Markets | NGI All News Access | NGI The Weekly Gas Market Report

Mexican LNG Imports Climb 42% in February Year/Year

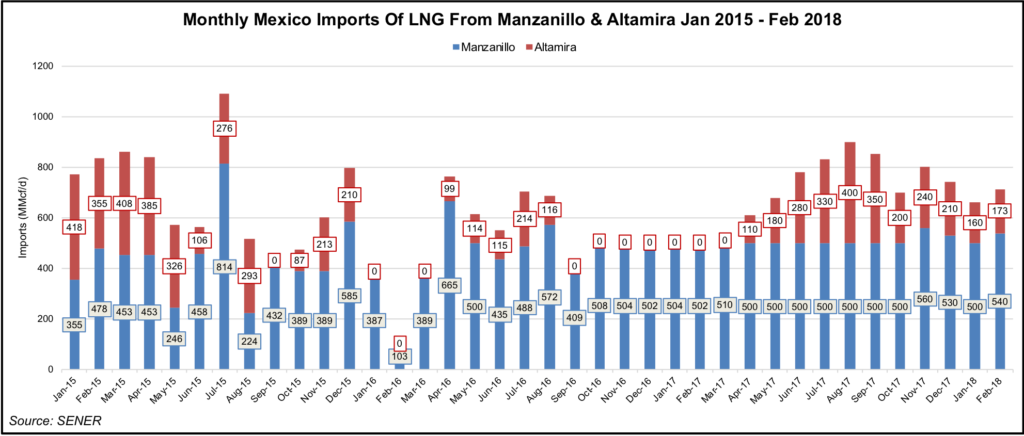

Liquefied natural gas (LNG) imports into Mexico increased 42% year/year in February, according to the latest data from the Mexican Energy Ministry (Sener).

The two active LNG terminals supplied an average 713 MMcf/d during the second month of the year, compared with 502 MMcf/d in February 2017, and sequentially from 660 MMcf/d in January.

The Manzanillo terminal on the Pacific Coast in Colima state operated at almost full capacity during February, delivering 540 MMcf/d. The Altamira facility on the Gulf Coast in Tamaulipas supplied 173 MMcf/d, at around 25% of its operating capacity.

The two terminals together provided 13% of Mexican gas imports and 9% of the country’s total gas supply in February.

Mexico relies on its LNG terminals to supplement continental gas shipments from the United States. Startup delays on pipelines downstream from the U.S.-Mexico border have helped keep demand higher at both Manzanillo and Altamira.

A third LNG terminal, Costa Azul on the Baja California peninsula, has remained inactive since around mid-2016, according to Sener data. Changing market conditions have curtailed shipments to the terminal, which was originally intended to supply demand in Mexico and California. Costa Azul’s owner, Sempra Energy’s Mexico subsidiary, is now evaluating a plan to convert it to an export facility.

Mexican gas demand averaged 7.88 Bcf/d in February, roughly flat year/year and from January, according to Sener.

February pipeline shipments were 4.41 Bcf/d, increasing 7.3% from a year earlier. The NET Mexico and Mier-Monterrey pipelines, which each move gas from hubs in South Texas into northeast Mexico, together accounted for 54% of February’s pipeline imports.

NET Mexico averaged 1.87 Bcf/d and Mier-Monterrey 527 MMcf/d during the month.

Most pipeline shipments from the United States currently flow through the industrialized northeast and farther south to reach demand centers in central Mexico. Two new import pipelines in the region are due to come in-service later this year: the 504 MMcf/d Nueva Era pipeline in Nuevo Leon and the 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline.

The Centro Nacional de Control del Gas Natural (Cenagas), which operates Mexico’s main gas transmission network Sistrangas, also expects to boost capacity at two border-crossing areas in the northeast, according to the latest version of Mexico’s midstream infrastructure plan for the natural gas sector.

The infrastructure plan also includes another border expansion line from New Mexico into northwest Mexico. Several pipelines from the Permian Basin connect with Sistrangas and private systems in the northwestern states of Chihuahua and Sonora, but the delays to downstream pipelines have constrained exports from this prolific U.S. producing region. Gas shipments into Chihuahua and Sonora averaged 686 MMcf/d during February, the Sener data show.

Receipts of natural gas at all Sistrangas-connected import points averaged 3.17 Bcf/d during February, according to estimates by NGI’s Mexico GPI.

Total gas imports into Mexico, including pipeline shipments and LNG, averaged 5.12 Bcf/d in February, up 11.1% year/year and 1.1% from January. Imported gas supplied 65% of national demand during February, versus 58.8% a year earlier.

Domestic gas production fell to 2.75 Bcf/d from 3.23 Bcf/d in February 2017 and sequentially from 2.81 Bcf/d in January.

Most of that gas came from the processing plants operated by Petroleos Mexicanos (Pemex) in southern Mexico, near the country’s major offshore oil basins. Excluding the gas that Pemex uses for upstream and industrial processes, gas imports supply close to 85% of Mexican demand.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |