Mexico’s CRE New Daily Reporting Rules for Natural Gas Marketers Take Effect in Late March

Traders in Mexico’s natural gas market have until the last week of March to comply with new daily reporting requirements that energy regulators implemented earlier this month.

The Comision Reguladora de Energia (CRE) on Feb. 8 published a decree in the federal gazette that revamps the rules for the daily transaction report that all gas marketers in Mexico must file with the regulator. The decree, which entered into force the day after its publication, includes a grace period for participants to become compliant.

“Marketers have 30 business days to start filing information in line with the changes made to the daily report,” a CRE spokesperson told NGI’s Mexico GPI.

The CRE expects the changes to ease administrative and regulatory burdens for Mexican gas marketers, which have been required to submit daily reports since the end of 2016. The decree eliminated several variables from the report, such as the marketing margin and the storage, distribution and transportation costs for each trade.

Under the simplified rules, marketers would only have to report a final transaction price, consisting of the price per molecule plus delivery costs, along with a handful of other variables, including volume, type of buyer, start and end flow dates, delivery point and transaction type (sale or purchase).

Moreover, prices may be reported in the currency used for each trade, and companies would only need to file a daily report on days when there is trading activity.

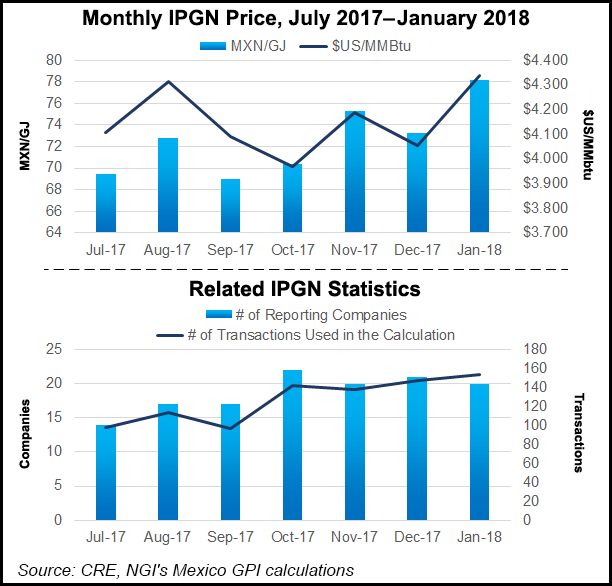

The CRE aims to use the updated daily reports to produce a new set of forward-looking price indexes. Currently, the regulator publishes a sole national price index, known as the IPGN, showing an average price of all trades billed in Mexico during the prior month.

The IPGN is based on data captured from post-transaction reports that gas marketers are also required to file each month.

Most transactions in the Mexican natural gas market are scheduled on a month-to-month basis, with very little daily trading activity at present.

“As the transactions reported by marketers increase, the CRE will publish indexes with different periodicities and that are broken down by region,” the spokesperson said.

The decree published earlier this month includes methodologies for calculating daily indexes that would show the average price of all trades scheduled for next-day flow, as well as monthly indexes of trades with flow dates on the following month.

The daily indexes would be released after 6:30 p.m. Central Mexico time on the first business day after the trades are reported, and the monthly indexes after 9:00 a.m. on the first business day of the next month, according to the text of the decree.

CRE is currently working on additional rules for the publication of regional gas price indexes, according to the spokesperson. “With the publications of these new regulations, we will reveal which regions are to have a local index. Initially, we will publish an IPGN” in those regions.

CRE officials have previously said the regulator expects to cease publishing its indexes once the market develops its own.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |