Natural Gas Futures Climb as Supportive Weather Means More Withdrawals; Spot Prices Up Too

Natural gas futures gained for the second straight day Wednesday, supported by a chilly near-term forecast and the promise of a prolonged withdrawal season. Spot prices in the Midwest and East Coast posted healthy gains Wednesday as temperatures were expected to cool off overnight and into Thursday across the northern United States; the NGI National Spot Gas Average gained 4 cents to average $2.78/MMBtu.

The May contract settled at $2.718 Wednesday, up 2.1 cents after trading as high as $2.746. The June contract settled at $2.766, also up 2.1 cents day/day.

“The latest midday data maintained a cold pattern across the northern and eastern U.S. this weekend through the middle of next week, but maintained a milder pattern April 12-18,” NatGasWeather.com said Wednesday, calling the forecast “bullish through the middle of next week, then neutral to potentially slightly bearish after.

“…Today’s move higher could be partially due to the markets seeing next week as cold enough to impress, especially when considering it will stall the injection season by two full weeks and push deficits in supplies to more than 400 Bcf versus the five-year average.”

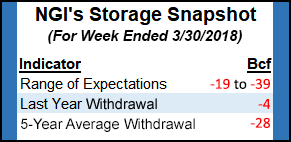

Estimates for Thursday’s Energy Information Administration (EIA) storage report — covering the last full week of the official withdrawal season — point to a pull in line with the five-year average.

The median taken from a Bloomberg survey showed traders and analysts expecting a 26 Bcf withdrawal for the week ending March 30, with responses ranging from 22 Bcf to 39 Bcf. Last year, 4 Bcf was withdrawn, while the five-year average is a withdrawal of 28 Bcf, according to EIA data.

IAF Advisors analyst Kyle Cooper called for a withdrawal of 23 Bcf, in line with Intercontinental Exchange EIA storage futures, which settled Tuesday at a withdrawal of 23 Bcf. A Reuters survey of 23 participants settled on a median 26 Bcf draw with a range of -19 Bcf to -35 Bcf.

OPIS by IHS Markit said it expects a withdrawal of 27 Bcf from U.S. gas stocks for the week ending March 30, 36 Bcf looser week/week “owing to warmer weather across the Lower 48 and a significant drop in heating demand.”

OPIS said it expects end-of-March inventories to total 1,353 Bcf versus a historical average of around 1,700 Bcf.

“This lower end-of-season inventory is needed to make room for growing production this summer (driven by Appalachia, the Permian Basin and the Haynesville Shale),” the firm said. “The U.S. Lower 48 inventory deficit is concentrated in the South Central region’s nonsalt fields and in the Midwest — areas that have access to this growing production. As a result, we expect the inventory deficit for these two regions…to shrink quickly this spring as growing supply supports accelerated refill rates ahead of summer heat.”

Considering the low end-of-season inventories, natural gas prices suggest that an “abundant supply scenario is the base case” going forward, INTL FCStone Financial Inc. Senior Vice President Tom Saal told NGI.

But the logistics of refilling storage could still present complications even with plenty of supply, according to Saal.

“We could have a hot summer, or the supply may not be where the pipes are,” he said. “These are a couple things that might prove to be a little confounding…and we’re going to need the gas in storage because of where we are now. We’re going to need the same amount of storage we had at the beginning of last season, because an average kind of winter brought us down to where we are now.

“You start getting below 1 Tcf and people get nervous.”

In the spot market, colder temperatures across the Midwest and Northeast helped set the tone for broad-based gains as winter’s last hurrah is expected to last into next week.

“A strong late season winter storm will track into the East Wednesday with areas of rain and snow,” NatGasWeather said. “Temperatures behind the cold front are running 15-25°F below normal as lows the next few nights drop into the teens to 30s, locally single digits. An even colder shot of Canadian air will follow into the northern and eastern US this weekend into the middle of next week, including deep into the Southeast, aiding strong national demand. This is where notably colder trends have occurred since this past weekend.”

AccuWeather was calling for overnight lows of around 30 degrees in Boston Wednesday and Thursday, about 7 degrees colder than normal. New York was expected to see lows in the mid-30s, also about 7 degrees below normal, according to the forecaster.

Transco Zone 6 New York added 11 cents to $2.92, while Iroquois Waddington jumped 27 cents to $3.33. Algonquin Citygate proved an outlier, dropping 42 cents to $6.81, moderating somewhat after spiking the day before.

Algonquin Gas Transmission announced late Tuesday that it would be delaying a scheduled outage on its system from Stony Point to Oxford that would have restricted volumes starting with Wednesday’s gas day, according to Genscape Inc.

“The restrictions were originally planned to begin Wednesday and last through April 18, sharply limiting northbound throughput capacity into New England,” Genscape said. “Algonquin Citygate popped $2.44 in Tuesday’s trading before the announcement of the delay.”

In the Midwest, AccuWeather was calling for lows in Chicago to drop into the low 20s by Friday, about 16 degrees below normal.

Joliet surged 25 cents to $2.93, while Dawn added 38 cents to average $3.10.

“The Dawn Area Storage Hub ended March with about 50 Bcf in storage — about 31 Bcf below end of March levels in 2017 and 18 Bcf below the five-year average,” Genscape noted Wednesday. “Withdrawals lessened near the end of the month due to mild temperatures in Toronto, with a net injection reported on March 31.

“However, net withdrawals have been over 1 Bcf/d since the beginning of April, and will likely continue with forecasted temperatures in the Toronto area colder than usual for April 5-8.”

In the West, SoCal Border Average gained for the third straight trading day, adding 17 cents to $2.36, while SoCal Citygate continued to moderate but remained at a premium to the surrounding points, giving up 34 cents to $2.97.

Southern California Gas Co. (SoCalGas) on Wednesday was forecasting relatively moderate demand through the end of the week, with total system sendout expected to dip below 2.3 Bcf/d Thursday and Friday, versus receipts of around 2.4 Bcf/d.

Meanwhile, Genscape was forecasting total California/Nevada regional demand of close to 6 Bcf/d for Thursday and Friday, higher than the recent seven-day average of 5.14 Bcf/d.

Further upstream in West Texas, El Paso Permian added 22 cents to $2.05, while Waha jumped 18 cents to $2.18.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |