EIA Storage Stats Match Expectations; Market Reaction Muted

The Energy Information Administration (EIA) on Thursday reported a storage withdrawal that matched market expectations, and futures traded in a tight range after selling off a few cents earlier in the morning.

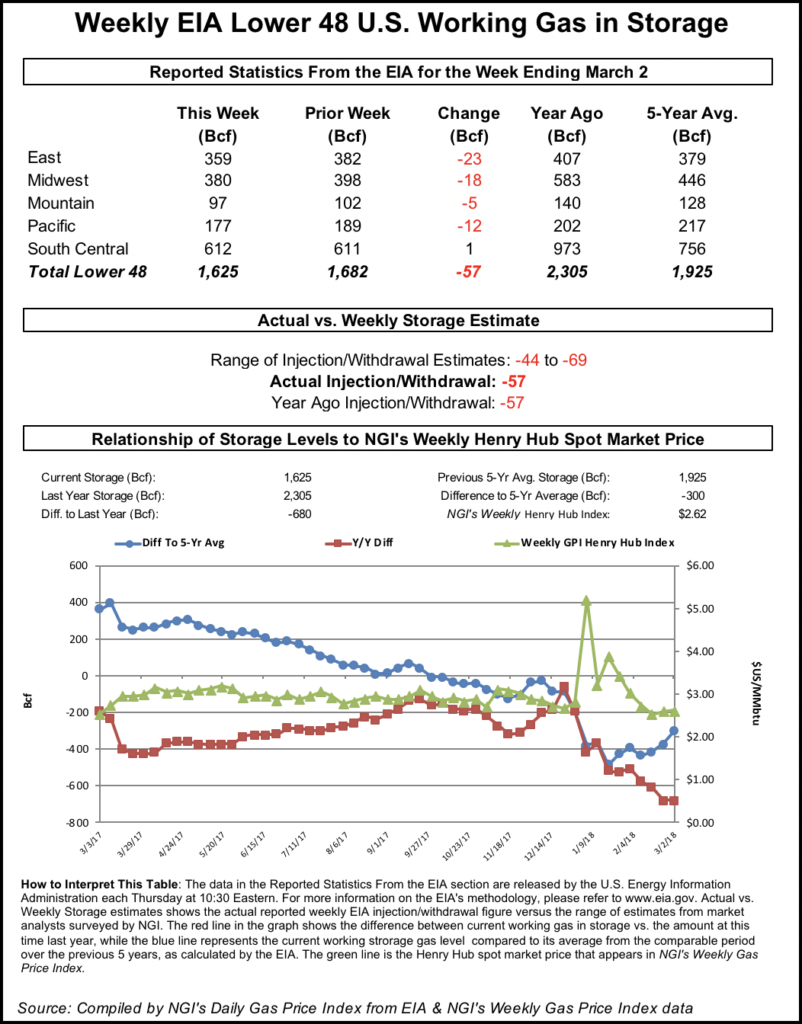

EIA reported a 57 Bcf withdrawal for the week ending March 2, matching the year-ago withdrawal of 57 Bcf and looser versus a five-year average pull of 129 Bcf. Last week, EIA reported a 78 Bcf withdrawal.

In the minutes following the 10:30 a.m. EDT release of the final number, the April contract hovered around $2.752, within a penny of where prices stood prior to the report. By 11 a.m. EDT, after briefly moving as high as $2.764, April was trading around $2.750, down about 2.5 cents from Wednesday’s settlement.

Prior to Thursday’s report, estimates had pointed to a withdrawal that was close to the actual figure.

A Reuters survey of traders and analysts had on average predicted a 58 Bcf withdrawal for the week. Responses had ranged from -44 Bcf to -69 Bcf. A Bloomberg survey had showed a median -58 Bcf and a range of -50 Bcf to -69 Bcf. OPIS, through its newly formed analytics division (formerly PointLogic Energy), had estimated a 61 Bcf withdrawal for the week. Stephen Smith Energy Associates had called for a 57 Bcf withdrawal. Intercontinental Exchange storage futures had settled at -58 Bcf Wednesday.

“This number hit the market consensus perfectly, however, with prices not moving much off the release,” Bespoke Weather Services said following the report. “Prices were already down on the day, seemingly pricing in such a print, and we do not see this as significantly shifting our understanding of balance.

“However, such a print does confirm that in periods of lower weather-driven demand the market is loosening, especially at these higher price levels,” the firm said. “Though we are skeptical that the number itself is enough to push prices much lower, especially given weather expectations, we see this loosening as firming up resistance from $2.80-2.82.”

Total working gas in underground storage stood at 1,625 Bcf as of March 2, according to EIA. That’s versus 2,305 Bcf a year ago and five-year average inventories of 1,925 Bcf. The current year/year storage deficit held week/week at -680 Bcf, while the year-on-five-year deficit shrank from -372 Bcf to -300 Bcf, EIA data show.

By region, the largest withdrawal came in the East at -23 Bcf, followed by 18 Bcf withdrawn in the Midwest. The Pacific saw a 12 Bcf pull for the period, while 5 Bcf was withdrawn in the Mountain region. The South Central region finished nearly unchanged for the week, with 6 Bcf injected into salt offsetting 6 Bcf pulled from nonsalt, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |