Infrastructure | E&P | NGI All News Access

BHI U.S. Rig Count Climbs by Three Despite STACK Pullback

Driven by a strong growth in natural gas drilling activity — despite declines in Oklahoma — the United States added three rigs overall for the week ended Friday, according to data from Baker Hughes Inc. (BHI).

A gain of seven natural gas-directed rigs was enough to offset the loss of four oil-directed rigs in the oilfield services giant’s latest weekly domestic tally. The United States ended the week at 984 rigs, up from 768 a year ago, according to BHI.

Two vertical units were added, along with one horizontal unit. Four units were added on land for the week, while the Gulf of Mexico’s count fell by one to 13, down from 20 a year ago.

In Canada, 15 oil rigs and 14 gas rigs packed up for the week, dropping its tally to 273 from 315 a year ago. BHI’s combined North American rig count finished the week at 1,257, up from 1,083 in the year-ago period.

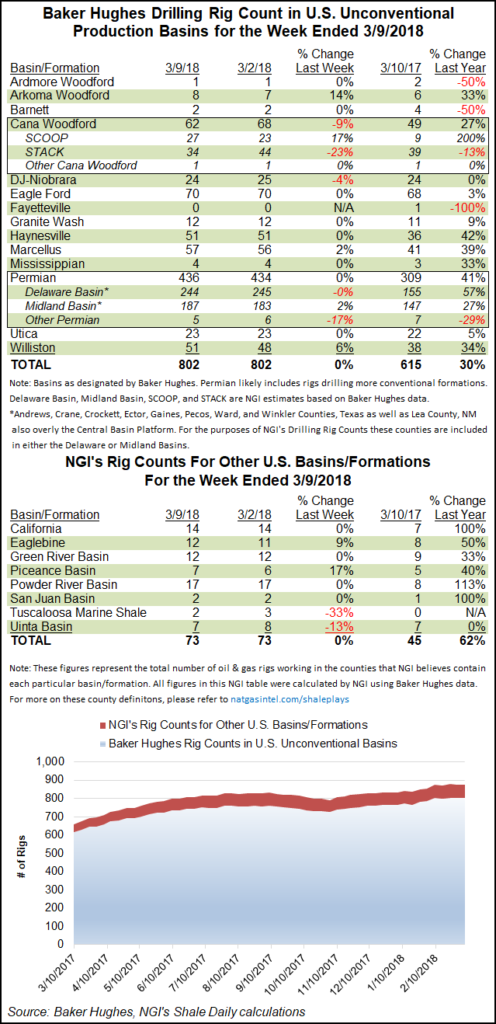

Among plays, the largest week/week decline came in Oklahoma’s Cana Woodford, where six rigs were dropped to leave the play at 62 from 49 a year ago. According to more detailed breakdown of BHI data by NGI’s Shale Daily, the losses were driven entirely by a sharp pullback in the STACK (aka, the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties).

The STACK lost 10 rigs (23%) week/week to finish at 34, lagging its year-ago tally of 39, NGI’s Shale Daily breakdown shows. Oklahoma’s SCOOP (South Central Oklahoma Oil Province), meanwhile, added four rigs for the week to end at 27, triple its year-ago total of nine.

Also among plays, North Dakota’s Williston Basin had a good week, adding three rigs to climb to 51, versus 38 a year ago. The Permian Basin added two rigs for the week, while the Marcellus Shale added one, according to BHI.

Among states, Texas led the way with seven net rigs added week/week. The Lone Star State boasted 490 rigs as of Friday, up from 392 at this point last year. Unsurprisingly given the declines in the Cana Woodford, Oklahoma dropped four net rigs for the week. Alaska saw two rigs pack up, while Louisiana, New Mexico and Utah each dropped one net rig.

This week, BHI released its international rig count for February 2018, tallying 979 rigs running outside of North America, up from 960 a month ago and 941 in February 2017. BHI’s worldwide rig count for February 2018 was 2,271, versus 2,175 the month before and 2,027 counted a year ago.

Also this week, exploration and production guru Mark Papa, former chief of EOG Resources Inc. who now runs Centennial Resource Development Inc., threw a bit of shade on Lower 48 oil and gas optimists, warning that some of the onshore basins may “soon be past their prime.”

“The impression of U.S. shale as the big bad wolf is perhaps a bit overstated,” Papa said, referring to the recent annual oil outlook report issued by the International Energy Agency, which is forecasting the United States will surpass all other global producers.

“There are good geological spots in shale plays and weaker geological spots, and a lot of the good geological spots have already been drilled,” Papa said. “My theory is that you’ve got basically resource exhaustion that is beginning to take place. It’s no secret that you’ve only got three shale oil plays in the U.S. of any consequence…The rest of them don’t amount to a hill of beans.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |