SoCal Citygate Reaches Four-Year High as West Coast Natural Gas Spot Prices Surge

Colder-than-normal temperatures drove big natural gas spot price gains in the West on Tuesday, including a four-year high at SoCal Citygate. Gains across California and the Rockies offset declines in the warm Northeast to lift the NGI National Spot Gas Average 37 cents to $2.78/MMBtu.

Futures also finished higher on the day, helped by colder trends in the weather models for early March. The March contract settled at $2.616 Tuesday, up 5.8 cents, while April settled 5.1 cents higher at $2.649.

Bespoke Weather Services said afternoon guidance from the European model yielded more gas-weighted degree days in the firm’s outlook Tuesday, focused around the first week of March.

“We see cold risks lingering into the second week of March too, ensuring that model runs through the week should continue to print out a favorable long-range pattern,” Bespoke said. “Cold does not look extreme at this time, but it should be enough to increase demand from the Midwest into the South and much of the East, with a nationwide tick up in heating demand enough to deplete stockpiles further than traders were expecting last week.”

NatGasWeather.com said the market’s focused on “when the eastern U.S. ridge that sets up this week will finally” break down to allow more cold into the East.

“Both the Global Forecast System and European weather models see this occurring the first week of March and trended cooler Monday afternoon and Monday night, favoring the strong upper ridge weakening as a cold trough becomes established,” NatGasWeather said. “We see the markets higher based on this, but it’s very important colder air looks convincing into the East during early March or the markets are likely to be quite disappointed if any milder trends were to occur.”

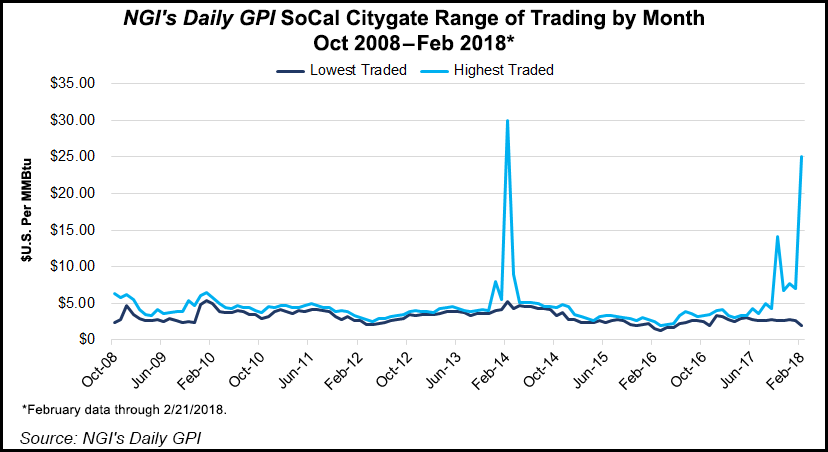

Meanwhile, spot prices at SoCal Citygate traded as high as $25/MMBtu Tuesday, setting a four-year high as colder-than-normal temperatures drove up demand on utility Southern California Gas Co.’s (SoCalGas) imported-constrained system.

Day-ahead deliveries at SoCal Citygate spiked more than $15 to average $19.58, with a range of $12.00-25.00. SoCal Border Average gained $1.79 to $4.16.

Tuesday’s high is the most expensive day-ahead trade at SoCal Citygate since Feb. 5, 2014, when prices traded as high as $30, Daily GPI historical data show.

The Los Angeles basin is expected to see temperatures around 10-12 degrees below seasonal norms through the end of the week, Genscape Inc. said in a note to clients Tuesday. Amid the unusually cold temperatures, SoCalGas system demand has risen above 3.7 Bcf/d, “its highest level this winter-to-date and the highest single-day since mid-January 2017,” according to Genscape.

Genscape analyst Joseph Bernardi further noted to NGI that SoCalGas is reporting daily storage withdrawals exceeding the 1 Bcf/d mark this week, “also for the first time in over a year.”

On Tuesday SoCalGas was projecting system demand to remain between 3.6-4 Bcf/d through the end of the work week, with daily receipts topping out at a little more than 2.7 Bcf/d.

“Import zone capacities continue running near max capacity, with less than 10% capacity available in the Northern Zone and less than 20% available in the Southern Zone,” Genscape said.

SoCalGas and San Diego Gas & Electric jointly declared a system-wide curtailment for electric generation customers starting Tuesday “due to forecasted low temperatures and expected high customer demand.

“…System conditions remain dynamic and are subject to change,” the utilities said. “Until further notice, a system-wide curtailment watch will be in effect for all other noncore customers. Customers are advised that they may be receiving a notice to curtail service.”

SoCal Citygate has been no stranger to price spikes in recent months. In late October, SoCal Citygate jumped $9 day/day to more than $12 amid higher demand and a combination of planned and unplanned pipeline outages. The point remained volatile — and traded at an elevated basis — for weeks afterwards.

Meanwhile, Southern California had competition from other markets Tuesday as colder temperatures were expected lift demand across the West.

Genscape said it expected upward pressure on spot prices in western markets this week because of cold weather and pipeline constraints. The Bay Area is expected to see temperatures around 8-10 degrees below normal through the end of the week, raising demand on PG&E’s system to a year-to-date high of more than 3.3 Bcf/d, according to Genscape.

PG&E Citygate jumped 56 cents to $3.27, while Malin added 72 cents to $3.18.

“The pattern this winter has seen western markets sustaining colder-than-normal temperatures, while the rest of the U.S. generally has run above normal with sporadic but sharp swings to cold,” Genscape said. “That trend continues this week as the bulk of the country east of the Rockies enters a warm period while western markets remain locked in cold.

“Pacific Northwest market demand is also up, nominated to 2.815 Bcf/d, the highest since the start of January. This has enabled Sumas basis back into positive territory,” Genscape said, adding that the demand has led to operational flow orders (OFO), including on the GTN, Tuscarora and SoCalGas systems.

“TransWestern has posted numerous operational flexibility warnings,” the firm said. “In addition, as an indication of the strain on Rockies pipes, OFOs have been declared on Rockies eastbound pipes CIG and Tallgrass.”

The Rockies regional average jumped 68 cents Tuesday to $3.01. Opal added 74 cents to average $3.12, while Kingsgate surged 67 cents to $3.10. Further upstream, West Texas prices saw big gains as well, including Transwestern, which added 56 cents to $2.49.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9966 |