U.S. Adds One NatGas Rig as BHI Tally Rises on Oil

The United States added one natural gas rig during a week of oil-driven gains, according to data released Friday from Baker Hughes Inc. (BHI).

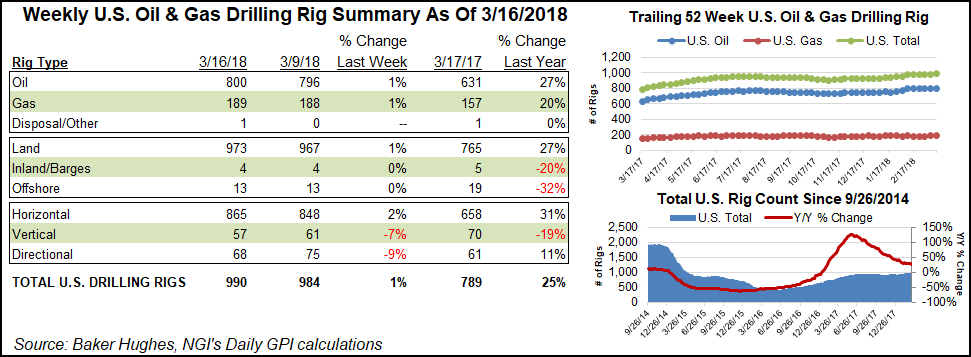

U.S. operators added six rigs to end the week at 990, up from 789 active units at this time last year. Gains included four oil-directed rigs to go with one gas-directed rig and one “miscellaneous” rig, according to the oilfield services giant.

The gains were driven by a week/week increase of 17 horizontal units, while seven directional units and four vertical units packed up shop, according to BHI. This week’s additions all were on land, with the Gulf of Mexico finishing flat week/week at 13 active rigs.

Spring break-up season appeared to be well underway in Canada for the week, as producers packed up 54 rigs to end at 219 from 276 a year ago. That left the combined North American rig count at 1,209, down 48 week/week but up from 1,065 rigs a year ago.

By basin, the biggest gainer for the week was the Williston, which added three units to finish at 54, up from 42 rigs in the year-ago period. The Cana Woodford and Granite Wash each added two rigs for the week. The Eagle Ford, Fayetteville, Haynesville and Utica shales added a rig a piece, as did the Permian Basin.

Net losers for the week among basins included the Arkoma Woodford, the Denver Julsburg-Niobrara and the Marcellus Shale, which each dropped one rig.

NGI Shale Daily’s detailed breakdown of the Cana Woodford showed five rigs returning to the STACK (aka Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties), and four rigs exiting the SCOOP (South Central Oklahoma Oil Province). One rig was also added to “Other Cana Woodford,” the breakdown shows.

Unsurprisingly, considering which basins gained rigs, Oklahoma led the way among the states, with four additions for the week, while three rigs returned to the patch in North Dakota. Arkansas, New Mexico, Ohio and West Virginia each added one rig for the week.

States that lost rigs for the week included Alaska, Colorado and Pennsylvania, which each saw two rigs pack up, while Louisiana and Wyoming each saw one net rig exit the patch, according to BHI.

The increased activity in the Williston helps support the outlook recently shared by North Dakota Department of Mineral Resources director Lynn Helms.

Predictions that the Bakken Shale may be nearing its peak are wrong and, in fact, production in North Dakota may establish a record above 1.3 million b/d by the end of the year, Helms said during a webinar.

“I think by mid-year we will be producing more oil than we’ve ever produced in North Dakota,” he said. “I’m predicting we will hit 1.3 million b/d by the end of the year, well above our record” of 1.22 million b/d in December 2014.

Meanwhile, U.S. oil and natural gas producers stoked their hedges in the final three months of 2017 and 2018 hedging is already above the historical average, according to recent analysis by Goldman Sachs & Co. LLC.

Based on data issued by exploration and production companies during the 4Q2017 earnings season, 2018 hedged oil/liquids increased to 48%/35% from 30%/22% post-3Q2017.

“For natural gas, 2018 hedging rose to 47% from 40% post-3Q2017 results, remaining above the five-year season average of 44%,” said analysts led by Brian Singer.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |