Texas, Permian Lead Weekly Gains in BHI’s U.S. Rig Count

The United States added three rigs for the week ended Friday, including more gains in Texas and the Permian Basin, according to data from Baker Hughes Inc. (BHI).

U.S. drillers added two natural gas-directed rigs and one oil-directed unit to finish the week at 978 from 754 rigs running a year ago. In the last two weeks, rig tallies by BHI have shown small adjustments to the domestic count, but the United States has posted some big gains since the start of the year, including a 29-rig surge for the week ending Feb. 9, data from the oilfield services giant shows.

Three rigs were added on land for the week ending Friday, along with one in inland waters. The Gulf of Mexico saw one rig pack up to end the week at 17. Three horizontal units and two vertical units were added, while two directional rigs left the patch.

Canada, meanwhile, saw nine oil rigs depart along with three gas-directed units, ending the week at 306 active rigs versus 341 a year ago.

The combined North American tally as of Friday was 1,284, compared with 1,095 active rigs this time last year.

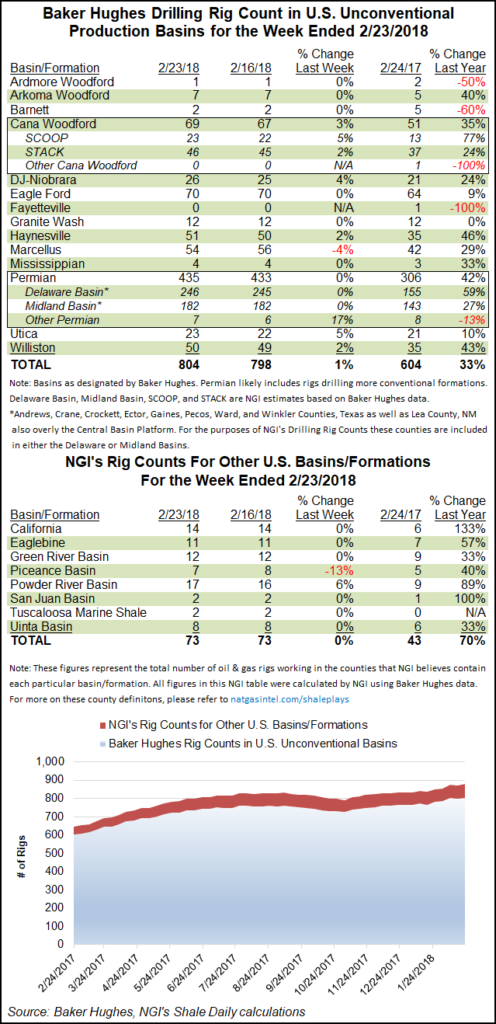

Among the major basins BHI tracks, the Permian added two units to grow its tally to 435 (306 a year ago), while the Cana Woodford also added two to end at 69 (51 a year ago). The Denver Julesburg-Niobrara and Williston basins, along with the Haynesville and Utica shales, each added one rig.

Meanwhile, the Marcellus Shale saw its tally slip by two to 54 units, still good enough to best its year-ago count of 42.

Among states, Oklahoma dropped two rigs for the week, while Pennsylvania, Kansas and West Virginia each dropped one. Gainers included Texas, which added three rigs, and New Mexico, which added two. Colorado, North Dakota, Ohio and Wyoming each added one rig.

For the week, the mighty Marcellus saw its lead as the most active gas-focused play cut in half, with the Haynesville nipping at its heels.

Amid production growth and expectations for gas-on-gas competition to drive infrastructure constraints and negative basis in markets across the country, the Haynesville’s close proximity to the Gulf Coast could provide a leg up.

Liquefied natural gas (LNG) player Tellurian Inc. during the week announced an open season for its Haynesville Global Access Pipeline (HGAP), a proposed 2 Bcf/d, 42-inch diameter gas pipeline to connect the Haynesville and Bossier shales to markets in southwestern Louisiana.

Tellurian CEO Meg Gentle said demand growth in the region is expected to triple to around 12 Bcf/d by 2025.

“Louisiana continues to serve as the U.S. natural gas market hub, requiring additional infrastructure to efficiently deliver gas from fields in the Northeast U.S., the Midwest and Texas to local and global markets,” Gentle said. “HGAP will improve the connection between North and Southwest Louisiana, debottlenecking existing pipeline routes and providing shippers access to expanding markets.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2158-8023 |