Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Cheniere LNG Exports Surge, with More Trains Underway

Cheniere Energy Inc. more than tripled liquefied natural gas (LNG) exports last year from its Sabine Pass export terminal in Cameron Parish, LA, while narrowing its annual losses and posting a more than four-fold increase in annual revenues.

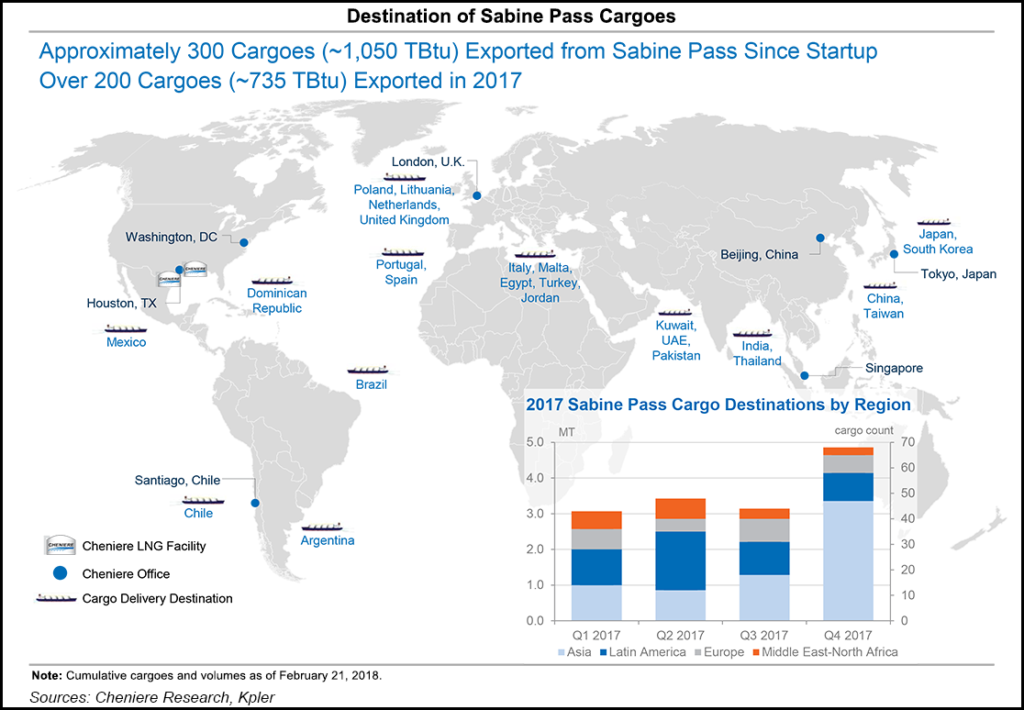

Houston-based Cheniere said Wednesday it exported 70 LNG cargoes totaling 252 trillion Btu from Sabine Pass in 4Q2017, compared with 23 cargoes (81 trillion Btu) exported in the year-ago quarter. For the full year, the company exported 205 cargoes (734 trillion Btu), versus 56 cargoes (195 TBtu) in 2016.

To date, Cheniere management said the company has exported about 300 cumulative LNG cargoes from Sabine Pass to 25 countries and regions worldwide.

Four trains are operational at Sabine Pass, with Train 4’s date of first commercial delivery (DFCD) scheduled for March. Meanwhile, Train 5 is under construction and should be substantially completed by the first half of 2019, with DFCD set for the second half of next year. Train 6 has been permitted, but it is not yet under construction.

DFCD for Train 4 was reached last June, after Cheniere and Korea Gas Corp. agreed to a 20-year sales and purchase agreement (SPA) for about 3.5 million metric tons/year (mmty) of LNG. Two months later, Cheniere reached DFCD for Train 2 with 20-year LNG SPAs with Gas Natural Fenosa LNG GOM Ltd. and BG Gulf Coast LNG LLC. DFCD under a 20-year SPA with GAIL (India) Ltd. related to Train 4 is expected to be reached next month.

Cheniere also advanced its plans to export LNG from a new terminal near Corpus Christi, TX, where Trains 1 and 2 are currently under construction while Train 3 has been permitted. The company expects Train 1 to be substantially complete and reach DFCD in the first half of 2019, while Train 2 is expected to be substantially complete in the second half of 2019 and reach DFCD in the first six months of 2020.

“With the commercialization of the trains substantially complete, we are now focused on completing the remaining steps necessary to make a final investment decision [FID] on Train 3 at Corpus Christi in the next several months,” CEO Jack Fusco said during an earnings call with analysts Wednesday. “I look forward to putting a check mark on the now famous to-do list on my white board next to ‘FID CC3,’ as I’m sure you all do as well.”

Later in the call, Fusco said Cheniere appears to have enough contracts to commercialize Train 3 at Corpus Christi.

“If you go out there, you’ll see that we’ve already started with the foundation work and some of the groundbreaking work,” he said. “There’s a lot of synergies with being able to transfer the workforce from Train 2 right over to Train 3.”

In addition, Train 6 at Sabine Pass “is shovel-ready,” he said. “There are still some crews there. It would be a logical next extension of Cheniere…So, if the market continues to grow the way it has been and demand in the product that we have, we’re very hopeful that we can launch right into having two trains’ FID.”

Asked to comment further on the complexities of developing two LNG terminals, Fusco said the intent is to create value for Cheniere shareholders.

“While the capital structure is complicated, it’s not going to hinder us from doing what’s right for the investor base,” Fusco said. “Again, we feel like at Sabine 6, just like at Corpus [train] 3, there is a lot of utilities, etc., that we’ve already invested in that would make that a very competitive train, and we want to capitalize on that and earn the maximum returns we can for our shareholder base. It’s not going to influence our decision-making of what entity that sits in.”

Earlier this month Cheniere signed two SPAs with PetroChina International Co. Ltd., a subsidiary of China National Petroleum Corp., for 1.2 mmty of LNG, a development that should help advance the Corpus Christi project. A portion of supply is scheduled to begin shipping later this year, with the balance beginning in 2023.

Cheniere also entered into a 15-year LNG SPA with Singapore-based Trafigura Pte Ltd. for about 1 mmty of LNG last month, with shipments to begin in 2019.

The company said it had $722 million in cash and cash equivalents at the end of 2017. Cheniere said it also had current and noncurrent restricted cash of $1.9 billion, $544 million of which it plans to spend on Sabine Pass and $227 million to develop the Corpus Christi terminal. Cheniere said $1.1 billion was for restricted purposes under the terms of Cheniere Energy Partners LP’s credit facilities, while $75 million was for other restricted purposes.

Cheniere reported net income of $127 million (54 cents/share) in 4Q2017, compared with year-ago profits of $110 million (48 cents). For the full year, net losses totaled $393 million (minus $1.68), versus a 2016 net loss of $610 million (minus $2.67). The company attributed increased income from operations as a result of additional trains in operation at Sabine Pass.

Total revenues were $1.75 billion in 4Q2017, more than triple the $572 million reported in the year-ago quarter. For the full year, Cheniere had total revenues of $5.6 billion, more than quadruple the $1.28 billion revenue in 2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |