Markets | NGI All News Access | NGI Data

Production, Spring Weather Loom Large in Bearish Week for Natural Gas Prices

With April just around the corner, some lingering winter weather in the East was never likely to sustain natural gas spot prices for long. Strong production and softening demand saw spot prices — and futures — trend lower for the week ended Friday; the NGI Weekly Spot Gas Average fell 15 cents to $2.53/MMBtu.

The largest declines during the week came in New England, where prices were elevated as another cold blast swept through the region. Algonquin Citygate finished $2.15 lower at $3.96 after prices moderated following another nor’easter earlier in the week. Tennessee Zone 6 200L fell $1.63 to $4.43.

In the West, prices at SoCal Citygate fell 44 cents on the week to $3.36. Day-ahead prices at SoCal Citygate had averaged as high as $3.82 during the week amid ongoing import constraints. Points throughout California moderated heading into the weekend on projections for regional demand to decline. SoCal Border Average finished 28 cents lower at $2.06, while Malin gave up 17 cents to $2.09.

Further upstream, prices in the pipeline constrained West Texas region continued to come under downward pressure as Lower 48 production remained near record levels. El Paso Permian tumbled 17 cents to average $1.59 for the week, while Waha dropped 15 cents to $1.72.

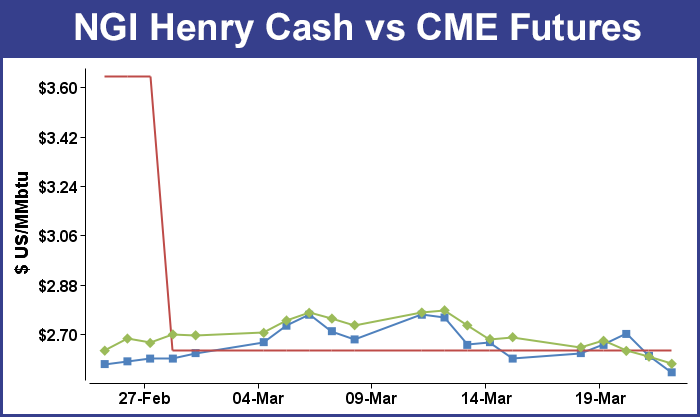

In the Gulf Coast, Henry Hub dropped 6 cents for the week to $2.63, generally following the decline on the soon-to-expire April contract.

Natural gas futures slid further Friday to cap a bearish week that saw production overshadow a supportive storage outlook as injection season looms. The April contract dropped 2.6 cents to settle at $2.591 Friday after trading both sides of even — as high as $2.627 and as low as $2.579. Week/week April shed close to a dime after settling at $2.688 the Friday before.

“Natural gas prices continued to grind lower through the week, closing just slightly above the $2.58 final support level we had been watching,” Bespoke Weather Services said Friday. “The decline was at first quite surprising given how supportive weather forecasts have been the last few weeks. However, through the past week we have continued to see production grow and nuclear outages stagnate in a time of year where they typically” increase sharply.

“The result is significant short-term loosening with less demand and very impressive supply, and recent Energy Information Administration (EIA) data has not done much to show the type of tightening we had expected.”

Industry prognosticators hit it nearly right on the nose Thursday morning as the EIA reported that 86 Bcf was withdrawn from underground storage for the week ending March 16.

The April natural gas futures contract responded accordingly by remaining within a nickel range. Just prior to the 10:30 a.m. EDT report, the prompt-month contract had worked its way higher to $2.661. In the minutes that followed, the April contract reached a high of $2.667 before backing off to $2.627. As of 11 a.m. EDT, it was trading at $2.630, down eight-tenths of a cent from Wednesday’s regular session close.

Analysts at Bespoke Weather Services noted that the withdrawal “hit expectations,” and that it showed that there is no “urgent tightness” in the supply-demand equation. With no surprise in the size of the withdrawal, Bespoke said the report seemed to temporarily confirm the current trading range.

For the comparable week last year, 137 Bcf was withdrawn from storage and the five-year average withdrawal for the week stands at just 53 Bcf.

Heading into the report, early estimates showed the EIA reporting a storage withdrawal in the upper 80 Bcf to lower 90 Bcf range. A Reuters survey of traders and analysts on average predicted an 87 Bcf withdrawal, with responses ranging from 77 Bcf to 99 Bcf.

Kyle Cooper of IAF Advisors projected a storage draw of 87 Bcf and Stephen Smith Energy Associates forecast a 92 Bcf draw, while OPIS estimated a draw of 89 Bcf, driven by gains in supply offsetting a third week of strong weather-driven demand in the Northeast and Midwest. Intercontinental Exchange EIA storage futures settled at -87 Bcf Wednesday for this week’s report.

As of March 16, working gas in storage levels stand at 1,446 Bcf, according to EIA estimates. Supplies are now 667 Bcf less than last year at this time and 329 Bcf below the five-year average of 1,775 Bcf.

For the week, the East Region withdrew 44 Bcf, and the Midwest was close behind with a 35 Bcf draw. The South Central Region dropped 4 Bcf and the Mountain Region declined by 3 Bcf, while the Pacific Region stood pat with no change from the prior week’s level.

Powerhouse President Elaine Levin said the production appears to be “overwhelming” other factors as the market heads into the shoulder season. “The production numbers have been impressive, and here we are starting to talk about the injection season.

“Where the storage number ends up just doesn’t seem to matter. It doesn’t look like the market is concerned” about refilling inventories, Levin told NGI.

Levin pointed to $2.50-2.53 as a significant area of technical support. If prices were to move below $2.50, “that would bring the market into some territory that we haven’t seen in a while…We’re at the end of winter, here we are at mid-$2. We’ll see what comes next, but it doesn’t look good for the bulls, I have to say.”

Analysts with Tudor, Pickering, Holt & Co. (TPH) said the on-target withdrawal “indicated a move back toward weather-adjusted market balance, though heating degree day (HDD) data came in strong on nor’easter driven demand, driving the draw above five-year norms.

“Expect the trend to continue as colder than normal weather sustains, with early estimates for the week ending March 23 forecasting larger draws than normal on higher than normal HDD forecasts,” the TPH analysts said. “With supply continuing to chug along at a steady growth pace, we anticipate the market will continue to slide into neutral, cold weather aside.”

Storage withdrawals for March are on track to total 298 Bcf, the largest withdrawal for the month since 2014, OPIS analyst Jack Weixel told clients Friday. “The increase in withdrawals is due in large part to the relatively cold weather that has been persistent along the East Coast,” he said.

OPIS projections put end-of-March inventories just below 1,350 Bcf, which would be the lowest since inventories ended March 2014 at 857 Bcf, according to Weixel.

In the spot market Friday, expectations for Lower 48 demand to decrease for the week ahead appeared to temper interest in three-day deals at most points; the NGI National Spot Gas Average retreated 8 cents to $2.40/MMBtu.

Forecasts for more chilly temperatures in parts of the Northeast and Mid-Atlantic helped lift weekend and Monday prices at a few points.

Radiant Solutions was calling for temperatures to hover in the 30s and 40s — about 5-10 degrees below normal — over the weekend along the Interstate 95 corridor in cities that include Boston, New York, Philadelphia and Washington, DC.

Prices along the Transcontinental Gas Pipe Line (Transco) worked higher Friday. Transco Zone 6 New York added 6 cents to $2.80, while further south Transco Zone 5 added 5 cents to $2.79. In New England, Algonquin Citygate added 2 cents to $2.99.

“Chilly conditions will linger over the Northeast with highs again mainly in the 30s and 40s for relatively strong demand, although mild to warm over large stretches of the central and southern U.S. with highs of 60s to 80s,” NatGasWeather.com said in its one- to seven-day outlook Friday. “A mild ridge is still expected to build over the southern and eastern U.S. during the middle of next week through the following weekend…bringing with it widespread temperatures in the 60s to 80s for light demand.”

Prices throughout the Midwest and Midcontinent softened heading into the weekend. Chicago Citygate dropped 6 cents to $2.42, while Northern Natural Ventura gave up 11 cents to $2.30.

Lower 48 demand totaled 75.8 Bcf/d for Friday, down about 2.3 Bcf/d day/day, according to OPIS’. “OPIS projects that demand for the week ending March 29 will average 72.3 Bcf/d, representing a significant warming across the Lower 48 compared to the past three weeks,” Weixel said. “While rumors persist of another nor’easter due the first week of April, the current 15-day forecast indicates that demand will slide to 69.2 Bcf/d for the week ending April 5.”

In the West, prices fell throughout California — and especially the volatile SoCal Citygate — as demand was expected to moderate through the weekend.

Genscape was calling for demand in California/Nevada to fall to around 5.6 Bcf/d Saturday and Sunday, down from 6.7 Bcf/d Friday and a recent seven-day average of 6.88 Bcf/d.

SoCal Citygate tumbled 62 cents Friday to average $3.04, while SoCal Border Average gave up 12 cents to $2.01, only a couple pennies above the 30-day low set earlier in the week.

Further upstream in West Texas, Transwestern dropped 15 cents to $1.56.

Elsewhere in Texas, price moves were mixed as most points traded close to Henry Hub.

South Texas exports to Mexico via the NET Mexico pipeline could see a reduction of more than 1.23 Bcf/d in the upcoming week due to maintenance on Mexico’s Los Ramones systems, according to Genscape.

For Wednesday and Thursday “the Los Ramones I system capacity will be reduced to 1,300 MMcf/d. This is a reduction of about 800 MMcf/d from the system’s design capacity,” the analytics firm told clients Friday. “Genscape’s proprietary estimate of monitored flows from Texas’ NET Mexico system to Los Ramones I have averaged a steady 2,034 MMcf/d month-to-date, suggesting flows will be cut by about 734 MMcf/d for the two days.

“Steeper cuts are scheduled to kick in March 30-April 1. During that period, Los Ramones I capacity will be reduced to just 800 MMcf/d. This will limit exports via NET by more than 1.23 Bcf/d versus the month-to-date average.”

This maintenance could affect even more volumes due to maintenance further south limiting throughput capacity on the Los Ramones II Norte system, according to Genscape. But “those downstream restrictions do not necessarily mean cross-border flows from Texas will decline as a result; volumes originating on NET can be diverted to Monterrey and/or Los Indios markets instead of moving down the the Los Ramones II Norte system.”

Coinciding maintenance on Tennessee Gas Pipeline could see South Texas molecules rerouted through the Texas Eastern Transmission Co. (Tetco) system, with Mexico also potentially relying on liquefied natural gas imports to make up for reduced volumes, the firm said.

Tennessee Zone 0 South fell 6 cents to $2.46 Friday, while Tetco South Texas added 2 cents to $2.58.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |