Markets | NGI All News Access | NGI The Weekly Gas Market Report

Southeast Natural Gas Price Volatility Thriving in Direct Contrast to Henry Hub

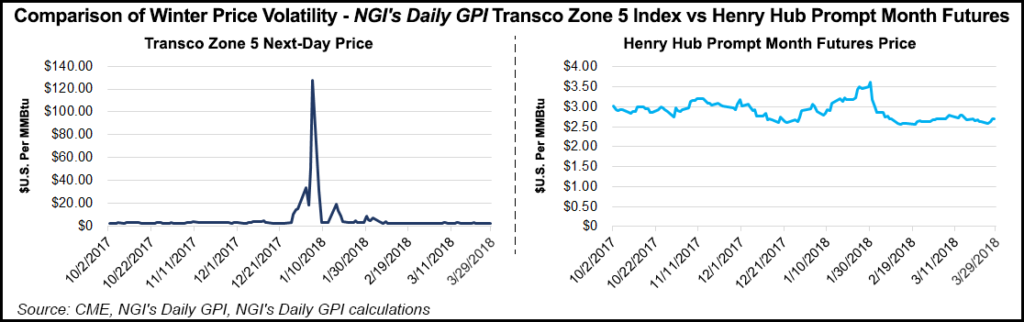

The U.S. unconventional oil and gas revolution has helped to lower realized natural gas prices, reduce concerns about domestic energy security and more recently, price volatility, particularly at the Henry Hub, according to energy experts.

During the 18th Southeast LDC Forum n Atlanta, NextEra Energy Resources’ Anupam Das, manager of market analytics, said “last year, we actually had the lowest intraday volatility since the contract started trading.”

Much has been written lately about the lack of New York Mercantile Exchange (Nymex) volatility, but that does not mean it has disappeared from the U.S. gas markets. It’s more of a local issue today, according to speakers at the LDC conference on Tuesday.

In a morning address, BP plc’s Michael Thomas, COO of North American Gas & Power, said he read a recent article that said gas volatility was dead. But the article only discussed Nymex “and it didn’t even really differentiate between basis markets and Nymex markets…

“I was waiting for the ”but,’ but producing basins are $1.00 under the market, or you’ve got AECO that’s pricing negative, or you have this happening in the basis markets,” Thomas said. “You have $135/MMBtu in Transco, you’ve got Houston Ship Channel going to $14, you’ve got Algonquin trading at $83.

“At no time,” he said, did the news article discuss regional markets, basically, “the basins and what’s happening in the various markets,” he added.

Thomas expects regional volatility to continue going forward, particularly “in the production basins,” where there are “winter peaking markets that…do have significantly increased volatility in the marketplace.”

To wit: Das said the “very, very volatile” Transco Zone 6 Non-New York and Transco Zone 5 markets this past winter, “even though the pricing volatility did not extend as widely or over a longer period of time as it did during the winter of 2013/14, prices this winter actually set a higher level.” He was referring to the winter four years ago when a polar vortex occurred.

“…During the intervening years, Northeast production actually grew by close to 20 Bcf/d, so that did not seem to make even a little bit of impact on this extreme weather related volatility that we saw.”

According to NGI data, winter 2017/18 prices reached a high of $124.71 on Transco Zn 6 Non-New York, vs. $127.57 on Transco Zone 5.

Just how much regional volatility will continue to outpace that at the Henry Hub was a topic on a panel regarding southeast demand and supply economics.

Das noted that prices at the Henry Hub likely will be subdued for the next two years, with prices averaging around $2.75/MMBtu as supply outstrips demand through 2019. He thinks producers in the Marcellus and Utica shales may be quicker to fill new pipeline capacity than the market is anticipating.

Growing Appalachia production may have an impact on future price volatility in several regions of the country.

NG Advantage’s Michael Holt, director of business development, noted that gas flows into Transco from Appalachia have increased the last two years. While that may have had something of a calming impact on regional pricing volatility in New England, everything else being equal, he said growing power generation in the Southeast is “something that’s very likely to keep volatility alive and well” in that part of the country.

Pipeline reversals from the Appalachia to the Gulf Coast and Southeast, and gas-on-gas competition from the Haynesville Shale versus the Marcellus/Utica are also having an impact on gas prices in those regions.

Tenaska Marketing Ventures’ John Reinhardt, senior director of marketing, discussed Haynesville prices. He said “the running joke until recently was that you could always quote what the basis this summer was minus 6 cents; what’s the next winter minus 6 cents. What’s the next year? Minus 6 cents. It didn’t change much. So we’re starting to see some of the volatility creep into the forward basis.”

Reinhardt, who expects the Southeast to become more volatile over time, noted that extreme winter weather in other parts of the country can impact supply in the south. The Energy Information Administration’s storage report for Jan. 5 was a record 359 Bcf withdrawal, 153 Bcf of which was from the South Central region, the most in any region of the country.

On the sidelines of the conference, an industry trader told NGI that forward curves do not necessarily tell the complete story with respect to future volatility. Volatility “is going to manifest itself in the cash market. And with growing power demand, and liquefied natural gas exports just around the corner, expect volatility in the Southeast to continue to grow.”

It may not be as volatile as in the Northeast, however. Reinhardt said, “as long as people continue to live in New York and Boston,” there will be natural gas price volatility in the region, because of a lack of pipeline infrastructure.

“But price volatility in the Southeast could rival that in the Northeast over time, and even now, on some days, it’s even greater,” the trader said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |