Continued Cold Risks Help NatGas Futures Find Upward Momentum

Natural gas futures gained for a third straight session Wednesday as weather models continued to advertise short- and medium-term cold trends, with potentially more to follow later in the month. In the spot market, a winter storm in the Northeast supported demand and prices there, and the NGI National Spot Gas Average tacked on 4 cents to $2.66/MMBtu.

The April contract settled at $2.777, up 2.8 cents on the day and around 8 cents higher since the end of last week. May also added 2.8 cents to settle at $2.806.

It’s “not an impressive breakout, but certainly out of the recent two-week range,” NatGasWeather.com said in a note to clients Wednesday. “The midday Global Forecast System weather model was notably colder trending, better matching the colder trending overnight European model.

“Bigger picture, the data maintained three primary periods of interest to play out over the next two weeks, with the first being two rather strong weather systems to sweep across the eastern U.S., the first Wednesday through Friday, the second early next week,” the firm said. “This will be followed by a mild ridge expanding over the eastern half of the country March 16-20, although less warm in recent runs. We continue to see increasing potential for colder systems to return across the northern and eastern U.S. March 21-25.”

Powerhouse CEO Al Levine said some bullishness has been gradually creeping back into the market over the last week or two and that he would look for prices to test $2.90 from here

“After plodding along in February at roughly $2.56,” the market “started to lift its head, and since Feb. 26 it looks like natural gas has had six or seven days that made new highs or higher lows,” Levine told NGI. “So while it’s true that not any single day has been especially dramatic overall, they’re really starting to get some motion into the trade, and you might actually get some rally coming out of this.”

The storage picture is also supportive, he said.

Given near-record production and mild temperatures, “if you have that and you still can’t quite build the inventory, it suggests that demand may continue to be there to ultimately be supportive of prices.”

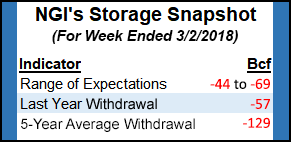

As the market tries to zero in on end-of-winter inventories, estimates this week have the Energy Information Administration (EIA) reporting a storage withdrawal Thursday that would be in line with a year ago but looser versus the five-year average.

A Reuters survey of traders and analysts on average predicted a 58Bcf withdrawal for the week ending March 2, versus a year-ago withdrawal of 57 Bcf and a five-year average pull of 129Bcf. Responses ranged from -44Bcf to -69Bcf.

A Bloomberg survey came in with a median -58 Bcf and a range of -50 Bcf to -69 Bcf.

Last week, EIA reported a 78 Bcf withdrawal from U.S. gas stocks.

OPIS, through its newly formed analytics division (formerly PointLogic Energy), estimated a 61 Bcf withdrawal for the week, with the smaller withdrawal week/week “owing to an uptick in production and warmer weather in the Midwest and Mountain regions.

“…With strong production and weaker-than-normal withdrawals, the East region has contributed to just over half (37 Bcf) of the overall shrink in the country’s inventory deficit over the past three weeks alone,” OPIS analysts said. “And despite lingering cold in the East this week, that region’s deficit continues to diminish. As a result, we expect end-March inventories for the East to be within 20 Bcf of the five-year average, with total U.S. Lower 48 end-March inventories projected to be at a deficit of roughly 300 Bcf.”

Stephen Smith Energy Associates is calling for a 57 Bcf withdrawal. Intercontinental Exchange futures for the upcoming report settled at -58 Bcf Tuesday.

In the spot market, a storm that should bring significant snowfall to the Northeast and Mid-Atlantic region Wednesday supported higher prices along the East Coast and in parts of Appalachia.

“A strengthening nor’easter will continue to parallel the Northeast U.S. coast on Wednesday night and Thursday, and then move westward into Maine by Friday,” the National Weather Service (NWS) said. “…The heaviest snow is expected to occur in Maine, where over 18 inches of snow is possible through the end of the workweek as the surface low lingers.”

New York City and Boston “are on the gradient in between substantial snowfall totals and lighter snowfall totals,” NWS said. “…Farther west, the Great Lakes region and the Central Appalachians will also see snowfall,” with six-to-eight inches possible in places.

Algonquin Citygate gained sharply for the fourth straight trading day Wednesday, adding 35 cents to average $4.20. Transco Zone 6 New York added 6 cents to $3.09. In Appalachia, Tetco M3 Delivery jumped 25 cents to $3.06.

In the West, where Radiant Solutions’ latest one- to five-day outlook showed normal to above-normal temperatures across much of the region, especially in the Southwest, prices moderated.

Most Rockies points gave up around 3-5 cents, including Cheyenne Hub, which fell 7 cents to $2.35.

In California, SoCal Citygate fell 6 cents to $2.97 as utility Southern California Gas Co. (SoCalGas) was projecting system demand to fall below total receipts at around 2.5-2.7 Bcf/d over the next several days. The decline in demand comes after a stretch of colder temperatures had prompted price spikes as high as $25 or more at the import-constrained point.

On Tuesday, SoCalGas notified customers of another withdrawal from the Aliso Canyon storage facility, the third such withdrawal since last month. SoCalGas said on Sunday it pulled 0.21 Bcf from Aliso — the site of a high profile leak in 2015 — to help maintain system reliability.

The withdrawals from Aliso prompted protests Tuesday by activists who want the 86 Bcf capacity facility closed. While the California Public Utilities Commission has approved each of the withdrawals since Feb. 19, critics claim SoCalGas is manufacturing a false shortage of gas supplies to justify keeping the 3,600-acre facility in service.

Elsewhere in the region, SoCal Border Average added 4 cents to $2.44, while El Paso S. Mainline/N. Baja climbed 4 cents to $2.50.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9966 |