Another April Natural Gas Storage Withdrawal Expected as Futures Finish Near Even

Natural gas futures briefly contemplated a move higher Wednesday before finishing near even, with storage deficits and strong production continuing to push and pull the market. Meanwhile, with the latest bout of April cold working its way across the northern United States this week, Northeast spot prices gained and Midwest points eased off; the NGI National Spot Gas Average was up 6 cents to $2.98.

The May contract settled 0.1 cents higher at $2.739 Wednesday after trading as high as $2.790 early in the session. June settled at $2.768, down 0.2 cents.

NatGasWeather.com said the midday data Wednesday “held cooler trends for late next week, but was a little warmer at the end of April into early May, trending bullish weather patterns to neutral and then slightly bearish.

“…We expect the markets will be watching closely to see how May weather patterns shape up and if record production will be able to meaningfully cut into bullish storage deficits.”

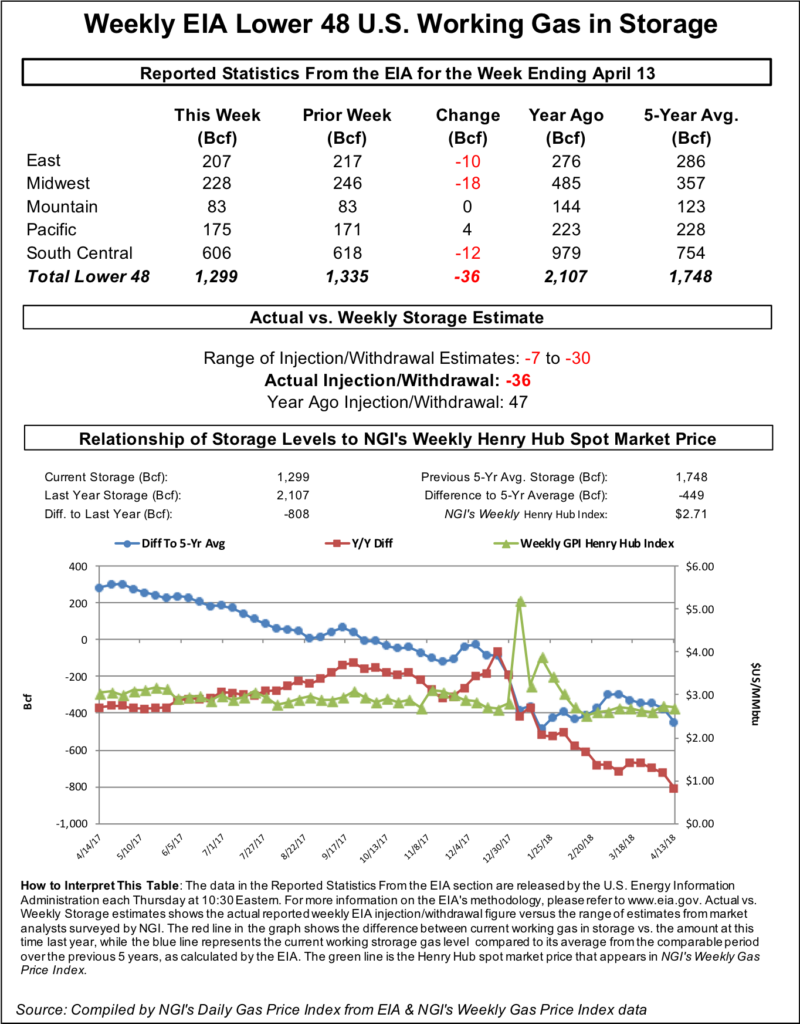

Predictions for this week’s Energy Information Administration (EIA) storage report show the market anticipating another April withdrawal, significantly tighter than recent norms as lingering cold has delayed the start of injection season.

A Reuters survey of traders and analysts on average predicted a 23 Bcf withdrawal from U.S. gas stocks for the week ending April 13, bullish versus last year’s 47 Bcf injection and a five-year average injection of 38 Bcf. Responses to the Reuters survey ranged from a minus 7 Bcf to minus 30 Bcf. A Bloomberg survey produced a median withdrawal of 26 Bcf, with responses ranging from minus 11 Bcf to minus 30 Bcf.

OPIS By IHS Markit this week called for EIA to report a 24 Bcf withdrawal for the period, 5 Bcf tighter week/week “owing to cooler weather across the U.S. Lower 48 and a slight uptick in exports to Mexico.

“…Drawdowns at this time of year are unusual; there was an injection of 47 Bcf in the same week of 2017,” the firm said. “This year’s late-spring withdrawal will further widen the already-large inventory deficit, to 437 Bcf” versus the five-year average. “However, prices have barely twitched.” The muted price response “underscores supply-side strength, with dry gas production reaching a new record high of over 80 Bcf/d at the end of last week.”

IAF Advisors analyst Kyle Cooper predicted a 27 Bcf withdrawal, while Intercontinental Exchange EIA storage futures settled Tuesday at a withdrawal of 26 Bcf for the upcoming report.

The colder-than-normal temperatures in April have presented a problem for the bears, Price Futures Group Senior Analyst Phil Flynn told NGI.

“There is a bit of concern that we might flip the switch from winter to summer,” Flynn said. “We’re already getting some heat down south. There’s some fear that we won’t get a shoulder season, and if we don’t get a shoulder season, there’s a concern that the market may be tighter than it normally would.”

Still, record-level production is reassuring the market that it can balance out storage deficits, he said.

Turning to the spot market, a storm spreading “a mixture of wintry precipitation” was working its way through the Middle Mississippi Valley toward the Upper Great Lakes Wednesday, according to the National Weather Service (NWS).

“While a bulk of the heavier snowfall will have concluded across northern Iowa/southern Minnesota by” Wednesday “evening, some lighter accumulations are likely farther east. More specifically, this will include locations from the vicinity of Chicago eastward across the Upper Ohio Valley into a vast majority of the interior northeastern U.S.,” NWS said.

“To the south of this wintry precipitation axis, a broad swath of quarter- to half-inch amounts of rain are possible from Pittsburgh through New York City and into Boston. Regarding temperatures, readings should remain well below average across the region with anomalies in the 10 to 20 degree range. Such numbers are expected to continue into Friday with general troughing remaining in place.”

Northeast prices rose ahead of the arrival of more precipitation and chilly temperatures. Algonquin Citygate jumped $1.39 to $8.34. Transco Zone 6 New York gained 15 cents to $3.05, while Transco Zone 5 tacked on 17 cents to $3.09.

“This year, the Algonquin Gas Transmission pipeline started major maintenance outages a month earlier than last year,” Morningstar Commodities Research analyst Dan Grunwald said in a note Wednesday. “While natural gas demand had been dropping in March, it has not dropped off enough that these pipeline outages don’t have an effect. So, the outages have put pressure on the system and caused constraints.”

While more outages on Algonquin are expected April 24-25, more moderate weather should start to ease constraints by the end of next week, according to Grunwald.

“While there are a couple of days of further outages that should cause some pain, the New England area finally saw a” more moderate “weather forecast for the latter half of the month over this past weekend,” Grunwald said. “For next week, the forecast is still showing some colder weather, with temperatures staying below 50 degrees but rising. The following week — coinciding with the late-month outages on Algonquin — we should see warmer temperatures alleviating load in the region.”

In Appalachia, Dominion South climbed 9 cents to $2.65 Wednesday, while Millennium East Pool surged 55 cents to $2.15.

“In a notice posted Tuesday afternoon, Millennium announced restrictions along the Corning East segment, capping it at 730 MMcf/d until further notice,” Genscape Inc. analyst Molly Rosenstein said. “Corning East is a key segment on the western end of the system, upstream of storage interconnects to Stagecoach and Seneca Lake, and pipeline interconnects to Empire and Dominion. Based on Tuesday’s flows, the restrictions will affect 65 MMcf/d westbound New York flows.”

Meanwhile, Midwest prices, after seeing a weather-related bump earlier in the week, eased off Wednesday. Chicago Citygate gave up 57 cents to $3.16, while in the Midcontinent Northern Natural Ventura tumbled 84 cents to $3.15.

Genscape was calling for Midwest demand to drop from 15.66 Bcf/d Wednesday to 11.76 Bcf/d Thursday.

Further upstream, Rockies prices also pulled back. Cheyenne Hub dropped 20 cents to $2.06.

West Texas continued to come under downward pressure Wednesday, with Waha falling another 10 cents to $1.71 after giving up 13 cents on Tuesday.

Analysts have been noting the pressure growing production out of the Permian Basin has been putting on takeaway capacity for crude and associated gas flowing out of the region.

Negative West Texas crude differentials to trading hubs in Cushing, OK, and the Gulf Coast have seen “at least a little relief in the past few days,” RBN Energy LLC analyst John Zanner wrote in a note to clients Tuesday. “For one, Phillips 66 has been restarting the Borger refinery (jointly owned by Phillips 66 and Cenovus Energy) in Hutchinson County, TX (50 miles northeast of Amarillo) after months of maintenance.”

Meanwhile, Enterprise Products Partners recently announced an increase in capacity on its Midland-to-Sealy pipeline from 330,000 b/d to 540,000 b/d, Zanner noted.

“The combined effect of the Borger restart and the 210,000 b/d Midland-to-Sealy expansion has been to improve the pricing of West Texas Intermediate at Midland by almost $2/bbl. Additional relief could come from Enterprise in May, when another 35,000 b/d is added” to Midland-to-Sealy’s total capacity, Zanner said.

“The problem is that a lot more pipeline capacity out of the Permian will be needed — and fast. In our current Permian production forecast, we expect the play’s output to increase by an average of 500,000 b/d every year through 2020…Put simply, producers in the Permian’s Delaware and Midland basins desperately need big new chunks of pipeline takeaway capacity as soon as possible.”

Earlier this week, EIA released its latest Drilling Productivity Report (DPR) calling for Permian natural gas and oil production to increase month/month in May by 222 MMcf/d and 73,000 b/d to 10.273 Bcf/d and 3.183 million b/d, respectively.

The Permian also added 122 drilled but uncompleted wells (DUC) from February to March, by far the most of the seven regions covered in the DPR. Since last year, the number of Permian DUCs has doubled, going from 1,522 in March 2017 to 3,044 in March 2018, EIA data show.

May crude oil futures settled at $68.47/bbl Wednesday, up $1.95 day/day after trading as high as $68.72.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |