Markets | NGI All News Access | NGI Data

Natural Gas Futures Range-Bound After Bullish Storage Surprise; Spot Prices Mixed

Natural gas futures inched higher Thursday after government storage data turned up a bullish miss, though trading action remained range-bound. Spot prices were mixed, with declines in the Midwest and Northeast on milder temperatures accompanying gains in West Texas and another spike at SoCal Citygate; the NGI National Spot Gas Average finished down 9 cents at $2.42.

The May contract settled at $2.686 Thursday, 1.1 cents higher on the day after probing either side of even, including a low of $2.647 and a high of $2.700. The June contract settled at $2.717, up 0.8 cents.

The Energy Information Administration (EIA) on Thursday reported a natural gas storage withdrawal that was somewhat tighter than the market had been expecting, and futures got a slight bump on the news before pulling back.

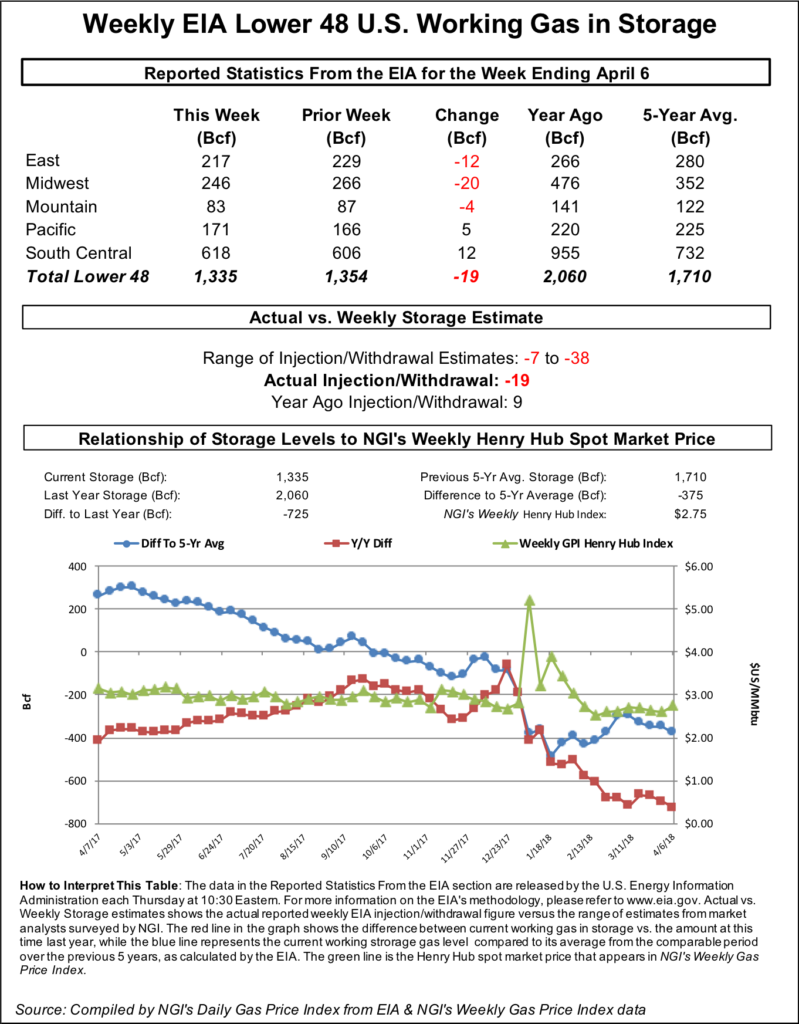

EIA reported a 19 Bcf withdrawal from Lower 48 underground storage for the week ending April 6, a net decrease to stocks during a stretch that typically marks the start of injection season. Last year, 9 Bcf was injected during the period, matching the five-year average.

Immediately following the 10:30 a.m. ET release of the final number, the May contract added 1.5-2 cents but stayed within a range established earlier in the morning, briefly topping $2.695. However, by 11 a.m. ET, May was trading down around $2.672, a fraction of a penny below Wednesday’s settle.

Prior to the report, the market had been looking for a withdrawal somewhat looser than the actual figure. A Reuters survey of traders and analysts on average had predicted a 14 Bcf withdrawal for the period, with estimates ranging from 9 Bcf to 38 Bcf. A Bloomberg survey had produced a median estimate for a 12 Bcf withdrawal, with a range of 7 Bcf to 18 Bcf.

IAF Advisors analyst Kyle Cooper had called for a withdrawal of 12 Bcf, while Intercontinental Exchange EIA storage futures settled Wednesday at a pull of 14 Bcf. OPIS by IHS Markit had also called for a 14 Bcf withdrawal. Bespoke Weather Services had called for a 16 Bcf withdrawal.

Total working gas in underground storage stood at 1,335 Bcf as of April 6, versus 2,060 Bcf a year ago and five-year average inventories of 1,710 Bcf, according to EIA. The year-on-year deficit widened week/week from 697 Bcf to 725 Bcf, while the year-on-five-year deficit increased from 347 Bcf to 375 Bcf, EIA data show.

By region, the Midwest and East saw the largest withdrawals for the period at 20 Bcf and 12 Bcf, respectively, while 4 Bcf was pulled in the Mountain region. Warmer conditions in the other regions during the report week led to injections, including 5 Bcf put back into storage in the Pacific. The South Central saw a 12 Bcf injection for the period, including 8 Bcf into salt and 3 Bcf into nonsalt, according to EIA.

“The market shook off this small bullish surprise and remained in a tight range the rest of the day, with the front of the strip settling just slightly higher,” Bespoke said. Next week’s storage report should be “much tighter with higher nuclear outages this week, though we are skeptical that it will be enough to break prices out of their current range.”

The firm said it sees that range “dominating into the upcoming weekend” with “strong support still around $2.60-2.62 and strong resistance from $2.72-2.75.”

This week’s withdrawal marks to occur during the month of April since 2016, analysts with Jefferies LLC said Thursday. “Despite this week’s withdrawal, last week marked the technical end of the winter storage season, with end of March storage at 1.35 Tcf, around 340 Bcf (20%) below the five-year average and around 700 Bcf (34%) below prior-year levels.

“To reach 3.8 Tcf by the end of October, 2.5 Tcf will need to be injected into storage,” analysts said. “This level of injections has been reached before, when 2.65 Tcf was injected in the summer of 2014, though prices were above $4/MMBtu for the first half of the injection season. Compared to last year, we estimate 3.6 Bcf/d of additional gas will need to be injected” meaning production would need to average around 6-6.5 Bcf/d higher year/year to reach 3.8 Tcf.

And as it happens, production has continued to increase, the Jefferies team said. “Production has again reached a new high in April, with month-to-date production averaging 78.2 Bcf/d, and 17 days in the last three weeks have registered above 78 Bcf/d…

“Interestingly, the production growth has been driven largely by regions outside of Appalachia. While total U.S. production is up around 0.9 Bcf/d versus February levels, Appalachia has driven only about 0.15 Bcf/d of that growth,” with a big portion of the growth driven by the Permian Basin and Haynesville Shale, as well as Oklahoma’s SCOOP (South Central Oklahoma Oil Province) and STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties).

In the spot market Thursday, prices in the Northeast sold off heavily amid continued forecasts for weak demand.

Genscape Inc. was calling for New England regional demand to fall to around 2 Bcf/d Friday versus a recent seven-day average close to 3 Bcf/d. In the Appalachia region, Genscape was forecasting demand to come in at 6.74 Bcf/d Friday, down from a recent seven-day average 13.71 Bcf/d.

Algonquin Citygate continued to moderate after recent volatility, dumping $1.29 to average $2.94, while Tennessee Zone 6 200L similarly fell $1.72 to average $2.78. Transco Zone 6 New York dropped 41 cents to $2.38.

“Next week, Transco will begin work associated with the Atlantic Sunrise project on its 24-inch Leidy Line A,” Genscape told clients Thursday. “The first event will run from April 16-26, and the second will run from May 1-11. During these outages, scheduled capacity at the Leidy Line Aggregate Receipt MP 101 location will be limited to 756 MMcf/d.

“As much as 1,120 MMcf/d has been nominated at this point within the last 30 days,” the firm said. “This will create bullish pressure for Transco Zone 5 and Zone 6 prices, and coinciding work in Tetco’s M2 and M3 will add to northeastern volatility in the last half of April.”

Mild conditions to close out the week also pushed down prices in the Midwest, where Radiant Solutions was calling for temperatures to average about 7.5 degrees warmer than normal in Chicago Friday, including highs in the 60s. Chicago Citygate slid 5 cents to $2.50.

Even with some generally sedate spot prices on Thursday, forecasts were suggesting things could get a lot more interesting weather-wise by the weekend.

“When it comes to near-term U.S. weather conditions, the days ahead are slated to bring about an undoubtedly wild pattern,” OPIS by IHS Markit analyst Alan Lammey said Thursday. “Very unusual weather anomalies will feature surges of warmth that will be countered by blasts of frigid Arctic air, which will offer up plenty of heating degree days relative to the season.

“Additionally, because of the battle between extreme temperature variances in the days ahead, atmospheric fights are forecast to breakout across large expanses of the eastern U.S., which could produce severe weather conditions in several states during the approaching weekend and early next week.”

In the firm’s latest one- to five-day outlook Thursday, Lammey said the forecast showed a U.S. population-weighted average low temperature of 49.6 degrees (2.7 degrees warmer than average), with an average high of 71.9, 4.3 above average.

“However, this warm-up will be very short-lived as the next bout of Arctic air surges into the U.S. during this period,” Lammey said, pointing to “very snowy conditions” developing over the northern Rockies and the Dakotas before reaching the Midwest by Friday.” Spring-like conditions in the East “will be temporary as the storm system in the middle of the country will gradually crawl eastward” over the weekend. “As the cold Arctic air mass meets the warm conditions, it will result in sleet, freezing rain and even some snow flurries from Michigan to New York to northern New England.”

According to the National Weather Service (NWS), A late season winter storm on Thursday was “developing over the Rockies and Intermountain West.” Moderate to heavy snow was expected for the central and northern Rockies through Thursday night, and then it was expected to spread eastward across the northern Plains and Upper Midwest.

“…The main surface low is forecast to track from Colorado towards Iowa, with widespread six- to 12-inch snowfall amounts likely across northern Nebraska, much of South Dakota and western Minnesota with blizzard conditions possible at times,” NWS said. “…The same storm system is also expected to produce heavy rainfall from eastern Texas to western Kentucky, with the potential for one to three inches of rain through early Saturday. A few areas across Louisiana and Arkansas could get over three inches based on the latest forecasts.”

In the Rockies, Cheyenne Hub added 11 cents to $2.18, while CIG tacked on 10 cents to $2.12.

In California, SoCal Citygate shot up 47 cents to $3.82 amid continued restrictions on Southern California Gas Co. (SoCalGas) imports.

According to Genscape, SoCalGas will be undergoing planned reductions at two receipt points through Sunday for remediation work, including a 200 MMcf/d capacity reduction at the Kern River/Mojave-Kramer Junction receipt point. On Thursday SoCalGas was forecasting receipts to drop to about 2.3 Bcf/d through the weekend after totaling more than 2.5 Bcf/d Wednesday. Meanwhile, system demand was expected to come in at a little more than 2.3 Bcf/d through the end of the work week.

Further upstream in West Texas, El Paso Permian bounced back after trading as low as 96 cents earlier in the week, adding 19 cents to average $1.62, still more than a dollar discount to Henry Hub. Waha added 17 cents to $2.02.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |