E&P | NGI All News Access | NGI The Weekly Gas Market Report

Texas Efficiencies Gaining as State Churns Out Higher Natural Gas, Oil Volumes with Fewer People

Texas natural gas output increased 3% in February from a year ago to nearly 638.5 Bcf, while crude oil production climbed by 21% to a near-record 110.5 million bbl-plus, according to the latest Texas Petro Index (TPI).

Economist Karr Ingham, who created the TPI and updates it monthly, said it took fewer people to recover the volumes, “defying nearly all usually reliable economic indicators.” The upstream economy in Texas also continues to expand, with the TPI up for the 15th consecutive month.

“Most of the components used to calculate the TPI — including crude oil and natural gas prices, the rig count, drilling permits, well completions, and upstream industry employment — are down compared to their pre-downturn peak levels,” Ingham said. “What’s not lagging behind prior peak levels? Crude oil production, and most likely by the time 2018 is said and done, natural gas production as well.

“The implications are striking: record crude oil and natural gas production at significantly lower prices, rig counts, and number of industry workers,” he said. “It means that fewer employees are needed to produce more crude oil in Texas and the U.S. than has ever been produced.”

In 2008, each Texan employed in the upstream oil and gas industry produced about 2,000 bbl of crude, according to the TPI. Crude oil production per employee began to climb in 2009, with sharp annual increases from 2012 through 2016, which pushed the recovery in Texas to more than 6,000 bbl/employee.

“The ratio slowed in 2017 as industry employment began improving on the heels of the downturn, but was still higher than in 2016,” Ingham said.

Events are more nuanced than that relationship might suggest, he noted. The economist said growing industry employment and other measures of activity from 2002-2008, when nearly 90,000 jobs were added and expanded industry employment by nearly 75%, brought about a big expansion of gas production, even as oil output continued to decline.

“In many ways, that set the stage for the growth in crude oil production from 2009-2015,” Ingham said. “The fact that crude oil and natural gas can now be produced at record levels in Texas (and the U.S.), with significantly fewer employees and rigs is the result of extraordinary industry expansion from 2002-2008 and 2009-2014, and also achieving greater operating efficiency to attain ever-higher levels of productivity.”

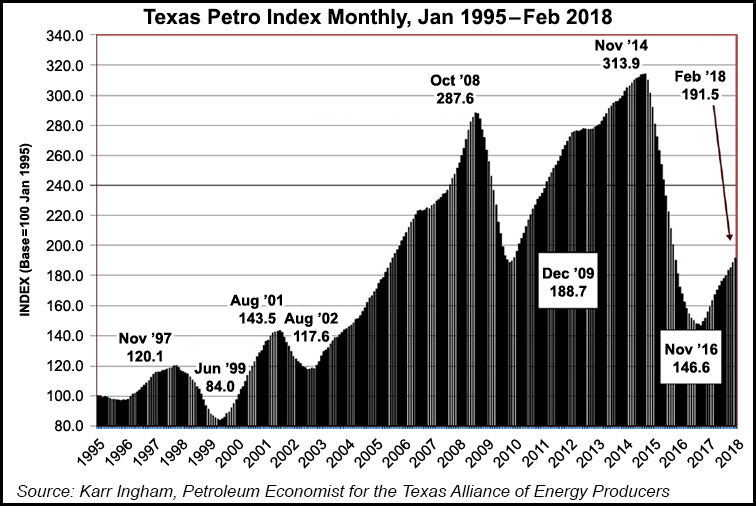

The TPI is a composite index based upon a group of upstream economic indicators. It climbed in February to 191.5, up from 188.7 in January and 155.7 in February 2017. Before the most recent economic downturn, the TPI peaked at a record 313.9 in November 2014, which marked the peak of an economic expansion that began in December 2009, when the TPI stood at 188.7.

According to the index, oil prices in February averaged $58.72/bbl, putting the value of Texas-produced crude oil at about $6.49 billion, or roughly 42.1% more than in February 2017.

Gas prices during February averaged $2.67/Mcf, which meant the value of Texas-produced gas increased about 40% year/year to more than $2.34 billion.

Ingham also noted that the Baker Hughes Inc. active rig count in Texas averaged 476 units in February, 28.5% higher year/year when an average of 370 rigs were working.

The number of original drilling permits issued in February also climbed from a year ago to 1,097, 10.7% higher.

An estimated average of 215,500 Texans remained on upstream oil and gas industry payrolls in the second month of 2018, about 13.8% more people than the revised average of 189,400 in February 2017, but about 27.5% fewer than the estimated high of 297,130 in December 2014.

According to revised TPI estimates per the revised data from the Texas Workforce Commission (TWC), the trough of upstream oil and gas employment in Texas in the most recent downturn occurred in September 2016 at 181,600. The TWC in March issued revised monthly industry employment data for 2016 and 2017, requiring the TPI to be updated.

The TPI is a service of the Texas Alliance of Energy Producers, which is the nation’s largest state association of independent oil and gas producers.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |