Natural Gas Futures Bounce Amid Lean Storage, Colder Forecasts; SoCal Blowout Continues

Natural gas futures gained for a second straight trading day Wednesday as forecasters continued calling for cold to spread into the East in early March. In the spot market, SoCal Citygate’s basis blowout stretched into a second day as other western points moderated from Tuesday’s gains; the NGI National Spot Gas Average added 2 cents to $2.80/MMBtu.

The March contract added 4.3 cents to settle at $2.659 Wednesday, building on Tuesday’s 5.8 cent increase, a rally that comes as momentum indicators have been pointing to oversold conditions. April settled at $2.681 Wednesday, up 3.2 cents.

A ridge that has kept cold temperatures from pushing into the East should start to weaken by late next week, according to NatGasWeather.com.

“The data has been notably colder trending with this since early in the week,” and midday the Global Forecast System trended colder for after March 4, the firm said. “This should result in a return to stronger-than-normal national demand, lasting into the second week of March. But the data is mixed if reinforcing cold can continue into the East March 11-14,” which would likely be “required if a sustained rally is to be expected.”

The afternoon European model run “was a little milder trending in the first 10 days of March,” NatGasWeather said. “It still brings colder air across the east-central U.S. for stronger-than-normal demand, just not quite as impressive this round. If the models back off on the arrival of cold or intensity much further, the markets are sure to notice.”

The market is in forward carry mode, and that could have some traders looking to start injecting into storage as inventories track below recent norms, INTL FCStone Financial Inc. Senior Vice President Tom Saal told NGI.

“When people say the market’s rallying because of the weather, I really don’t see the weather as the reason,” he said. “If you ask me, March is the cheapest gas around, so that’s one reason why it’s being bought. Some people may be getting a little bit of a head start on the injection season.

“…We’re going to be below last year’s level by quite a bit, so that should create a little bit of anxiety, because last year the injections were below average,” Saal added. “…If you take a rubber ball and hold it up a foot above the table and drop it, it’s going to bounce. So this is a bounce…I’m not surprised we’re rallying given the amount of gas that’s been pulled out and the amount we’ve got to put back in.”

The most recent Commitment of Traders report shows hedgers holding net short positions, and that could mean “some more buying maybe coming around the corner” as they cover those positions ahead of next week’s expiration, Saal said.

Thursday’s Energy Information Administration (EIA) storage report is expected to show a larger withdrawal than a year ago, but looser versus the five-year average.

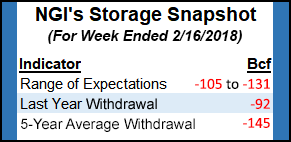

A Reuters survey of traders and analysts predicted on average a 120 Bcf withdrawal for the week ending Feb. 16, versus 92 Bcf withdrawn last year and a five-year average pull of 145 Bcf. Responses ranged from -105 Bcf to -129 Bcf. A Bloomberg survey showed a median -121 Bcf, with responses ranging from -116 Bcf to -131 Bcf.

Last week, EIA reported a 194 Bcf withdrawal for the week ending Feb. 9.

PointLogic Energy predicted a withdrawal of 120 Bcf, attributing the smaller withdrawal week/week “to warmer weather in the East and Midwest regions.

“…While the overall winter has been relatively close to normal, periods of extreme cold have forced heavier reliance on storage withdrawals,” the firm told clients this week. “PointLogic Energy/IHS Markit currently expects storage inventories to end March at approximately 1.4 Tcf, or 0.3 Tcf below the prior five-year average.”

Kyle Cooper of ION Energy predicted a 116 Bcf pull, while Intercontinental Exchange futures for Thursday’s storage report settled at -120 Bcf Tuesday after trading at -125 Bcf on Monday.

Tuesday’s spot price blowout at SoCal Citygate continued Wednesday as estimates showed demand remaining elevated in Southern California through the end of the work week.

SoCal Citygate fell 66 cents but held onto the lion’s share of the prior day’s $15 pop, finishing at $18.92. Wednesday’s range was higher day/day at $15.00-28.00 versus $12.00-25.00 Tuesday.

“The surge in spot prices can be pinned on a burst of weather-related demand on Southern California Gas Co.’s (SoCalGas) often-constrained system at the same time that temperatures are forecast to be in the 40s this week in Los Angeles,” about 13 degrees below average, PointLogic Energy analyst Alan Lammey told clients Wednesday.

“The more northern locations of the Pacific coast, such as Portland, OR, were placed under their first winter storm warning of the 2017/18 season, as up to 6 inches of snow are in the forecast,” Lammey said. “Daytime highs are expected to reach the mid-30s and wind-chills in the teens.”

SoCalGas was forecasting total system demand of just under 4 Bcf/d for Thursday and Friday.

System-wide sendout has exceeded 3.9 Bcf/d this week for the first time in more than a year, according to Genscape Inc.

“The last time demand was this high, in late January 2017, SoCalGas resorted to emergency withdrawals from Aliso Canyon,” Genscape said. This is also the first time demand has risen to this level following “the unplanned L235-2 remediation event” that “went into effect at the beginning of October 2017, which is still limiting SoCalGas’s two Needles receipt points by over 500 MMcf/d.”

The ongoing import constraints mean SoCalGas is now relying more on storage even as total demand is similar to the cold snap last January, according to the firm.

“For example, when demand averaged 3.96 Bcf/d for four days in January 2017, SoCal’s system-wide receipts averaged 3.03 Bcf/d. That left 930 MMcf/d that needed to be made up via storage withdrawals,” Genscape said. “But with demand at 3.82 Bcf/d over the past three days, receipts have only come in at 2.64 Bcf/d, necessitating an average withdrawal of 1.18 Bcf/d.”

And the current supply/demand dynamics could linger, based on forecasts.

“Genscape meteorologists are forecasting a prolonged cold snap for Southern California, with temperatures currently expected to remain well below seasonal norms for the next two weeks,” the firm said. “SoCalGas entered this cold snap with ample storage reserves relative to this time last year, but it will need to draw on those reserves in order to continue to meet this elevated demand.”

SoCal Border Average tacked on 10 cents Wednesday to $4.26. Elsewhere in the region, El Paso S. Mainline/N. Baja remained elevated, averaging $5.08 after dropping 25 cents on the day, while Kern Delivery added 83 cents to $5.40.

As weather maps continued to show below-normal temperatures blanketing much of the western half of the Lower 48, a number of western points moderated Wednesday after posting strong gains Tuesday.

In the Rockies, Opal fell 11 cents to $3.01, while Kingsgate dropped 17 cents to average $2.93.

Rockies production has dropped off this week, possibly due to freeze-offs, which could be putting more upward pressure on West Coast basis, according to Genscape.

Genscape subsidiary “Spring Rock’s daily pipe production estimate has Rockies production down 0.3 Bcf/d from the month-to-date average,” the firm said. “The Rockies decline, combined with about 0.18 Bcf/d of declines out of the Northeast, has dragged total Lower 48 production below the 76 Bcf/d mark, with the estimate for the last two days around 75.9 Bcf/d, about 0.5 Bcf/d below the month-to-date average.”

According to Genscape, the declines in the Rockies have been focused in the Green River and Piceance basins.

“It is very possible they are being driven by a new round of freeze-offs,” the firm said. “Daytime highs along Colorado’s Western Slope had been in the mid-60s Sunday, then quickly plummeted to freezing by Monday, with nighttime lows dropping into the single digits.

“Opal-area processing volumes are running about 60 MMcf/d below month-to-date. Processed volumes deliveries are being diverted nearly one-to-one from Rockies Express Pipeline/Overthrust over to Kern, presumably to capture the premiums available by shipping gas to SoCalGas,” Genscape said. “However, deliveries to Ruby are down 139 MMcf/d day/day and about 76 MMcf/d off the month-to-date average and do not appear to have been redirected to other lines out of the hub.”

Over in the Northeast, points posted big day/day gains as temperatures were expected to cool off following unseasonably mild conditions.

According to AccuWeather, highs in Boston reached 73 Wednesday, about 33 degrees warmer than normal. The forecaster was calling for temperatures there to drop into the 30s and 40s on Thursday. Highs in New York reached 77 Wednesday but were expected to drop into the 40s on Thursday.

Algonquin Citygate jumped 64 cents to $2.94, while Transco Zone 6 New York added 19 cents to $2.71. Further upstream in Appalachia, Dominion South tacked on 16 cents to $2.17.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |