Eagle Ford Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Noble Energy Delivers in 4Q, Hints of New ‘Material Exploration Focus’

Lifted by gains in the U.S. onshore and an overseas natural gas prize, Noble Energy Inc. last year increased its proved reserves by 37%, the Houston super independent said Tuesday.

Total proved reserves rose to nearly 2 billion boe net, an increase of 528 million boe from 2016.

Organic reserve additions, including extensions, discoveries, performance and price revisions, totaled 871 million boe and were added at a cost of about $2.90/boe, representing 6.3 times 2017 output.

CEO Dave Stover and operations chief Gary Willingham discussed full-year and fourth quarter results during a conference call. The U.S. focus now is on the Denver-Julesburg (DJ) and Permian basins and the Eagle Ford Shale. Overseas, growth is keyed to the massive Leviathan natural gas project, sanctioned last year for development offshore Israel, as well as in West Africa.

“For Noble Energy, 2017 was a transformative year, as we repositioned our portfolio and executed on our strategy to drive capital efficiency in our high-margin, high-return basins,” Stover said. “We significantly advanced the development of our U.S. onshore assets as we reduced drilling costs and enhanced well productivity, while materially increasing the scale of our Texas operations.

“In addition, the value of our midstream business expanded through the build-out of multiple facilities to support the company’s future upstream production plans.”

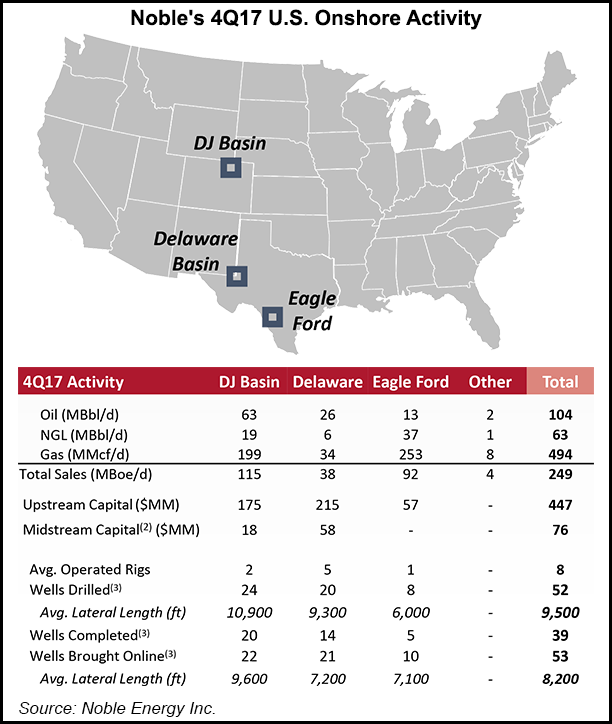

Noble’s U.S. onshore volumes in 4Q2017 climbed by 40% year/year, averaging 249,000 boe/d, with record volumes from the Eagle Ford and the Permian’s Delaware sub-basin.

Onshore oil volumes totaled a record 104,000 b/d, about 40% higher from 1Q2017. Texas volumes were reduced by about 7,000 boe/d in the final quarter because of winter storms and third-party facility impacts.

DJ output rose 3% year/year to average 115,000 boe/d, with strong performance in the Wells Ranch and East Pony areas. DJ oil volumes were up 5% from 4Q2016 to 63,000 b/d, which was 55% of total basin production.

Texas volumes from the Eagle Ford and Permian Delaware increased year/year by more than 75,000 boe/d. Eagle Ford output doubled from a year earlier to average 92,000 boe/d, while Delaware production was 38,000 boe/d, nearly four times higher from 4Q2016. Volumes in Texas during 4Q2017 fell by about 7,000 boe/d from winter storms and third-party facility impacts.

Noble averaged eight operated drilling rigs during the fourth quarter in the onshore, with two in the DJ, five in the Delaware and one in the Eagle Ford. It also had two completion crews working the DJ and two in the Delaware.

Operated wells brought online in 4Q2017 included 22 in the DJ, 10 in the Eagle Ford and 21 in the Delaware.

Globally, Noble’s volumes totaled 380,000 boe/d in 4Q2017, up nearly 50,000 boe/d year/year and 25% higher sequentially. Full-year sales volumes rose 7% from 2016 to 381,000 boe/d.

A ”Material’ Play In Offing?

Stover spent time detailing Noble’s strategy from now to 2020, when the company expects to generate $1.5-2 billion/year in free cash flow. He also hinted that the company “would certainly envision investing in additional projects” and said later, “I look forward to being able to announce another material exploration focus area this year.”

For the future, “there’s no doubt that oil and gas will continue to be a dominant energy source, playing a vital role in the global quality of life for decades to come,” the CEO said. “Noble’s demonstrated excellence in onshore and offshore operations, along with our exploration and major project capabilities, position us to be a long-term winner.”

To be successful long-term as an exploration and production company, “we believe a company needs to be able to thrive in a $50/bbl world while remaining flexible to take advantage of fluctuations in commodity prices. Our outlook provides that.

“We also believe a sustainable company needs to be able to successfully manage geographic and commodity risk. Our portfolio is designed with multiple high-return investment options in low-cost high-margin areas, minimizing the potential impact from those risks and providing a clear line of sight into the next decade.”

Noble has sold off huge pieces of its portfolio in the past few years, withdrawing from some active onshore areas and last week agreeing to part with its Gulf of Mexico portfolio.

“The sale of our Gulf of Mexico assets is the last major step in focusing our portfolio to deliver our plan,” Stover said. “It also enables us to ensure our exploration teams are focused on the areas that can be very material to Noble, with running room based on success.”

About 80% of the estimated $579 million spent for capital projects in 2017 was deployed to the U.S. onshore, with 17% spent for Leviathan. The company plans to spend a total of around $2.8 billion a year through 2020, about 6% more than it spent in 2017.

Noble has about 6,500 potential drilling locations with strong rates of return, which should result in the business generating $900 million of free cash flow (FCF) over the next three years at a $50/bbl oil price, said Willingham.

“In 2020 our onshore business should grow to a total of 400,000 boe/d,” Willingham said. “The growth engine is the Delaware Basin. With its exceptional economics and large inventory, the Delaware will deliver substantial growth every year over the plan and is the leading contributor to Noble’s oil growth.”

In the DJ, the key going forward is to drive more capital efficiency by enhancing well completions, he said. Growth in the DJ is expected accelerate beginning in 2019. Following rapid growth in the Eagle Ford last year, production is set to remain flat through 2020.

“Combined, this plan delivers very competitive growth for our onshore business, with volumes growing at a compound annual rate of 25% over the next three years, and oil growing even faster at 31%,” Willingham said.

Onshore Volumes Rising

Onshore volumes from U.S. targets overall are projected to increase 20% from 2017, excluding divestments, on “flat capital,” he said.

“The momentum that we are generating in the Delaware, along with the return to growth in the DJ, position our onshore business to deliver approximately 25% growth in 2019 over 2018. Continued onshore growth, along with a full year of Leviathan volumes, provide over 30% growth for the total company from 2019 into 2020.”

Organic replacement ratio in 2017 was about 625%, while reserves bookings improved in all three U.S. onshore business units. Reserves life increased to more than 10 years for the onshore business and 14 years-plus for the total company.

U.S. proved reserves totaled 940 million boe at the end of 2017, which on paper was down from 976 million boe at the end of 2016. However, Noble’s divestitures reduced U.S. reserves by 261 million boe and it lost 99 million in output from the sales. Last year’s extensives/discoveries added 185 million boe, with another 57 million boe increased by acquisitions.

The composition of reserves at the end of 2017 was about 50% international natural gas, 15% U.S. natural gas and 35% liquids.

Net income totaled $494 million ($1.01/share) in 4Q2017, versus a year-ago loss of $252 million (minus 59 cents). Excluding one-time items, Noble earned around 32 cents/share in 4Q2017, compared to Wall Street estimates that on average had forecast earnings of 4 cents/share. Revenue soared 19% to $1.2 billion in the final period of 2017.

Full-year 2017 net losses totaled $1.118 billion (minus $2.38/share), compared with 2016 net losses of $998 million (minus $2.32).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |