Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Continental Sees Higher Production in Bakken and STACK, Earns $841.9 Million in 4Q

Continental Resources Inc. reported net income of $841.9 million in 4Q2017, which included more than $700 million in benefits from federal tax reform, as production surged in the North Dakota portion of the Bakken Shale and Oklahoma’s STACK (aka the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties).

The Oklahoma City-based independent produced 286,985 boe/d in 4Q2017 (59% of which was oil), a 36.8% increase from the year-ago quarter (209,861 boe/d). Full-year production rose 11.9%, to 242,637 boe/d in 2017 (57% oil), up from 216,912 boe/d in 2016.

Although production declined in most of the regions in which Continental operates, surging production in the North Dakota Bakken and STACK helped offset the losses. In the North Dakota Bakken, production was a record 158,640 boe/d, a 65.2% increase from 4Q2016 (96,035). For the year, the increase was 14.5%, reaching 125,577 boe/d in 2017, up from 109,686 boe/d in 2016.

Meanwhile, STACK production was 47,914 boe/d in 4Q2017, up 96.2% from the year-ago quarter (24,426 boe/d). For the year, STACK production more than doubled to 36,220 boe/d in 2017, up from 16,983 boe/d in 2016.

Continental brought 39 gross operated wells online in the Bakken in 4Q2017, with an average 24-hour initial production rate of 2,180 boe per well. Five Bakken wells had record 30-day production rates that averaged 2,230 boe/d.

Meanwhile, in the Springer Shale portion of the South Central Oklahoma Oil Province (SCOOP), the company said initial density testing was complete, and that full-field development would begin this year with an average of five rigs running over the course of the year. There are currently six rigs deployed in the Springer.

“Continental’s fourth quarter performance was a fitting completion to a standout year,” said CEO Harold Hamm. “As we made clear in our 2018 guidance announcement, we expect even stronger performance in 2018 with both significant production growth and robust free cash flow.”

Continental unveiled a $2.3 billion capital budget for 2018, all of which would be funded from internal cash flow. The company plans to spend $2 billion on drilling and completions, 78% of which would target the Bakken and Springer oil reservoirs. The rig count would remain flat at about 21 rigs.

During an earnings call Thursday, Continental President Jack Stark said the company plans to complete 305 gross operated wells in 2018. Of the 21 rigs, six would be focused on the Bakken and five would be deployed in the Springer. Another eight rigs would focus on the STACK, while the remaining two rigs would be deployed in the SCOOP, targeting the Woodford Shale. An average of 10 stimulation crews would remain active in 2018.

“This is a higher percentage of development than we have had in prior years,” Stark said. “It marks the beginning of what we believe is the first of many years of positive cash flow growth, as we begin to harvest more than two decades of high quality inventory and some of the best oil weighted reservoirs in the U.S. today.”

CFO John Hart added that the STACK “is going to bring huge growth in 2018.”

“We show STACK production volumes in 2018, compared to 2017, are going to grow 50-60%,” Hart said. “That’s a lot of growth. We’ve still got eight rigs in STACK. We are not pulling out of that. We are putting a little more into the Bakken [and] in the Springer because we’re focusing on the fairways that we’ve got there.”

The company said its production guidance for 2018 would be 285,000-300,000 boe/d, of which 57-60% would be oil. It projects to exit 2018 at a rate of 305,000-315,000 boe/d.

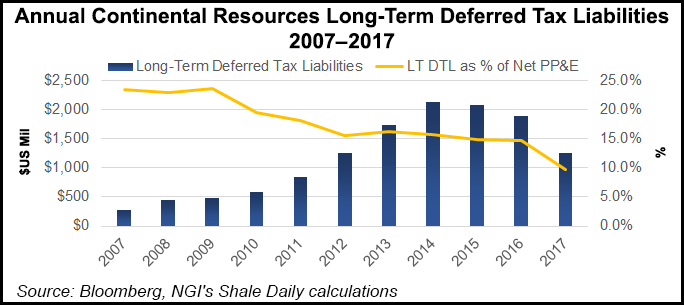

Continental reported net income of $841.9 million ($2.25/share) in 4Q2017, compared to net income of $27.7 million (seven cents) in the year-ago quarter. The company attributed $713.7 million of the net income to benefits from federal tax reform, while $128.2 million came from operations. For the full year, Continental reported net income of $789.4 million ($2.11) in 2017, compared to a net loss of $399.7 million (minus $1.08) in 2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |