Infrastructure | E&P | NGI All News Access

U.S. Adds One Natural Gas Rig as Oil Gains Drive Domestic Tally Higher

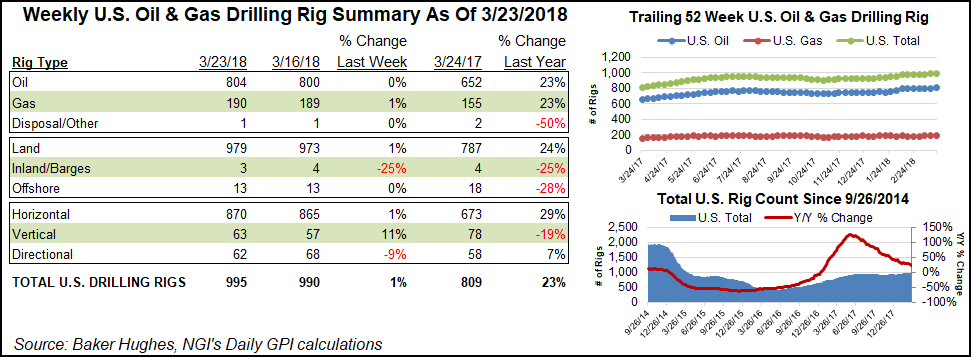

The United States added one natural gas rig for the week ended Friday as oil drilling accounted for the bulk of the week’s domestic gains, according to data from oilfield services giant Baker Hughes Inc. (BHI).

The United States added five rigs — including four oil-directed — for the week to end at 995 active units, up from 809 running at this time last year.

Six directional units packed up for the week, offset by the addition of five horizontal and six vertical rigs. Six units were added on land, while one departed from inland waters, according to BHI. The Gulf of Mexico finished flat for the week at 13.

Spring (break-up) is in the air in Canada, where the rig count dropped sharply for the second straight week. Canadian drillers packed up seven gas rigs and 51 oil rigs to end the week at 161 (185 a year ago). Last week, Canada saw 54 rigs pack up shop.

The combined North American rig count finished the week at 1,156, down 53 week/week but up from 994 a year ago.

Among plays, the Permian, which extends across West Texas and into southeastern New Mexico, led the way, adding seven units to finish at 444 (315 a year ago). Other gainers for the week included the Denver Julesburg-Niobrara and the Eagle Ford Shale, which each added one rig.

Meanwhile, the Cana Woodford saw five rigs pack up shop for the week to end at 59 (50 a year ago). According to NGI’s detailed breakdown of the Cana Woodford, all of the losses for the week came in the STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties). The STACK ended the week with 34 active rigs (down from 39 at this time last year), while the SCOOP (South Central Oklahoma Oil Province) remained unchanged at 23 units (up from 10 a year ago).

Among states, the strong week in the Permian saw Texas add seven to its tally to end at 499, well above the 404 rigs running in the year-ago period. Alaska and Colorado each added two rigs for the week.

Oklahoma saw a net decrease of four rigs to end at 120, roughly in line with its year-ago tally of 118. Two rigs also exited the patch in Utah for the week, while Ohio dropped one rig.

The declines in Oklahoma came the same week that the Oklahoma Supreme Court ruled unanimously in favor of a ballot initiative to enact an additional 5% gross production tax on oil and natural gas wells during the first 36 months of production, with proceeds funding state education needs.

Also during the week, a subsidiary of South Korea’s SK Innovation Co. Ltd. revealed plans to expand in the Midcontinent by acquiring an affiliate of a privately held exploration and production (E&P) company based in Texas. SK E&P America Inc. agreed to acquire all of the outstanding membership interests of Longfellow Nemaha LLC, which has assets in the STACK. The assets being acquired are in Garfield and Kingfisher counties.

Meanwhile, liquefied natural gas player Tellurian Inc. appears bullish on the Permian’s gas growth prospects. The company has begun gauging interest in its Permian Global Access Pipeline LLC, a project proposed to move up to 2 Bcf/d of gas out of the oil-focused play to southwestern Louisiana for export.

“Natural gas production from the Permian is expected to exceed 12 Bcf/d by 2023 and continue to grow through the middle of the decade,” said Tellurian CEO Meg Gentle. “New pipeline infrastructure will be needed to reach growing export and industrial demand in Southwest Louisiana and to establish crude production flow assurance.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |