Mexico | NGI All News Access | NGI The Weekly Gas Market Report

Imports Supplied 64% of Mexico’s Natural Gas in January, Says Sener

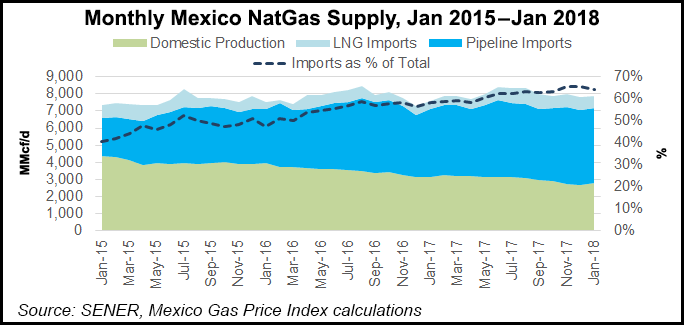

Imports supplied just over 64% of Mexico’s natural gas during the first month of the year, according to the latest data from the energy ministry (Sener).

The country imported 5.05 Bcf/d in January, up 14.7% from 4.43 Bcf/d in January 2017 and roughly flat compared to December, when imports averaged 5.12 Bcf/d.

Pipeline shipments from the United States supplied around 87% of January’s imports, while liquefied natural gas (LNG) covered the remaining 660 MMcf/d.

Mexico has been an annual net importer of gas since 2016. Its reliance on imports has been rising since 2000, in line with declining domestic output from maturing fields and, more recently, the startup of pipeline infrastructure along the U.S. border.

NET Mexico, which crosses the border at Ciudad Camargo in Tamaulipas state, remained the top export pipeline with 1.89 Bcf/d in January, or 43% of all pipeline shipments into Mexico. Kinder Morgan’s Mier-Monterrey pipeline, in the neighboring Nuevo Leon state, was the month’s number two exporter at 516 MMcf/d.

Both pipelines move gas from hubs in South Texas, which is currently the leading supply source into Mexico.

Gas from this region is “sourced from the Eagle Ford, other supplies along the Texas coast and a mixture of inbound supplies from the Midcontinent and the Northeast on the growing network of pipelines designed to move Marcellus and Utica production to growth markets,” according to a recent report from OPIS by IHS Markit

Imports from the Permian Basin, however, remain constrained by infrastructure delays south of the border. Several Mexican pipelines located downstream from the major border-crossing points for Permian supply have yet to come into service, although most are due for start-up later this year.

In January, Mexico imported some 680 MMcf/d from U.S. pipelines into the northwestern Mexican states of Sonora and Chihuahua, the latter of which borders West Texas, according to Sener’s data.

“Pipelines like NET Mexico and Kinder Morgan Texas are running at over 90% and 80% utilization, respectively,” OPIS analysts Warren Waite and Kevin Adler said.

“Others like Comanche Trail and TransPecos have extremely low utilization rates of 10% and less than 1%, respectively. The latter two are Texas Permian-sourced pipelines that entered in-service in 1Q2017, but are awaiting pipeline buildouts downstream in Mexico and the materialization of Mexican gas demand,” namely from power plants under construction in the northwest.

Mexican gas imports in January ran slightly above the full-year average for 2017. Last year, Mexico imported 4.92 Bcf/d, up 15.6% from the 4.32 Bcf/d in 2016, according to data from Sener. Imports reached a monthly record of 5.26 Bcf/d in November, while pipeline-only shipments hit an all-time peak of 4.47 Bcf/d last June.

During the first month of this year, the United States piped 4.39 Bcf/d of gas into Mexico, compared to 3.93 Bcf/d in January 2017 and 4.38 Bcf/d in December.

The LNG terminals Manzanillo on the Pacific Coast, and Altamira on the Gulf Coast, supplied the remaining 660 MMcf/d imported in January. A third LNG terminal near the Baja California peninsula has not received any cargos since around mid-2016, the Sener data shows.

Mexico uses LNG to help cover seasonal demand peaks, which typically occur in the hotter summer months, as well as for short-term system balancing.

The country lacks underground storage facilities to ease supply disruptions, as occurred when Hurricane Harvey struck South Texas last year. The storm affected some 3.3 Bcf/d of imports from Aug. 24-28, according to Sener.

Mexican authorities are keen to develop gas storage within the country as a contingency for future supply emergencies. Last month, the Energy Ministry released the final draft of a storage policy that mandates the construction of 45 Bcf in strategic gas inventories, which must be fully operational by 2026 at the latest.

The Mexican government has also announced two bidding rounds for later this year that will offer natural gas-rich prospects for development by upstream operators. A conventional onshore tender with 37 blocks is scheduled for July 25, while a smaller unconventional round offering nine blocks is set for Sept. 5.

State oil company Petroleos Mexicanos (Pemex) is also working to reduce gas flaring at its offshore oil fields in southern Mexico, after the upstream regulator in 2016 issued new standards for gas utilization at oilfields. Flaring was reduced by 58% to 209 MMcf/d in 2017, according to Sener.

However, it seems unlikely that any current activities in the upstream sector will slow Mexico’s growing dependence on gas imports, at least in the near future. In its 2017-2031 Natural Gas Outlook, Sener predicts Mexican gas imports will peak at 6.08 Bcf/d in 2020 before tapering off to 4.61 Bcf/d by 2031.

“The largest unknown is how quickly Mexico’s demand will increase, and whether the necessary gas pipeline infrastructure will be in place to serve the new demand,” Waite and Adler said. “Like New England, Mexico suffers from capacity constraints — in this case not just on gas pipelines, but also on the gas-fired power plants that will drive demand in the future.”

The OPIS analysts noted that around 6.5 Bcf/d of Mexican pipeline capacity is currently in development. “Of that total, only 0.5 Bcf/d is directly connected to the U.S. border via the Nueva Era pipeline system, and the rest is within Mexico.”

They added that “the bottom line is that the demand growth story for Mexico will be gradual, just like the objectives of the country’s energy reforms, and much of the capacity being built today will not be highly utilized for many years to come.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |