Spot Prices Weaken in West as Natural Gas Markets Close Book on Mild February

Shoulder season-like weather across much of the country to close out February contributed to a mix of changes in the natural gas spot market for the week ended Friday. But generally prices trended downward amid moderate national demand; the NGI Weekly Spot Gas Average fell 21 cents to $2.43/MMBtu.

The biggest price moves for the week occurred in the West, where SoCal Citygate moderated from the prior week’s price spikes, dropping $8.87 to average $2.88. Supply/demand tightness eased somewhat for Southern California Gas Co. during the week, and the utility managed higher demand levels on its system through large daily storage withdrawals, including pulls from Aliso Canyon.

Rockies points also fell after widespread cold in western markets had sent spot prices climbing the week before. Kingsgate dropped 63 cents to $2.08, while Opal fell 52 cents to $2.29.

Most points in West Texas gave up 30 cents or more on the week, and a series of constraints on El Paso Natural Gas pipeline’s system didn’t help the situation for Permian Basin producers looking to get their gas to markets. Waha fell 27 cents to $2.10.

The East Coast saw more mild temperatures during the week, though a storm bringing rain, snow and strong winds hit the Northeast and Mid-Atlantic on Friday. The storm — not an especially cold one — appeared to have a limited impact on prices. Algonquin Citygate added 23 cents on the week but finished below $3 at $2.71. Transco Zone 6 New York added 13 cents to $2.69.

Points in the Gulf Coast had a quiet week, with most changes falling within a nickel of even. Henry Hub added 2 cents to $2.62, mirroring the sideways price action that transpired in the futures market.

Natural gas futures finished near even Friday, with the market content to remain range-bound as forecasters hinted at potential upside risks from a chilly outlook for the first half of March. The April contract settled at $2.695 Friday, down 0.3 cents on the day after trading as high as $2.728 and as low as $2.686. Week/week April added about 4 cents from the previous Friday’s settlement at $2.657.

NatGasWeather.com noted Friday that “the weather data trended colder Thursday and overnight, which continued in the latest midday, especially across the East, with cold lingering March 12-15 instead of ending by March 11-12, as the data was suggesting earlier in the week.

“Prices failed to sell off on” previous milder trends “but haven’t really added much now that notably colder trends have occurred in both the Global Forecast System and European models,” the firm said. “…Going into the weekend, we see the bias as being toward colder trends since there are ways additional reinforcing cold shots can continue into the East past March 15.”

That said, recent changes to guidance haven’t been producing strong movements in the market, the firm added.

Bespoke Weather Services on Friday observed an overnight rally before prices “pulled back at the pit open and into the settle. This appeared to be producers using high volume periods to hedge, as volume increased and contracts later in the strip (especially Winter ”18/19) declined more.

“Those later contracts lagged through the day while summer contracts once again led, indicating structural tightness continues to allow for a very tight floor for prices at the front of the strip,” the firm said. “We see this combining with recent colder risks over the next couple of weeks to open up a bit more upside towards the $2.75 resistance level into early next week.”

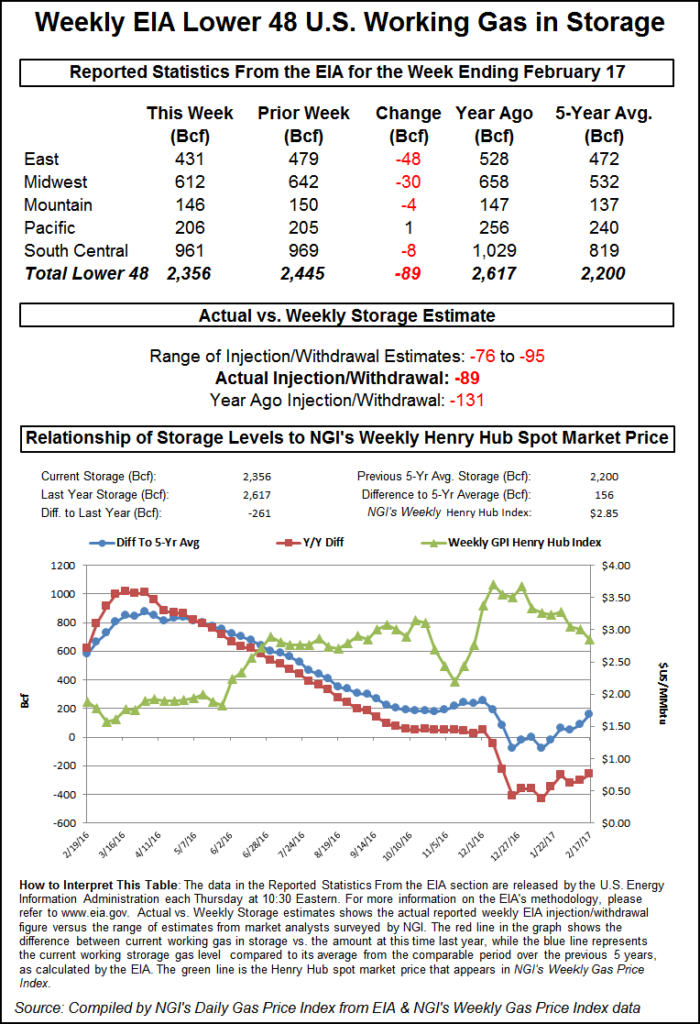

The Energy Information Administration (EIA) on Thursday reported a storage withdrawal that fell in line with market expectations, and prompt-month futures continued to trade sideways.

EIA reported a 78 Bcf withdrawal for the week ending Feb. 23, which was tighter versus the 7 Bcf withdrawn a year ago, but looser than the five-year average pull of 118 Bcf.

Prior to the 10:30 a.m. EDT release of the storage figure, the April contract on Thursday had been trading around $2.695. As the number crossed trading desks, the April contract briefly shot up to as high as $2.731 before pulling back to around $2.670-2.680. By 11 a.m. EDT, April was trading right around $2.70, up about 3 cents from Wednesday’s settle.

Before the report, the market had on average been looking for a withdrawal close to the actual number, though surveys showed a fairly wide range of expectations among respondents.

A Reuters survey of traders and analysts on average had predicted a 77 Bcf withdrawal, with responses ranging from -60 Bcf to -98 Bcf. Kyle Cooper of ION Energy had called for an 82 Bcf withdrawal, while PointLogic Energy on Tuesday had predicted a withdrawal of 72 Bcf.

Stephen Smith Energy Associates had predicted a 74 Bcf withdrawal, and Intercontinental Exchange futures for this week’s report had settled at -80 Bcf Wednesday. The Desk’s Early View survey, released last week, showed participants expecting on average a 70.9 Bcf withdrawal, with responses ranging from -60 Bcf to -86 Bcf.

“This number perfectly confirms our balance expectations, with the market balance being tight enough to keep support around the $2.62 level rather firm but weather not cooperating enough for any move above resistance from $2.70-2.75,” Bespoke Weather Services said following the report.

“Without a bullish miss there is a risk that $2.62 support gets tested again today, especially if afternoon model guidance eases off overnight medium-range trends, but for now we still expect to be range-bound.”

Total working gas in underground storage stood at 1,682 Bcf as of Feb. 23, according to EIA. That’s versus 2,362 Bcf in the year-ago period and five-year average inventories of 2,054 Bcf.

The year-on-year storage deficit increased week/week from -609 Bcf to -680 Bcf, while the year-on-five-year deficit shrank from -412 Bcf to -372 Bcf, EIA data show.

By region, the largest weekly withdrawal occurred in the Midwest at 30 Bcf, followed by a 21 Bcf withdrawal in the East. The Pacific Region saw a 15 Bcf withdrawal for the week, while 9 Bcf was withdrawn in the Mountain region. The South Central region recorded a net 3 Bcf withdrawal, with an 11 Bcf pull from nonsalt offsetting an 8 Bcf injection into salt.

The withdrawal fell in line with market expectations, though analysts with Tudor, Pickering, Holt & Co. (TPH) noted “a slight boost” to futures “as six- to 10-day weather forecasts show below-average temperatures across most of the U.S. and a winter storm is predicted to hit the northeast, a departure from the mild weather seen in February.

“Interestingly, this week’s draw indicated a weather-adjusted undersupply level of around 3 Bcf/d, moving further out of balance from” the prior week, the TPH analysts said. “We’re looking for the production side to begin to come into play in the coming weeks, with the full in-service of the Rover Pipeline driving a step-change in supply/demand dynamics.”

Meanwhile, natural gas bulls got some potentially good news during the week as a liquefied natural gas (LNG) tanker owned by a subsidiary of Royal Dutch Shell plc loaded up with the first export cargo from the Dominion Energy Cove Point LNG LP terminal at Lusby, MD.

Cove Point now joins Cheniere Energy Inc.’s Sabine Pass LNG terminal in a growing list of export projects poised to create additional demand for surging domestic natural gas supply.

The timing could be good for Cove Point’s first shipment, according to Genscape Inc.

“European market demand has spiked and is expected to remain high as an intense cold front has extended out of Siberia over the continent,” the firm told clients Friday. “Parts of Britain are reportedly breaking snowfall records set 30 years ago, and daytime highs in Britain and Scotland have failed to break out of the teens.

“…The UK’s primary gas provider, National Grid, has issued warnings of strained operating conditions and potential shortages as system demand on Wednesday set a 10-year high, and storage inventories have plummeted,” Genscape said. “Demand has been met with heavy storage withdrawals, but this has also pushed LNG storage inventories to year-to-date lows.”

In the spot market Friday, Southern California points surged, while a storm that swept through the Northeast and Mid-Atlantic Friday had a muted impact on prices; the NGI National Spot Gas Average climbed 3 cents to $2.46/MMBtu.

Prices in Southern California shot up as Southern California Gas Co. (SoCalGas) reported another withdrawal from the Aliso Canyon storage facility amid chilly conditions in the region.

SoCalGas and San Diego Gas & Electric (SDG&E) said Friday they were continuing to operate with a system-wide curtailment in place for electric generation customers due to cold temperatures and high demand.

“SoCalGas and SDG&E continue to meet system demand utilizing storage withdrawal and flowing supplies, and are closely monitoring out of state supplies and system demand,” the utilities said. “System conditions remain dynamic and are subject to change.”

SoCalGas was forecasting system-wide demand to increase through the weekend, climbing to around 3.5 Bcf/d by Sunday, up from around 3.2 Bcf/d on Thursday.

SoCalGas notified customers that last Wednesday it pulled another 0.24 Bcf from Aliso Canyon — the site of a high profile leak in 2015 — “to support system reliability.”

“This is the second withdrawal from Aliso Canyon in under a week,” Genscape said, pointing to an earlier withdrawal on Feb. 24. “The total 320 MMcf made across these two withdrawals represents the first gas SoCalGas has taken out of Aliso in over a year, since last January.

“…Over the last week and a half, with Southern California experiencing considerably colder-than-normal weather, SoCalGas’s average net storage withdrawal has been 777 MMcf/d,” the firm said. “Every day within this period has seen a net withdrawal…This activity represents a significant contrast with previous winter-to-date storage behavior, when only about 66% of days featured net withdrawals, averaging 247 MMcf/d.”

SoCal Border Average jumped 49 cents to $2.89, while SoCal Citygate surged 69 cents to $3.39.

Further upstream, West Texas prices fell sharply as a force majeure event on El Paso Natural Gas (EPNG) pipeline’s Tom Mix compressor station in Arizona looked to have a greater impact than previously thought.

“Instead of a flow cut of about 25 MMcf/d under the initial operating capacity limit, there will now be about a 500 MMcf/d flow cut in place this Saturday and Sunday,” Genscape said. “…Flow through Tom Mix and its corresponding high pressure meter, Oracle, correlate with EPNG’s deliveries at the California border to SoCalGas and North Baja, so whatever flow cut ultimately occurs this weekend due to this force majeure could be felt downstream in deliveries to SoCalGas.”

El Paso Permian tumbled 17 cents to $1.93 Friday, while Waha fell 17 cents to $2.00.

Meanwhile, a Nor’easter bringing rain, snow and heavy winds to the Northeast and Mid-Atlantic Friday had a limited impact on spot prices.

On Friday, the National Weather Service said, “Strong winds, heavy rain and accumulating snow will continue across the Northeast and northern Mid-Atlantic states Friday evening, but then conditions should gradually improve as a powerful storm system pulls away from the coast Friday night.

“High pressure building in behind the exiting storm should keep much of the region dry through the weekend, with the exception of some light snow showers across the Lower Great Lakes and interior New England.”

Algonquin Citygate added 17 cents to $2.99, while Transco Zone 6 New York gave up 6 cents to $2.66.

On Friday, Genscape said the system, besides lacking extreme cold, presented downside risks from possible “demand destruction. The storm will feature fierce winds that will generate increases in wind power and may” cause power outages. The storm could also limit travel, reducing commercial demand.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |