Infrastructure | NGI All News Access

Canada Natural Gas Sector Said in ‘Jeopardy’ Unless TransCanada Cuts Mainline Rates

A routine toll renewal application has triggered an avalanche of demands for rate cuts on TransCanada Corp.’s cross-country Mainline from natural gas shippers plagued by surpluses and poor prices.

“The viability of the Canadian natural gas sector is in jeopardy,” Jupiter Resources Inc. told the National Energy Board (NEB) regarding the order. Jupiter produces 340 MMcf/d in Alberta.

Shippers told the board that steep Mainline rates heighten downward pressure on gas prices by a delivery bottleneck, of more inlet than outlet capacity, on TransCanada’s supply collection grid in Alberta and British Columbia (BC), Nova Gas Transmission Ltd. (NGTL).

“Natural gas production companies within the Western Canadian Sedimentary Basin (WCSB) are under extreme duress,” said Peyto Exploration and Development Corp., which ranks in the top 10 with output of 560 MMcf/d. “Supply is in excess of ACCESS to demand,” it said.

“TransCanada, through both the existing NEB approved Mainline tolls and discretionary pricing of interruptible transportation service on the Mainline, is restricting access to U.S. and Eastern Canadian markets.”

Junior explorer Bellatrix Exploration Ltd., which produces around 175 MMcf/d, agreed.

“The combined NGTL-TransCanada system is currently operating in a manner that is bringing significant harm to Canadian producers and consumers,” Bellatrix said.

Peyto management told a horror story of heating-season demand and price disorder, blaming harm done to producers and consumers alike on the pipeline network linking Alberta and BC to the Dawn storage and trading hub in Ontario and export routes into the United States.

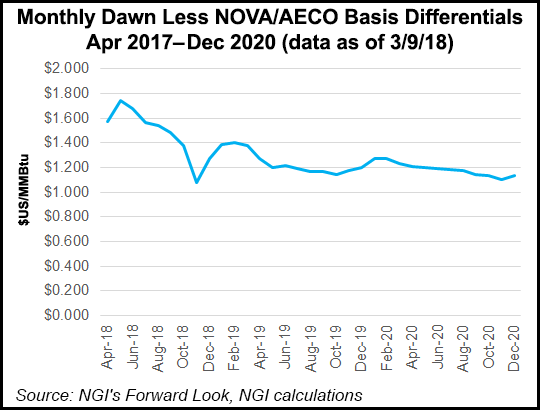

“A recent example of this occurred in the early days of January 2018,” Peyto noted, when the AECO price, the NGTL benchmark also known as Nova inventory transfer or NIT, fell below C$2/GJ, or $1.68/MMBtu,and the price at Dawn was above C$10/GJ, or $8.40/MMBtu.

“Via discretionary pricing TransCanada was charging over C$24/GJ [$20.16/MMBtu for interruptible service on the Mainline to get gas from the Alberta border to Dawn,” Peyto said. “The result was that the AECO price was depressed, the Dawn price was excessive, and there was idle capacity on the Mainline.”

The Canadian Association of Petroleum Producers (CAPP), representing 80% of the nation’s gas supplies, said TransCanada has the means to stop the muddle: a financial safety valve called the long-term adjustment account, or LTAA.

Said CAPP, “The current circumstances of the Mainline have changed significantly from the situation in 2013,” when the LTAA was created to save toll revenue surpluses and cover shortfalls for spells of gas traffic variability that were expected to be brief.

“There has been significant over-collection of revenues by TCPL over the 2015-2018 period,” CAPP has told the NEB. “This over-collection of revenues has resulted in an LTAA balance of approximately C$1.1 billion,” or $880 million.

CAPP urged the NEB to make TransCanada refund the surplus as a cut for the period covered by its Mainline rate renewal application. “Consideration of this over-collection, held in the LTAA, in setting the 2018-2020 tolls represents a material toll reduction,” the industry group said.

The board agreed to hold toll hearings rather than rubber-stamp the application as a routine renewal. The case issues list includes “the appropriateness of continued pricing discretion for interruptible transportation” as well as overall market and financial conditions.”

A parallel flurry of facilities construction proposals unveiled by TransCanada sets out a multi-billion-dollar blueprint for increasing inlet and especially outlet capacity on the NGTL network. Action to revive dormant excess capacity on the cross-country Mainline is understood to be under consideration.

Alberta and BC producers, meanwhile, received confirmation that years-old hopes for Pacific coast liquefied natural gas (LNG) export terminal projects to siphon off their surpluses are unlikely to be fulfilled any time soon.

The annual report of Woodside Energy Ltd. disclosed it has given up the site for a dormant BC terminal project at Prince Rupert. The Australian LNG developer remains a partner in a second dormant BC export scheme at Kitimat, which is led by Chevron Corp.

The TransCanada-NGTL gas transportation family’s current forecasts, disclosed in the Mainline toll case, said the driving force of market growth for WCSB production will be rising fuel consumption by thermal Alberta oilsands plants and power stations.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |