E&P | NGI All News Access | NGI The Weekly Gas Market Report

Gulfport’s Utica, SCOOP Quarterly Output Tracking 2018 Guidance

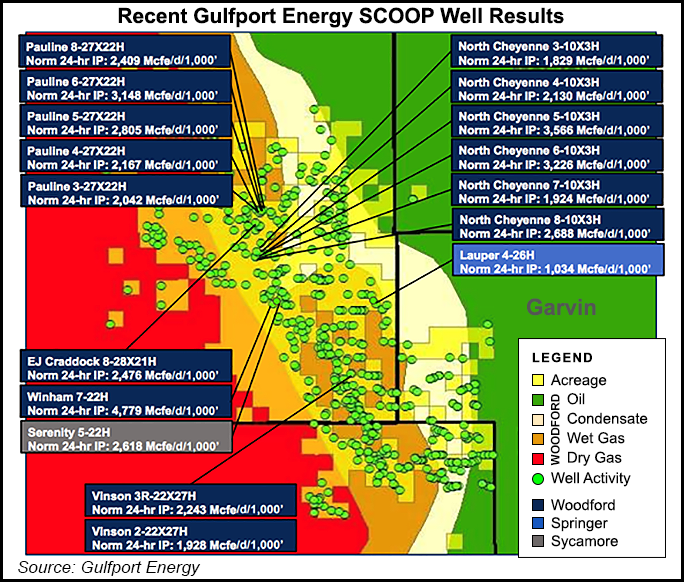

The Utica Shale and South Central Oklahoma Oil Province (SCOOP) helped Gulfport Energy Corp. increase year/year production by 52% in the first quarter.

The company, which beat Wall Street consensus for most of 2017 after entering the SCOOP early in the year, during the first quarter again topped analyst estimates, reporting Thursday it produced 1.288 Bcfe/d, which consisted of 88% natural gas, 8% natural gas liquids and 4% oil.

Production came in about 2% above consensus, up from 849.6 MMcfe/d in 1Q2017 and 2% higher sequentially. Full-year guidance for 2018 is 1.25-1.30 MMcfe/d.

Gulfport plans to run about five rigs in Ohio’s Utica and the Midcontinent this year. During the first three months, the company said it turned to sales three net wells in the Utica and 6.3 net wells in the SCOOP. The company said in January it would turn to sales 37 net wells in the Utica and 18 in the SCOOP for the full year.

Gulfport reported an average realized price of $2.81/Mcfe for the first quarter, versus $4.36 in 1Q2017. Realized prices for the period included a hedging loss of $25.4 million. Before the impact of derivatives, the realized price of gas was $2.95/Mcfe, compared with $3.05/Mcfe in the year-ago quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |