Infrastructure | E&P | NGI All News Access

Natural Gas Drilling Flat as Oil Still Leading U.S. Rig Count Higher

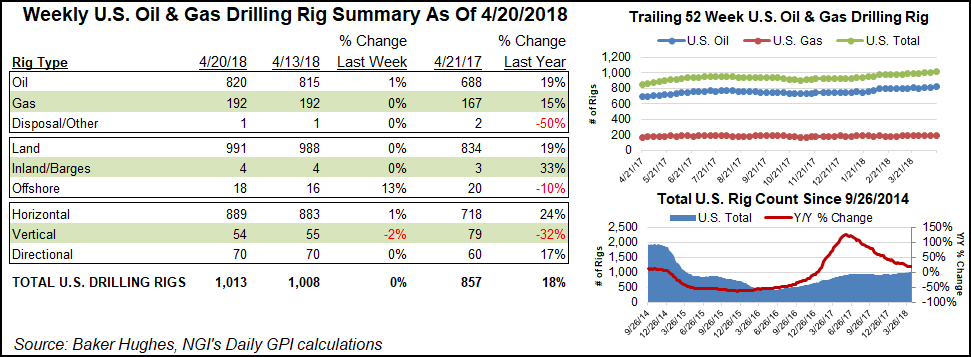

The U.S. rig count continued to climb for the week ended Friday, adding five units on growth in oil drilling while the number of natural gas rigs remained unchanged, according to data from Baker Hughes Inc. (BHI).

The domestic rig count finished the week at 1,013, up from the 857 at this time last year. All of the week’s net additions were oil-directed, with gas-directed rigs finishing even week/week at 192.

Six horizontal units returned to the patch, with one vertical unit departing. Three rigs were added on land, while two were added in the Gulf of Mexico, bringing its tally to 18 from 20 a year ago.

In Canada, nine rigs departed (three oil and six gas) to drop to 93, down from 99 active units at this time last year.

The North American rig count ended the week at 1,106, down four week/week but up 150 from 956 rigs in the year-ago period.

Broken down by major basins, the Permian added eight rigs for the week to further cement its status as the most active play in the U.S. onshore. The play, underlying West Texas and part of southeast New Mexico, grew its tally to 453 rigs, up from 340 a year ago.

Elsewhere, the Mississippian Lime added two rigs for the week to double its total, while one rig was added in the Eagle Ford Shale.

The Cana Woodford saw four rigs depart, with the declines split evenly among the SCOOP (South Central Oklahoma Oil Province) and the STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties), according to NGI’s more detailed breakdown of BHI data. The Utica Shale and Williston Basin each dropped two rigs, while the Denver Julesburg-Niobrara and the Granite Wash each dropped one.

Among states, Texas unsurprisingly led with eight rigs added, while one rig each went back to work in New Mexico and Louisiana.

Colorado and North Dakota each saw two rigs exit the patch for the week, while Ohio, Oklahoma and Pennsylvania saw net declines of one apiece, according to BHI’s breakdown.

The upward trajectory in the U.S. oil rig count comes as crude prices have been on the rise. The May Nymex West Texas Intermediate futures contract was trading above $68/bbl Friday.

In a conference call to kick off 1Q2018 earnings for the OFS sector Friday, Schlumberger Ltd. highlighted a strong close to the quarter for onshore activity in North America.

“…We experienced a slow start to the quarter due to freezing weather and as many shale oil operators took a conservative approach to ramping up activity after the holidays,” said Executive Vice President Patrick Schorn of New Ventures. “However, with oil prices stabilizing well above $60…drilling and pressure pumping activity started to ramp up in the second half of the quarter and showed healthy first quarter exit rates.”

The U.S. land hydraulic fracturing market should continue to improve during the second quarter, “both in terms of pricing and in operational efficiency and, therefore, we are continuing with our aggressive fleet reactivation and recommissioning program,” CEO Paal Kibsgaard said.

Baker Hughes, a GE company also held a 1Q2018 conference call Friday. A lot of the OFS operator’s expansion now and in the future is tied to U.S. unconventionals growth in oil and natural gas, according to management.

“In the oil market we see global demand rising at a steady pace, driven by an improved gross domestic product outlook for the United States and Europe,” CEO Lorenzo Simonelli told investors. “In Asia alone, strong economic growth is expected to add nearly 1 million b/d of demand in 2018.

“On the supply side, U.S. production grew to more than 10 million b/d, with first quarter average production up 7% versus the fourth quarter of 2017, driven mostly by shale.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |