Markets | NGI All News Access | NGI Data

Implied EIA Storage Withdrawal Seen Looser; Natural Gas Futures Slide

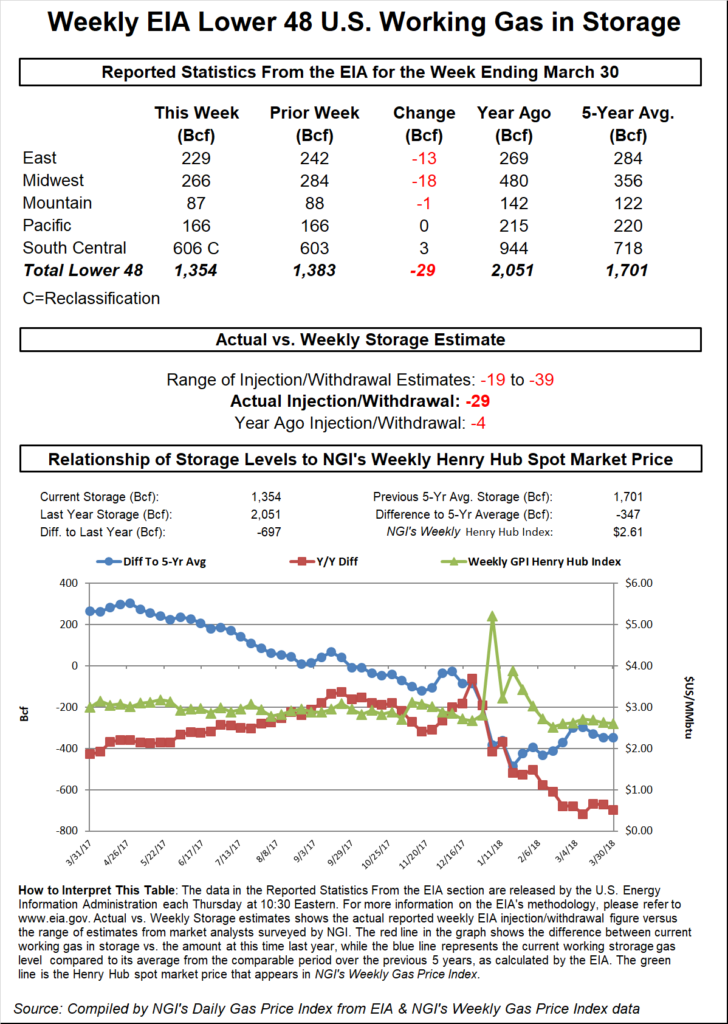

Natural gas futures pulled back Thursday after the Energy Information Administration (EIA) reported a weekly storage withdrawal that came in looser versus market expectations, although a reclassification resulted in a slightly larger net decrease to inventories overall.

EIA reported a net decrease of 29 Bcf for Lower 48 gas stocks for the week ending March 30, but the figure came with an asterisk. In a footnote, the agency said the implied flow for the week was actually a withdrawal of 20 Bcf, with “nonflow-related adjustments” accounting for a 9 Bcf decrease in inventories in the South Central Nonsalt region for the period.

Markets seemed to latch on to the less impressive minus 20 Bcf “implied flow.” As soon as EIA’s 10:30 a.m. ET report crossed trading desks, the May contract slid close to 4 cents to as low as $2.651 before settling into a range of around $2.665-2.675 over the next half hour or so. By 11 a.m. ET, May was trading around $2.662, down about 5.6 cents from Wednesday’s settle.

The 20 Bcf implied withdrawal compares with a 4 Bcf pull in the year-ago period, while the five-year average is a withdrawal of 28 Bcf. Last week, EIA reported a 63 Bcf withdrawal for the week ended March 23.

Prior to the report, the market had been looking for a larger withdrawal than the implied flow.

The median taken from a Bloomberg survey had showed traders and analysts expecting a 26 Bcf withdrawal for the week, with responses ranging from 22 Bcf to 39 Bcf. A Reuters survey of 23 participants had settled on a median 26 Bcf draw with a range of 19 Bcf to 35 Bcf. IAF Advisors analyst Kyle Cooper had called for a withdrawal of 23 Bcf, in line with Intercontinental Exchange EIA storage futures, which had settled Wednesday at a withdrawal of 23 Bcf. OPIS by IHS Markit expected a withdrawal of 27 Bcf.

Shortly after the release of the storage data, Bespoke Weather Services said it viewed the report as looser than the 25 Bcf withdrawal it had predicted.

“Though stockpiles are marginally smaller than previously modeled, it is the minus 20 bcf implied flow that is indicative of current balance, and that shows a market that has continued to loosen dramatically over the last few weeks,” Bespoke said. “As expected, prices quickly dipped off of what was expected to be a loose print and already tested our $2.65 support level, which should be tested again.”

Including the net 9 Bcf decrease because of reclassification, total working gas in underground storage stood at 1,354 Bcf as of March 30, versus 2,051 Bcf a year ago and five-year average inventories of 1,701 Bcf, according to EIA. The year-on-year deficit increased week/week from 672 Bcf to 697 Bcf, while the year-on-five-year deficit widened slightly from 346 Bcf to 347 Bcf, EIA data show.

Looking at the implied flow by region, 18 Bcf was withdrawn in the Midwest, followed by the East, which saw a net 13 Bcf withdrawal. The Pacific region finished flat for the week, while 1 Bcf was withdrawn in the Mountain region. In the South Central, EIA reported an implied injection of 12 Bcf, including 7 Bcf injected into salt and 6 Bcf injected into nonsalt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |