Texas Oil, Natural Gas E&Ps Pick Up Pace in January

Texas oil and natural gas producers during January for the 14th straight month pushed the state’s upstream economic indicators higher, propelled by higher commodity prices, the Texas Alliance of Energy Producers said Thursday.

At 192.7 in January, the Texas Petro Index (TPI) was 25% higher year/year, when it stood at 153.7, and rose 30% plus from November 2016 when it stood at 148.2.

“The statewide upstream oil and gas economy remains in a state of expansion with generally favorable pricing, a slowly rising rig count, growing industry employment, and record crude oil production,” said economist Karr Ingham, who created and updates the TPI monthly.

TPI estimates in January indicated wellhead prices were higher for crude oil and natural gas, boosting exploration and production (E&P) activity across the board:

Most of the impetus for the continuing E&P expansion in Texas came from crude oil, Ingham noted.

“According to TPI estimates, crude oil production in Texas in January totaled 119.4 million bbl, which would surpass all prior volumes in January, including the early 1970s when the statewide annual production record was set,” he said.

“In addition, the posted price for crude oil in Texas in January jumped more than $6/bbl compared to December to average more than $60/bbl for the first time since November 2014.”

The TPI is a composite index based upon a group of upstream economic indicators. The TPI peaked at a record 313.5 in November 2014 as the economic downturn took hold, marking the zenith of an economic expansion that began in December 2009, when the TPI stood at 187.4.

Estimated crude oil output in Texas during January totaled more than 119.4 million bbl, 21.9% higher year/year.

“With oil prices in January averaging $60.10/bbl, the value of Texas-produced crude oil amounted to nearly $7.2 billion, about 48.8% more than in January 2017,” Ingham said.

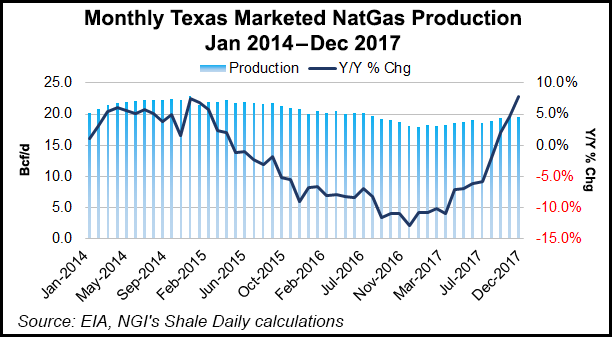

Texas natural gas output climbed 2.7% from a year earlier to nearly 665.9 Bcf. Gas prices averaged $3.62/Mcf in January, putting the value of Texas-produced gas up 16.4% from January 2017 to about $2.4 billion.

The number of original drilling permits issued during January totaled 1,166, 22% higher than the 956 permits issued in January 2017.

“An estimated average of 226,200 Texans remained on upstream oil and gas industry payrolls, about 15.5% more than the revised average of 195,900 in January 2017, but about 23.4% fewer than the estimated high of 295,200 in December 2014,” according to the TPI.

According to revised TPI estimates, the trough of upstream employment in Texas before the expansion ending December 2014 was 168,700 in October 2009. During the previous growth cycle, industry employment peaked at 211,100 in October 2008.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |