Bearish Storage Stats Sink Natural Gas Futures; More Spikes in New England

A bearish government storage report helped fuel a natural gas futures retreat Thursday as lingering cold couldn’t overshadow signs of a well-supplied market. Spot prices were mixed, with a few New England points spiking and California prices eased amid moderate demand in the region; the NGI National Spot Gas Average climbed 14 cents to $2.92/MMBtu.

The May contract settled at $2.675, down 4.3 cents on the day, enough to erase gains from the previous two trading sessions. June settled 3.7 cents lower at $2.729.

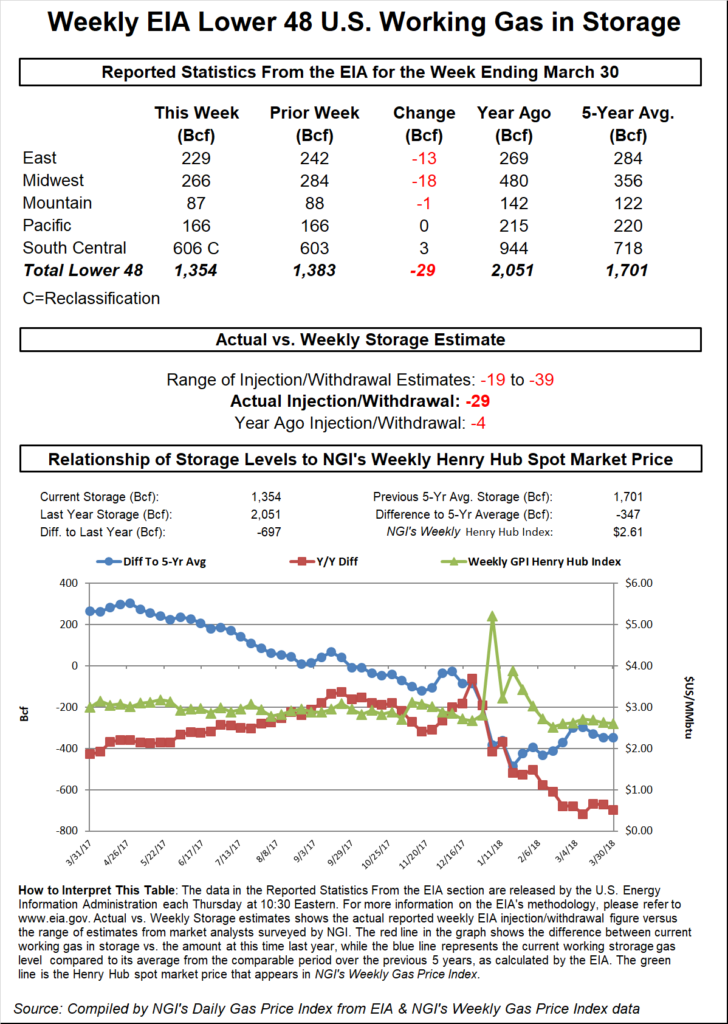

The Energy Information Administration (EIA) reported a weekly storage withdrawal that came in looser versus market expectations, although a reclassification resulted in a slightly larger net decrease to inventories overall.

EIA reported a net decrease of 29 Bcf for Lower 48 gas stocks for the week ending March 30, but the figure came with an asterisk. In a footnote, the agency said the implied flow for the week was actually a withdrawal of 20 Bcf, with “nonflow-related adjustments” accounting for a 9 Bcf decrease in inventories in the South Central Nonsalt region for the period.

Markets seemed to latch on to the less impressive minus 20 Bcf “implied flow.” As soon as EIA’s 10:30 a.m. ET report crossed trading desks, the May contract slid close to 4 cents to as low as $2.651 before settling into a range of around $2.665-2.675 over the next half hour. By 11 a.m. ET, May was trading around $2.662, down about 5.6 cents from Wednesday’s settle.

The 20 Bcf implied withdrawal compares with a 4 Bcf pull in the year-ago period, while the five-year average is a withdrawal of 28 Bcf. Last week, EIA reported a 63 Bcf withdrawal for the week ended March 23.

Prior to the report, the market had been looking for a larger withdrawal than the implied flow.

The median taken from a Bloomberg survey had showed traders and analysts expecting a 26 Bcf withdrawal for the week, with responses ranging from 22 Bcf to 39 Bcf. A Reuters survey of 23 participants had settled on a median 26 Bcf draw with a range of 19 Bcf to 35 Bcf. IAF Advisors analyst Kyle Cooper had called for a withdrawal of 23 Bcf, in line with Intercontinental Exchange EIA storage futures, which had settled Wednesday at a withdrawal of 23 Bcf. OPIS by IHS Markit expected a withdrawal of 27 Bcf.

Including the net 9 Bcf decrease because of reclassification, total working gas in underground storage stood at 1,354 Bcf as of March 30, versus 2,051 Bcf a year ago and five-year average inventories of 1,701 Bcf, according to EIA. The year-on-year deficit increased week/week from 672 Bcf to 697 Bcf, while the year-on-five-year deficit widened slightly from 346 Bcf to 347 Bcf, EIA data show.

Looking at the implied flow by region, 18 Bcf was withdrawn in the Midwest, followed by the East, which saw a net 13 Bcf withdrawal. The Pacific region finished flat for the week, while 1 Bcf was withdrawn in the Mountain region. In the South Central, EIA reported an implied injection of 12 Bcf, including 7 Bcf injected into salt and 6 Bcf injected into nonsalt.

“We continue to see a market that is rapidly loosening with production near record levels, even as weather appears to do all that it can to keep prices bid,” Bespoke Weather Services said. “Afternoon model guidance trended back significantly colder in the medium-range with lingering cold into the long-range.”

Patterns present “risks for colder model trends through April 20 that could keep heating slightly above average nationally. However, confidence continues to increase that past April 20 the pattern breaks and the final third of the month sees temperatures around to a bit above average.”

Bespoke said with the current balance it would expect prices to struggle to remain above $2.70, “even with storage levels further depleted. Colder trends in guidance Thursday afternoon do open up the potential for a bounce in prices Friday back toward $2.72, as cold peaks this weekend and cash prices may be bid up again.”

Turning to the spot market, in its one- to seven-day outlook Thursday, NatGasWeather.com called for “cool conditions over the northern and eastern U.S.” to “linger in the wake of an exiting weather system. A strong reinforcing cold shot is already pushing into the north-central U.S. and will track across the Midwest and East late this week through the coming weekend, keeping overnight lows in the teens to 30s, locally single digits.

“The southern U.S. will be mostly mild to warm with temperatures of 60s to 80s,” according to the firm. “The West will see a mix of mild and cool as weather systems with rain and snow track inland every few days. Cold conditions will continue over the Great Lakes and East early next week for strong national demand, then finally warming late week.”

Prices at the constrained Algonquin Citygate spiked again Thursday, adding $2.80 to average $9.61 even as a number of Northeast points dropped. Transco Zone 6 NY fell 4 cents to $2.88.

Algonquin Gas Transmission (AGT) placed an operational flow order into effect this week because of anticipated higher demand from some unusually winter-like April weather. Amid elevated spot prices, the pipeline also delayed planned maintenance that would have restricted capacity through its Stony Point and Oxford compressor stations starting this week.

Genscape Inc. analyst Molly Rosenstein attributed the spikes at Algonquin to a combination of maintenance and weather.

“Outside of this week’s price roller coaster due to bullish Southeast Compressor Station maintenance and delays, there is a continued outage at the Burrillville compressor near Boston that is causing more pull from Tennessee Gas Pipeline to AGT at Mendon, and Maritimes to AGT at Salem Essex,” Rosenstein told NGI. As for weather, “temperature driven demand in New England peaked at 3.32 Bcf/d and continues to hold strong in the latest demand forecasts. This is the highest April demand figure observed to date.”

Farther south, Genscape’s demand forecast for Appalachia (including New York and New Jersey) called for demand to drop from around 14 Bcf/d Thursday to 12.61 Bcf/d Friday before ramping up to nearly 15 Bcf/d Saturday.

In the Midwest, Radiant Solutions was calling for temperatures in Chicago, Minneapolis and St. Louis to come in 15-22 degrees below normal Friday. But the effect on Midwest spot prices was limited Thursday as points saw mostly small adjustments following larger gains the day before. Chicago Citygate added 2 cents to $2.96.

A few points in the Midcontinent climbed Thursday amid the cold conditions. Northern Natural Ventura added 7 cents to $2.95.

Northern Natural Gas on Thursday further extended an operational alert because of colder than normal temperatures forecast for its system, with the alert now including Saturday’s gas day.

Genscape was calling for Midcontinent demand to approach 4 Bcf/d Friday and Saturday, versus a recent seven-day average of less than 3 Bcf/d.

In the West, SoCal Citygate declined for the third straight day while surrounding points gave back gains from Wednesday. SoCal Citygate dropped 29 cents to average $2.68. SoCal Border Average tumbled 17 cents to $2.19 after adding 17 cents on Wednesday.

Southern California Gas Co. continued to forecast relatively light overall system demand Thursday, with demand expected to decline to just above 2 Bcf/d over the weekend, down from around 2.3 Bcf/d Thursday.

In South Texas, a pipe replacement on Texas Eastern Transmission Co.’s (Tetco) Line 16 running from the Sante Fe Compressor to the export point at Sistrangas Reynosa could cut up to 72 MMcf/d of receipts and up to 92 MMcf/d of deliveries from April 7-11, Genscape told clients Thursday.

“Tetco will also conduct an outage on the same line between the Sante Fe and Petronilla stations April 7-14 that will create bearish pressure as demand gets shut in,” Genscape said. “Up to 126 MMcf/d of power and intrastate demand will be shut in for the duration of the maintenance. From April 12-14, Line 16 south of the Petronilla station will be isolated and delivery locations in this segment must source supply from meters within the segment.

“Excluding the demand locations to be shut in, net demand has reached as high as 79 MMcf/d within the last month.”

Tetco South Texas dropped 2 cents to $2.70 Thursday, while Tennessee Zone 0 South gave up 5 cents to $2.61.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |