E&P | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report

Schlumberger, BHGE, Halliburton Seeing ‘Subdued Growth’ in Latin America

Latin America weighed on the international earnings of the top three oilfield services (OFS) operators during the first quarter.

Schlumberger Ltd. and Baker Hughes, a GE Company (BHGE) last Friday, along with Halliburton Co. on Monday each reported year/year and sequential declines in Latin American revenues for 1Q2018.

BHGE recorded a 6% sequential drop in international OFS earnings, citing lower activity in Latin America, Asia and the Middle East. The company finished its merger with the oilfield business of General Electric Co. (GE) last July, creating the second largest OFS firm by revenue.

No. 1 OFS operator Schlumberger posted revenues of $870 million in Latin America, down 9% year/year and off 16% compared to 4Q2017. Management noted “subdued growth” in Latin America, but expects activity to start picking up by the second half of the year.

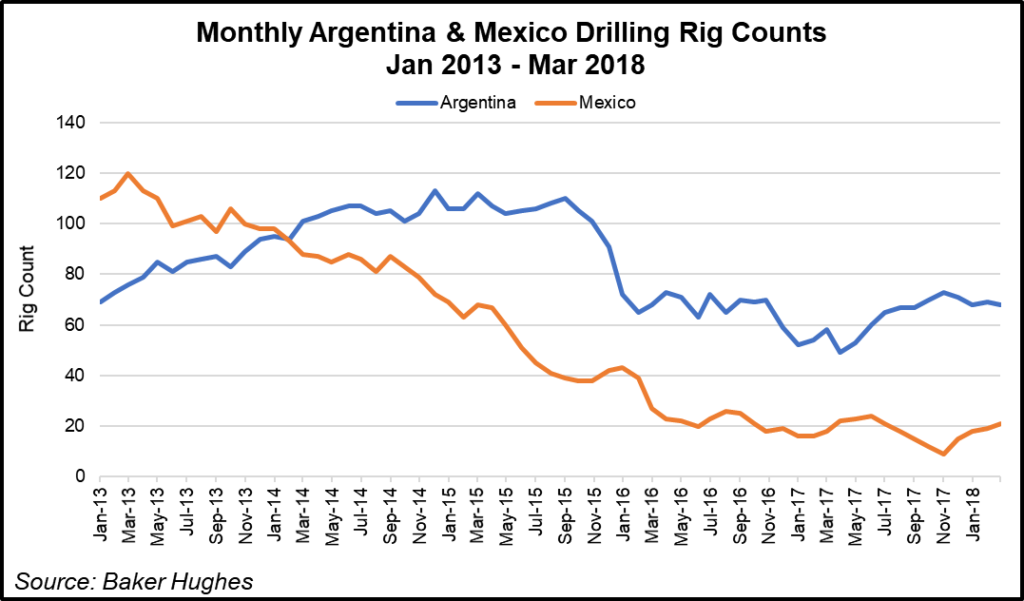

Schlumberger’s sequential decline in Latin America “was due to lower hydraulic fracturing stage count in Argentina, reduced activity in Brazil as we mobilize for new offshore projects for several international operators, and as our cash based operations in Venezuela declined further,” Executive Vice President Patrick Schorn of New Ventures said during a conference call on Friday.

“On the positive side, revenue in Mexico grew as onshore workover activity increased and as we continue to monetize our newly acquired WesternGeco multiclient seismic library on the back of another successful bid run for new offshore acreage in Mexico during the quarter.”

The Mexican government awarded 16 blocks in shallow water at the first auction of licensing Round 3, held in late March. Most of the blocks were in the Sureste basin, an area well explored by state oil company Petroleos Mexicanos (Pemex).

Mexico has scheduled two other auctions this year, both for onshore acreage — Round 3.2 on July 25 and Round 3.3 on Sept. 5.

“A record number of blocks are scheduled to be auctioned in Mexico and Brazil, representing a pipeline of service activity in the coming years,” Halliburton CEO Jeff Miller said Monday during a conference call.

Round 3.3 in Mexico will offer the country’s first unconventional blocks for development by operators other than Pemex. All nine blocks in the tender are in the northeast Burgos Basin, which is across the border from the Eagle Ford Shale in South Texas.

To date, Mexico has been unable to replicate the unconventional boom occurring across the border in the United States. In Latin America, only Argentina has so far managed to make headway in developing its shale resources.

“In Argentina, there are exciting improvements in unconventional resources,” Miller said. “We successfully completed the longest lateral section ever in the Vaca Muerta formation, flawlessly pumping 42 stages.”

Halliburton’s Latin American 1Q2018 earnings totaled $457 million, down 1.3% year/year. The decline resulted “primarily from activity declines across multiple product service lines in Venezuela, as well as decreases in pressure pumping and project management activity in Mexico,” management said.

Sequentially, Halliburton’s regional earnings fell 25.7% from $615 million in 4Q2017. “Certainly, a low-light for the quarter is the writedown of our remaining assets in Venezuela,” Miller said. “We continue to work at a reduced level as we believe the ultimate path for resolution in Venezuela involves oil and gas.”

BHGE reported international OFS revenues of $1.6 billion in 1Q2018. Because of the merged operations, year/year figures were not comparable.

Management said it expects international growth this year to be relatively flat with “pocks of sudden activity” in certain regions.

“As you look at Latin America, there’s political and economic instability in some countries,” BHGE CEO Lorenzo Simonelli said last Friday. “We see modest growth through the year, with weakness in Venezuela partially offset by an increase in Argentina.”

Schlumberger’s net quarterly profits rose to $525 million (38 cents/share) from year-ago earnings of $279 million (20 cents). Total revenue was $7.83 billion, up from $6.89 billion a year ago. The company’s international earnings were down 1% year/year.

BHGE turned in a net income of $70 million (17 cents/share) during 1Q2018. Revenue across all segments totaled $5.4 billion.

Halliburton’s revenues climbed 34% year/year to $5.7 billion in 1Q2018, with international earnings rising 9% to $2.2 billion. Operating income was $354 million, up from 1Q2017’s $203 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 | ISSN © 2158-8023 |