Markets | NGI All News Access | NGI Data

Shoulder Season Weather Sends Weekly Spot Prices Lower; Futures Rally on Storage

Some pleasantly mild temperatures across the Midwest and East Coast resulted in some unpleasant spot price action for natural gas bulls for much of the week ended Friday, though futures mounted a late-week rally thanks to a bullish storage surprise; the NGI Weekly Spot Gas Average fell 16 cents to $2.61/MMBtu.

The Midwest and Northeast regional averages posted double-digit declines for the week as key demand markets like New York City and Chicago saw moderate spring-like conditions during the second half of the week. But calls for some cooler changes over the weekend did send day-ahead prices higher Friday.

Chicago Citygate fell 20 cents on a weekly basis to average $2.63. Algonquin Citygate, volatile amid recent maintenance events and capacity restrictions, shed $2.16 to $5.23. Further upstream in Appalachia, Dominion South dropped 27 cents on the week to average $2.24.

In California, SoCal Citygate remained true to its up-and-down nature as ongoing import capacity constraints helped send prices racing 56 cents higher to $3.55 on the week.

In West Texas, meanwhile, prices weakened, especially at El Paso Permian, which traded as low as 96 cents and ended the week averaging $1.62, down 28 cents.

NOVA/AECO C dropped C89 cents on the week to average C$1.04 as production out of Western Canada remains strong, driving wide basis differentials.

Natural gas futures closed out the week on a bullish note Friday, with the front month adding close to a nickel on the heels of a larger-than-expected April storage withdrawal. After trading as high as $2.760, the May contract added 4.9 cents to settle at $2.735 Friday, up from the prior Friday’s settle price of $2.701.

Thursday’s storage data surprising to the bullish side, along with stronger cash prices ahead of more chilly April weather, helped drive Friday’s rally, INTL FCStone Financial Inc. Senior Vice President Tom Saal told NGI.

“I think it’s a reaction to Thursday’s storage number,” Saal said. “It was a pretty healthy withdrawal. Obviously not a triple digit one, but it was pretty good for this time of year.” The withdrawal is subtracting from “the already low number. It’s making the job to fill storage even bigger.”

Prices still sit on the wrong side of $3 from the bulls’ perspective, although “a week ago everybody had it going to $2.50. Now we’ve got a little bit of friendly information, and the market reacted towards it. That’s positive,” Saal said.

It was probably traders who took short positions “thinking it’s going to $2.50” that drove the increase, he added. After signs of a widening storage deficit and chillier trends in the forecast “those traders probably decided not to take that bet on and decided to get out.”

In addition to the tighter-than-expected storage report, Thursday overnight and early morning Friday weather data “could also be helping as it’s showed a little colder overall trends across the northern U.S. for late” in the upcoming week and the week after, NatGasWeather.com said Friday.

“The pattern has been rather bullish over the past month with the weather data trending colder just about every week,” according to the firm. “This failed to spark a rally, likely due to Lower 48 production continuously setting fresh record highs. Although, at the same time we thought it was beginning to become problematic bears failed to slam prices well under $2.72 over the past several weeks, and that could have resulted into today being a short covering rally.

“When the markets reopen after the weekend, the battle will resume between bullish storage deficits versus bearish production.”

The Energy Information Administration (EIA) on Thursday reported a natural gas storage withdrawal that was somewhat tighter than the market had been expecting, and futures got a slight bump on the news before pulling back.

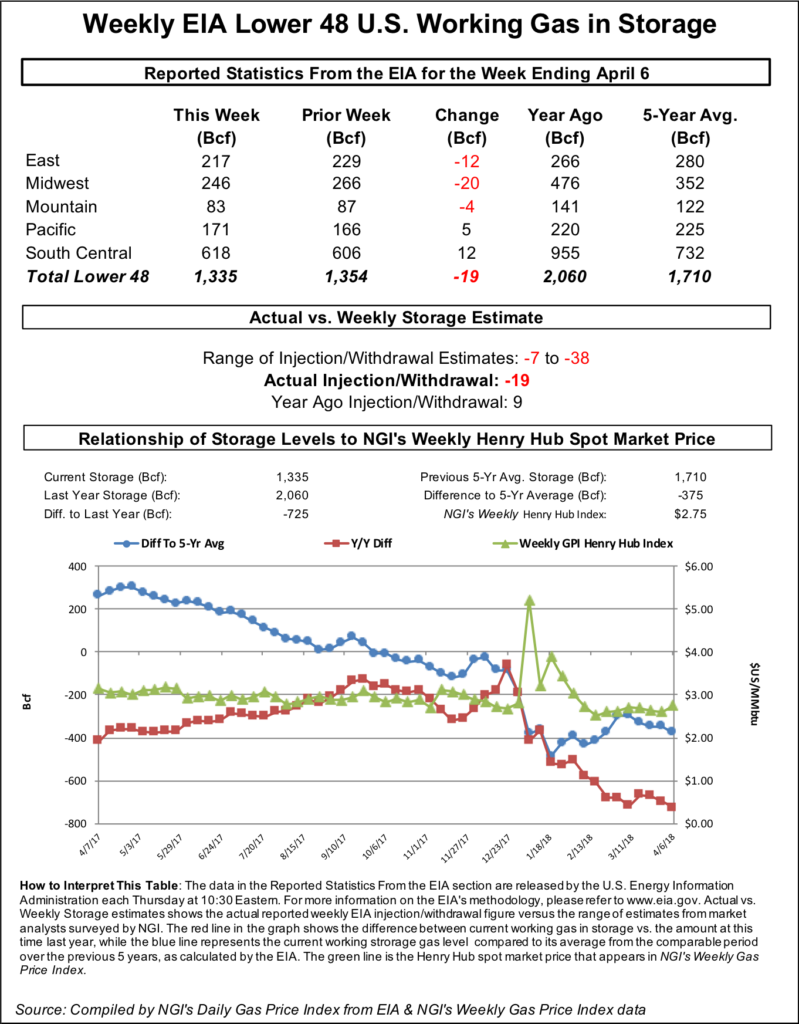

EIA reported a 19 Bcf withdrawal from Lower 48 underground storage for the week ending April 6, a net decrease to stocks during a stretch that typically marks the start of injection season. Last year, 9 Bcf was injected during the period, matching the five-year average.

Immediately following the 10:30 a.m. ET release of the final number, the May contract added 1.5-2 cents but stayed within a range established earlier in the morning, briefly topping $2.695. However, by 11 a.m. ET, May was trading down around $2.672, a fraction of a penny below Wednesday’s settle.

Prior to the report, the market had been looking for a withdrawal somewhat looser than the actual figure. A Reuters survey of traders and analysts on average had predicted a 14 Bcf withdrawal for the period, with estimates ranging from 9 Bcf to 38 Bcf. A Bloomberg survey had produced a median estimate for a 12 Bcf withdrawal, with a range of 7 Bcf to 18 Bcf.

IAF Advisors analyst Kyle Cooper had called for a withdrawal of 12 Bcf, while Intercontinental Exchange EIA storage futures settled Wednesday at a pull of 14 Bcf. OPIS by IHS Markit had also called for a 14 Bcf withdrawal. Bespoke Weather Services had called for a 16 Bcf withdrawal and said it viewed Thursday’s report as “slightly bullish” by comparison.

“This is right within the range of our expectations, though it appears a number of analysts got carried away with even looser expectations,” Bespoke said. “We still see this number as confirming the looseness of the last few weeks but not showing such dramatic looseness as to necessitate a break below the floor from $2.60-2.62.”

Total working gas in underground storage stood at 1,335 Bcf as of April 6, versus 2,060 Bcf a year ago and five-year average inventories of 1,710 Bcf, according to EIA. The year-on-year deficit widened week/week from 697 Bcf to 725 Bcf, while the year-on-five-year deficit increased from 347 Bcf to 375 Bcf, EIA data show.

By region, the Midwest and East saw the largest withdrawals for the period at 20 Bcf and 12 Bcf, respectively, while 4 Bcf was pulled in the Mountain region. Warmer conditions in the other regions during the report week led to injections, including 5 Bcf put back into storage in the Pacific. The South Central saw a 12 Bcf injection for the period, including 8 Bcf into salt and 3 Bcf into nonsalt, according to EIA.

“Compared to degree days and normal seasonality, the 19 Bcf withdrawal appears loose by 2.8 Bcf/d versus the five-year average,” according to Genscape Inc. “This is comparable to last week’s stat which appeared loose by 2.9 Bcf/d (degree days and storage were nearly unchanged week/week).”

After “two fairly loose stats in a row,” Genscape said the main drivers are production growth and the loss of heating demand. “Our daily production scrape model has gone from 6.5 Bcf/d over the five-year average in January to 8.6 Bcf/d so far in April…Our monthly forecast is calling for production to be more than 11 Bcf/d higher than the five-year average” by the fourth quarter.

Meanwhile, residential/commercial (res/com) demand has been growing on a per degree day basis, “which was evident in record shattering storage stats during the coldest weeks this winter,” Genscape said. But “that added res/com disappears in the summer, and the added res/com demand will fade further as heating degree days approach zero.”

Spot prices surged across the northern United States Friday as forecasters were calling for colder temperatures and even some blizzard-like conditions in some places over the weekend; the NGI National Spot Gas Averageclimbed 17 cents to $2.59/MMBtu.

Following warm conditions across the southern Great Lakes and East on Friday, “a strong spring storm is developing upstream and will track through the Rockies into the Plains with heavy snow, as well as powerful thunderstorms into the east-central U.S.,” NatGasWeather said in its one- to seven-day outlook Friday. “Temperatures behind the cold front will again drop into the teens to 30s for another round of stronger than normal demand. This strong system will track into the East Sunday and Monday.”

According to the National Weather Service (NWS), a “very impressive storm” was underway Friday, spreading snow across the Plains and bringing thunderstorms to Texas and Oklahoma. “A surface low will continue to deepen as it moves eastward across the central Plains Friday afternoon and into the Mississippi Valley Friday night.

“With cold air in place, moisture will wrap around the surface low and produce heavy snowfall across the northern and central Plains in addition to the Upper Midwest through Saturday,” NWS said. “Over a foot of snow is expected, especially from northeastern Nebraska through southwest Minnesota. High winds are also expected, which will cause blizzard conditions from the High Plains of Colorado, northern Kansas northward into South Dakota and southwest Minnesota.”

Midwest points saw double-digit gains across the board Friday, including a 33 cent increase at Chicago Citygate, which finished the day averaging $2.83. In the Midcontinent, Northern Border Ventura added 34 cents to $2.77.

Radiant Solutions was calling for temperatures to fall to 14 degrees below normal in Chicago by Sunday, with temperatures in Boston expected to dip into the 30s to low-40s, about 10 degrees colder than normal.

Iroquois Waddingtonclimbed 46 cents to $3.19 Friday, while Algonquin Citygateadded 86 cents to $3.80.

“Monday will mark the last day that the Algonquin Burrillville compressor will be restricted to 497 MMcf/d (a 526 MMc/fd reduction from regular operational capacity),” Genscape said. “Capacity through this station will still be restricted in some capacity through the end of the summer. Now that temperatures are warming, the weather risks to these outages are diminishing. The next severe outage at Burrillville will take place April 24, when capacity is maxed at 525 MMcf/d.”

Further upstream in Appalachia, Dominion South jumped 25 cents to $2.31, while Columbia Gas added 7 cents to average $2.55.

Columbia Gas (TCO) maintenance related to its WB XPress expansions could impact at least 300 MMcf/d of eastbound capacity in Virginia starting Monday, according to Genscape.

“This will likely decrease TCO pooled production, due to only a portion of the Braxton gathering gas” in West Virginia “being re-routable. Additionally, deliveries to Cove Point” at Loudoun County, VA “will be reduced for the duration of the maintenance, which concludes April 24,” the firm said. “When in service, the WB XPress project will provide 1,300 MMcf/d additional capacity between West Virginia and Virginia.”

In California, SoCal Citygate tumbled 70 cents to $3.12 as import-constrained Southern California Gas Co. was forecasting system demand to fall slightly over the weekend, going from around 2.3 Bcf/d Friday to 2-2.1 Bcf/d Saturday and Sunday.

Further upstream, West Texas prices continued to rebound after after declining earlier in the week. Waha climbed 14 cents to $2.16.

In Canada, NOVA/AECO Cslipped C6 cents to C82 cents Friday after dropping C53 cents to fall below C$1.00/GJ Thursday.

Facing widening basis differentials, Western Canadian producers have been taking steps to limit their exposure to AECO pricing, BTU Analytics LLC analyst Jason Slingsby said in a recent note.

“Despite the challenging environment, production has been strong and natural gas flows reached nearly 17.5 Bcf/d in January on the main pipelines out of Western Canada,” NGTL, Alliance and Westcoast, Slingsby said. “…For the second half of 2017, flows were significantly higher year over year as producers ramped up activity” with wells showing continuing initial production rate improvements. “Strong winter drilling helped push 2018 production receipts over 1 Bcf/d higher than witnessed in previous years for January and February.

“Much like the Permian Basin, drilling decisions in the Montney and Duvernay shales are being driven by the economic boost from liquids production, with the associated gas and the pricing of that gas being less important than in dry gas plays,” he said. “What this means is that natural gas prices can dip towards $1.00/MMBtu at AECO and Western Canada production will still keep coming” as cash flow from liquids makes up for “low prices and a widening basis.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |