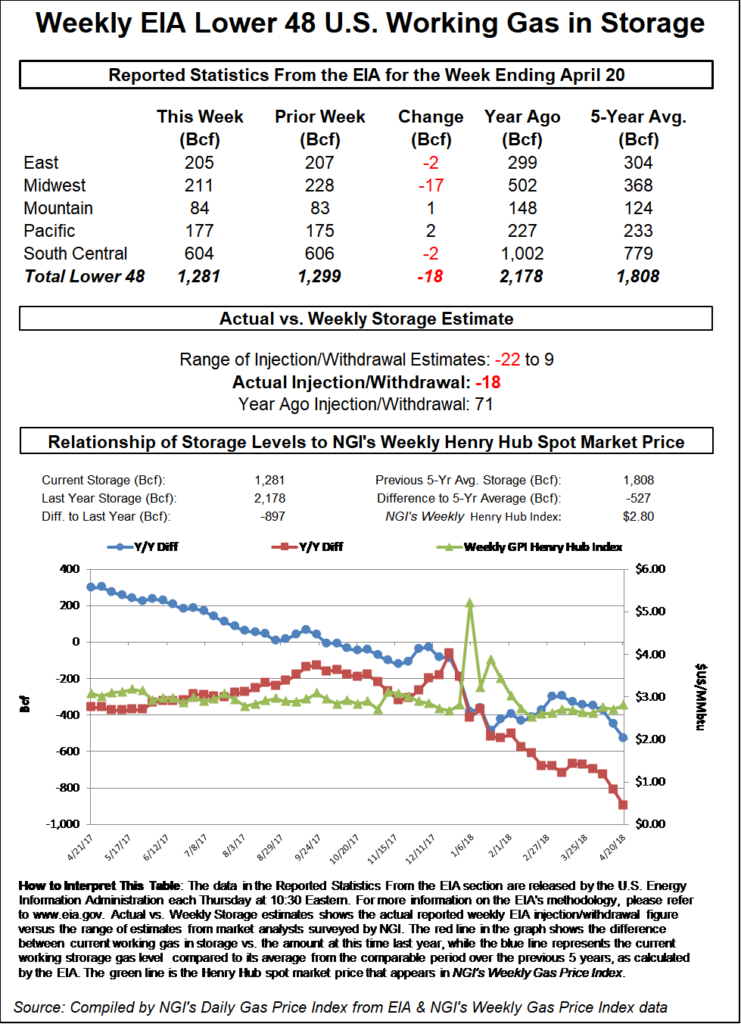

EIA reported an 18 Bcf withdrawal from Lower 48 gas stocks for the week ending April 20, an unusual pull from inventories weeks into the typical start of injection season. Last year, EIA recorded a 71 Bcf build, while the five-year average is a build of 60 Bcf.

The figure beat most estimates to the bullish side, and immediately following the 10:30 a.m. ET release of the number, the expiring May contract shot up around 2 cents to as high as $2.814, while June jumped a couple cents to as high as $2.839. By 11 a.m. ET, May was trading about 3.5 cents above Wednesday’s settle at $2.821, while June was up about 3.2 cents at around $2.839.

Prior to the report, the market had been expecting a withdrawal somewhat looser than the actual figure, with estimates calling for a small injection. A Reuters survey of traders and analysts on average had predicted a 12 Bcf withdrawal, with responses ranging from a pull of 22 Bcf to a 9 Bcf injection. A Bloomberg survey had produced a median withdrawal of 11 Bcf, with responses ranging from a 22 Bcf pull to a 5 Bcf build.

OPIS PointLogic had predicted an 11 Bcf withdrawal. IAF Advisors analyst Kyle Cooper had called for an 18 Bcf withdrawal, while Price Futures Group senior analyst Phil Flynn had called for an injection of 5 Bcf. Intercontinental Exchange EIA storage futures settled Wednesday at a withdrawal of 14 Bcf.

“The last two EIA prints are the primary factor propping up the front of the strip as other bullish catalysts look to ease into the month of May,” said Bespoke Weather Services, which had called for an 11 Bcf pull. “Gas-weighted degree days have generally stabilized in forecasts, with some colder trends into mid May removing as much expected cooling demand as they add lingering heating demand.

“…With a very limited weather-driven catalyst in May, EIA data will have to continue running as tight the next few weeks to keep prompt month prices above the $2.80 level, and that appears quite unlikely given production growth.”

Total working gas in underground storage stood at 1,281 Bcf as of April 20, according to EIA. That’s versus 2,178 Bcf a year ago and five-year average stocks of 1,808 Bcf.

Week/week, the year-on-year storage deficit increased from 808 Bcf to 897 Bcf, while the year-on-five-year deficit widened from 449 Bcf to 527 Bcf, EIA data show.

By region, the largest net withdrawal came in the Midwest at 17 Bcf, while 2 Bcf was pulled in the East. The Mountain and Pacific regions saw small injections for the period at 1 Bcf and 2 Bcf, respectively. In the South Central, 3 Bcf was pulled from salt for the week, while nonsalt finished flat, according to EIA.

“This marked the third withdrawal in April, the first time on record that three withdrawals have happened during the month,” analysts with Jefferies LLC said in a note Thursday. “Storage now sits at 1.3 Tcf, 28% below the five-year average and 42% below prior year levels. Given the current storage deficit, higher year/year exports and growing industrial demand, we estimate that supply will need to average about 7 Bcf/d higher year/year for storage to reach the five-year average by Nov. 1.”

This comes as month-to-date average dry gas production is up 6.9 Bcf/d year/year, according to the Jefferies team.

“Dry gas production has averaged 78.2 Bcf/d thus far in April…with about 55% of the growth provided by Appalachia,” the analysts said. “Demand has also moved higher in April, up 12.5 Bcf/d year/year, largely driven by colder weather (residential/commercial demand is up 8.0 Bcf/d year/year), though power generation (up 1.3 Bcf/d) and industrial demand (up 1.0 Bcf/d) have also moved higher.

Liquefied natural gas (LNG) exports “have averaged 3.5 Bcf/d in April, up 1.4 Bcf/d year/year, while Mexican exports have moved higher by 0.4 Bcf/d to 4.3 Bcf/d.”

Spot market action Thursday consisted of small adjustments to most regional averages amid forecasts for more moderate weather this week compared to the unusually cold conditions seen earlier in the month.

A system with showers and thunderstorms was expected to exit the Northeast late Thursday “while two new systems develop upstream,” NatGasWeather.com said in its one- to seven-day outlook. “The milder of the two will be tracking into the South and Southeast the next few days with showers,” with a colder system sweeping through the Northern Plains and Midwest Thursday and Friday.

“These two systems will meet over the Northeast this weekend with another round of showers and slightly cool conditions as highs reach the 40s and 50s,” NatGasWeather said. “Next week will bring rapid warming across most of the eastern two thirds of the U.S. for much lighter demand, while cooling shifts over areas of the West.”

In the Northeast, Algonquin Citygate continued to moderate from last week’s elevated prices, falling 13 cents to $2.59, while Iroquois Waddington shed 8 cents to $2.65.

Further upstream in Appalachia, Dominion South added 2 cents to $2.34.

The Federal Energy Regulatory Commission’s order Wednesday giving Rover Pipeline LLC the green light to ramp up part of its second and final phase likely won’t increase capacity on the pipe for now, according to Genscape analysts Colette Breshears and Vanessa Witte.

“Wednesday’s authorization is not expected to add additional throughput to Rover’s current roughly 2 Bcf/d capacity levels, as the newly authorized section of Mainline B is located in central Ohio, and will be capped at either end by sections of pipe restricted to only one operational mainline,” Breshears and Witte said.

In East Texas, a few points posted modest gains as Radiant Solutions was calling for temperatures to remain around 5 degrees below normal the next two days in Dallas and Houston, with overnight lows in the mid- to lower 50s.

Houston Ship Channel climbed 7 cents to $2.95, while Katy added 4 cents to $2.90.

Looking at reports last week of delays to the start-up of the Freeport LNG terminal south of Houston, the Jefferies analysts estimated that “the delay likely pushes about 1 Bcf/d of incremental LNG feedgas supply growth from late 2019 into 2020, though we still estimate around 4.5 Bcf/d of total LNG export capacity scheduled to come online in 2019.”

Meanwhile, management for Royal Dutch Shell plc said during a conference call Thursday that in the first three months of the year the company benefited from its substantial — and growing — LNG business, with global sales climbing 17% year/year to 18.58 million metric tons (mmt) and volumes increasing 9% to 8.9 mmt.

“We remain very bullish on the LNG market,” CFO Jessica Uhl said. “We continue to see very strong demand in a number of markets, particularly in Asia, that supported very strong pricing in the quarter…and overall, the LNG business continues to be a real source of strength for us…

“We believe the market fundamentals will support that going into the 2020s. We also believe that there will likely be a shortage in LNG supply coming into the 2020s, and that new liquefaction capacity will be needed…”

In West Texas, Waha gained for the third straight day after setting lows this week not seen since the late 1990s, according to Daily GPI historical data. On Thursday Waha added 8 cents to average $1.58. Waha’s Monday average of $1.34 marks the lowest average price at the hub since Dec. 4, 1998, when Waha traded as low as 95 cents on the way to averaging $1.03.

As NGI’s Shale Daily reported this week, with Permian Basin crude oil basis widening recently to as much as $8.00/bbl off of West Texas Intermediate (WTI), and as Waha natural gas capacity appears to be tapping out, producers working the widest and deepest stretch of land in the U.S. onshore are likely to face a lot of questions during earnings season, according to analysts.

In a recent note, BTU Analytics LLC CEO Andrew Bradford said any discussion of natural gas market dynamics in Oklahoma, Northern Louisiana, the Rockies or Appalachia has to include the Permian and all of its associated gas.

With the Permian’s already impressive geographic size, after considering its multiple drilling horizons, “even by the most conservative estimates of horizons that could potentially be developed, this doubles the size of potential developed ”horizon acres’ for the region, putting it in a league of its own in relation to other major plays,” Bradford said.

The Permian is also attracting an increasingly large share of U.S. exploration and production (E&P) capital expenditure (capex) budgets, according to Bradford.

“BTU estimates that by 2020 the Permian will grow to represent 40% of U.S. E&P capex,” with more Permian capex meaning “more activity and production growth relative to other plays,” he said. “Adding insult to injury, BTU’s forecast calls for Permian gas growth to outpace U.S. demand growth from 2020-2023. This means that, all else equal, other plays will need to decline to accommodate Permian gas growth.

“Barring a major WTI price correction, Permian associated gas is going to impact all gas basins for years to come.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |