Markets | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Global Natural Gas Demand Up 3% in 2017, Eclipsing Five-Year Average, Says IEA

Global natural gas demand grew by 3% in 2017 because of abundant and relatively low-cost supplies, along with fuel switching in key economies, which was sharply above the average growth of 1.5% of the last five years, the International Energy Agency (IEA) said.

“China alone accounted for nearly 30% of global growth, with more than 30 bcm out of a total of nearly 120 bcm,” the global energy watchdog said. “This signals a structural shift in the Chinese economy away from energy-intensive industrial sectors as well as a move towards cleaner energy sources, with both trends benefiting natural gas.”

However, U.S. gas-fired generation in 2017 fell by 8%, or 110 TWh, “offsetting half of the increase in gas demand for electricity generation elsewhere,” according to researchers. “The case of the United States last year highlights the importance of relative prices in determining emissions intensity trends in the power sector: a slight rise in the natural gas price in 2017 saw gas-fired generation squeezed by both renewables and coal.”

The research, which dissected carbon dioxide (CO2) emissions worldwide too, is part of IEA’s Global Energy and CO2 Status Report.

“The composition of gas demand growth is changing,” IEA said. “In the past decade, half of global gas demand growth came from the power sector. In 2017, over 80% of the growth came instead from industry and buildings. The power sector remains the largest single component of global demand, but this share is likely to decline gradually.”

China’s big surge follows an official policy to “make China’s skies blue again,” by phasing out burning coal in industrial boilers, particularly in and around major cities, and reducing coal use for residential heating.

China’s gas demand also has absorbed some of the slack during 2017 in liquefied natural gas markets, said IEA, “pushing up international spot prices for gas in the latter part of the year.”

European Union (EU) gas demand also rose last year, continuing a trend from 2016, with consumption up around 16 bcm.

“Some of this increase was weather-related, for instance due to a poor year for hydropower,” said researchers. “Demand from industry also reportedly picked up on the back of stronger economic activity.”

EU gas consumption still was more than 10% below the peak seen in 2010, IEA noted. “Gas imports were near historical highs as domestic production tapered off, notably in The Netherlands,” where output has been reduced from the giant Groningen gas field.

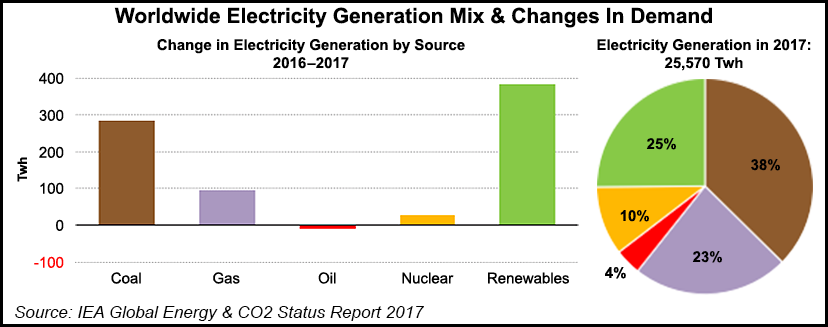

IEA said overall global energy demand last year rose by 2.1%, more than twice the 2016 rate, on strong economic growth. Oil, gas and coal met most of the increase in energy demand but renewables showed impressive gains.

More than 70% of global energy demand growth last year was met by oil, gas and coal, while renewables accounted for 30%. Meanwhile, improvements in energy efficiency slowed.

“As a result of these trends, global energy-related carbon dioxide emissions increased by 1.4% in 2017, after three years of remaining flat,” said researchers.

However, CO2 emissions, which reached a historical high of 32.5 gigatonnes in 2017, did not rise everywhere.

Most major economies reported an increase in CO2 emissions, but notably, the United States, United Kingdom, Mexico and Japan experienced declines. The biggest drop in emissions was in from the United States, driven by higher renewables deployment.

Also in 2017, IEA researchers said:

“The robust global economy pushed up energy demand last year, which was mostly met by fossil fuels, while renewables made impressive strides,” said IEA Executive Director Fatih Birol. “The significant growth in global energy-related carbon dioxide emissions in 2017 tells us that current efforts to combat climate change are far from sufficient. For example, there has been a dramatic slowdown in the rate of improvement in global energy efficiency as policymakers have put less focus in this area.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |