NatGas Futures Consolidating Amid Bearish Weather Outlook; SoCal Leads Weekly Spot Gains

Natural gas futures slid yet again during the week ended Friday as a lack of any impressive heating demand had the market looking past winter into the shoulder season. This set the tone for a cash market that showed signs of shedding its winter skin; the NGI Weekly Spot Gas Average dropped 29 cents to $2.46.

Points out West posted the only consistent weekly gains, led by SoCal Citygate, which ran up $1.35 to average $3.94 for the week.

Genscape Inc. noted some colder than normal temperatures in the region during the week, as well as a couple maintenance events that stood to curtail flows into utility Southern California Gas Co.’s already import-constrained market.

Elsewhere in California, Malin added 22 cents to $2.37, while SoCal Border Average added 17 cents to $2.39.

Rockies prices climbed week/week as well as forecasters on Friday were calling for chilly temperatures to move into the Northwest and Plains. Kingsgate finished 41 cents higher week/week at $2.21. CIG gained 19 cents to $2.29.

Most everywhere else, prices fell, especially in the Northeast, where Algonquin Citygate tumbled $3.58 to $3.12. Despite a few cold spells in the region, periods of weak demand helped Algonquin Citygate set a new three-month low during the week.

In the futures, the March contract dropped 2.2 cents to settle at $2.558 Friday after trading as high as $2.589 and as low as $2.539 — a tight range that characterized a week of small day/day adjustments and no sustained momentum in either direction. March ended the week about 3 cents lower than the week before, when the prompt-month settled at $2.584 on Feb. 9.

Technical indicators Friday were pointing to an oversold market, Powerhouse President Elaine Levin told NGI.

“Typically when you’re oversold, it gives you a corrective bounce, or it can give you consolidation. So far it looks like we’re getting the latter,” she said. “Nobody’s really coming in and buying it, but we’re not seeing a huge push from the shorts either.”

That the March contract has been trading at a discount to April “is not a huge vote of confidence for the bulls’ side,” Levin added. “I think this market still overall looks more bearish than not. It’s just taking a break. We’ll have to see if any forecasts for cold weather can breathe a little life into the March contract. A lot can happen between now and the end of the contract” in terms of the March/April spread.

NatGasWeather.com said the burden falls to the weather models to convince the market that “meaningful cold” could make its way into the East during the remaining weeks of winter, which the midday data didn’t see happening “until at least March 2-3.

“For a sustained rally, obviously much colder temperatures over the eastern half of the country are going to be needed,” the firm said Friday. “Right now the data is quite warm and bearish, thus likely not able to trend much warmer than it already is, making the risk to the cooler side this weekend. But even if there are some cooler trends, is it really going to be cold enough to intimidate this market?”

Bespoke Weather Services said the models Friday were still depicting a pattern in the North Atlantic Oscillation into early March that could “help to return heating demand closer to average through the first week” of the month.

“The result will likely be a rather small change in gas-weighted degree day forecasts come Tuesday, though the long-range forecast should feature marginally more cold risks.”

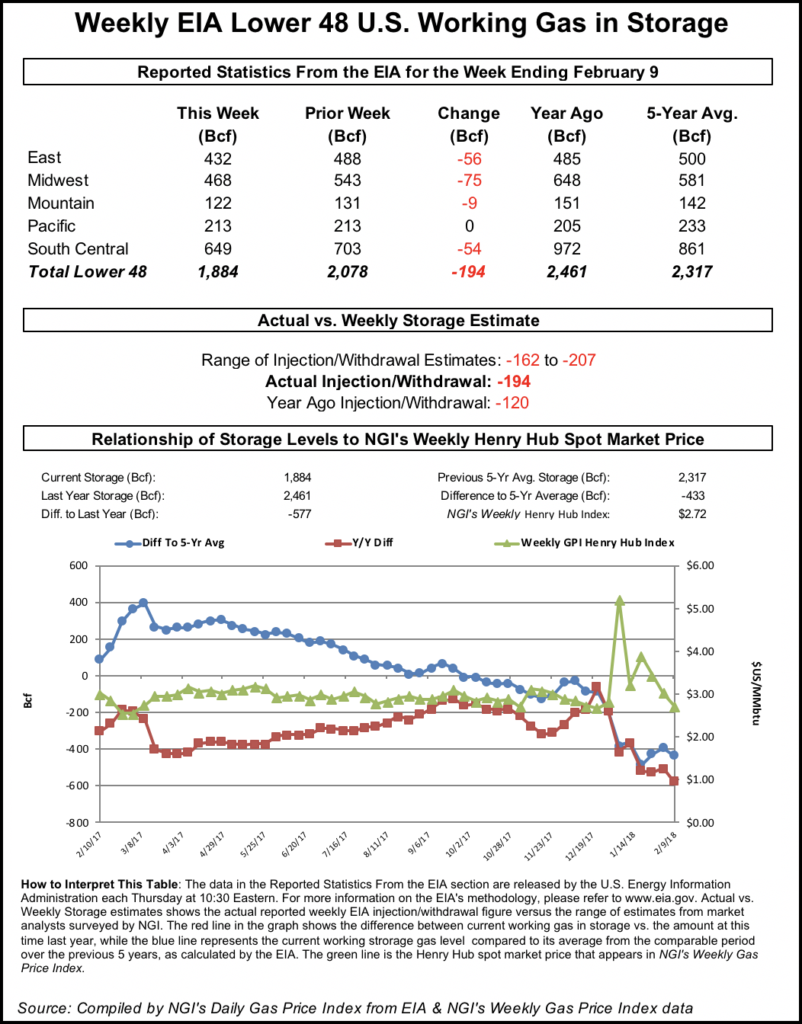

The Energy Information Administration (EIA) reported a net withdrawal of 194 Bcf from storage for the week ending Feb. 9, about 10 Bcf more than consensus estimates. Last year, 120 Bcf was withdrawn for the week, and the five-year average pull for the period is 154 Bcf.

In the minutes following the 10:30 a.m. EDT release, futures inched higher, with the March contract trading as high as $2.605 after hovering in the $2.555-2.565 earlier in the morning. By 11 a.m. EDT, March was trading around $2.583, near even with Wednesday’s settle.

Prior to Thursday’s report, the market had been looking for a withdrawal somewhat smaller than the actual figure.

A Reuters survey of traders and analysts on average had estimated a 183 Bcf withdrawal, with responses ranging from -162 Bcf to -207 Bcf. Stephen Smith Energy Associates had estimated a withdrawal of 183 Bcf, while PointLogic Energy had called for a withdrawal of 179 Bcf.

Kyle Cooper of ION Energy had estimated a withdrawal of 186 Bcf. Intercontinental Exchange futures for this week’s EIA report settled at -187 Bcf Wednesday.

“We see this print as very tight on a historical basis, as it is quite tight for similar gas weeks and even tight on a 10-week average basis,” Bespoke Weather Services said following the release of the final figure. “We see market tightness as at least temporarily counteracting bearish weather revisions overnight, with prices bouncing off the data release as expected.

“Production levels do remain elevated, and we will need more impressive weather to move up into the $2.70-2.75 level, meaning a rally above $2.62 may be ”fade-able’ for now, but it is clear that market tightness is putting in a floor for prices right around the $2.55 level.”

Total working gas in underground storage as of Feb. 9 stood at 1,884 Bcf, versus 2,461 Bcf a year ago and five-year average inventories of 2,317 Bcf, according to EIA. The current year-on-year deficit increased for the week from -503 Bcf to -577 Bcf, while the year-on-five-year deficit increased from -393 Bcf to -433 Bcf, EIA data show.

Analysts with Wells Fargo Securities LLC said they’re forecasting a cumulative withdrawal of 158 Bcf over the next two weeks based on their model and government weather data.

By region, the largest withdrawals came in the Midwest (-75 Bcf) and the East (-56 Bcf). The South Central saw a withdrawal of 54 Bcf, including 46 Bcf pulled from nonsalt and 6 Bcf pulled from salt. In the Mountain region, 9 Bcf was withdrawn, while the Pacific finished flat for the week.

“Though the market looks to be roughly 2-3 Bcf/d undersupplied” on a weather-adjusted basis after the report, “stagnant supply/demand fundamentals going forward haven’t been enough to support the commodity,” said analysts with Tudor, Pickering, Holt & Co. Friday.

“Supply levels are champing at the bit and early withdrawal estimates are about 20% higher than norms for next week,” said analysts. There’s also “no promise of a late February cold snap on eight- to 14-day forecasts.” These factors are “still stacking against any remaining chance of a late winter gas rally.”

The spot market was mixed Friday ahead of the long weekend, featuring large declines in the Northeast and a big increase in Southern California amid new import restrictions; the NGI National Spot Gas Average gave up 4 cents to $2.41/MMBtu.

In the near-term, while a cold front was expected to push through the Great Lakes and into the East on Friday and Saturday, “high pressure will rapidly strengthen” in the week ahead “over the South and East with highs warming into the mid-50s and 60s into the Northeast, with 70s and 80s over the southern U.S. and up the Mid-Atlantic coast,” NatGasWeather said.

“We are still expecting strong bouts of cooling into the West Coast and Plains next week and through the end of the month for regionally strong demand, but what remains the focus is when the eastern U.S. ridge that sets up next week will finally weaken.”

In the West, Kingsgate jumped 28 cents to $2.43 Friday, while in California Malin added 13 cents to $2.46.

Further south, SoCal Citygate continued its recent volatility, jumping 99 cents to $4.57. SoCal Border Average added 7 cents to $2.37.

Utility Southern California Gas Co. (SoCalGas) late Thursday announced new, unplanned maintenance is expected to cut about 250 MMcf/d of import capacity through its Needles points from Friday through Sunday, according to Genscape Inc.

“These points were limited to zero for a similar unplanned maintenance event Jan. 17-24,” Genscape said. “…To help compensate for the cut to Needles flows during that event, SoCalGas posted higher receipts from Kern at Kramer Junction.”

Forecasts on Friday showed moderate demand expected through the weekend, with SoCalGas projecting demand of around 2.4-2.6 Bcf/d through the weekend, the firm noted. “Genscape meteorologists are currently forecasting a significant cold snap to move in beginning Monday, however, meaning that if this maintenance is extended beyond the initially stated end date prices could spike further as SoCalGas seeks to meet increasing demand.”

During the previous maintenance at Needles, SoCalGas saw demand total around 2.5-2.7 Bcf/d, according to Genscape.

“Prices posted modest gains but did not exceed the previous two-week maximum, and even when demand crested at 3.2 Bcf/d later during that event, the movement on SoCal Citygate and Border basis prices was not significantly different from a previous cold snap when Needles was not restricted,” Genscape said. “That said, SoCalGas did rely on storage withdrawals much more heavily without Needles, posting an average 282 MMcf/d withdrawal during that event compared with no average withdrawals in the previous cold snap.

“System-wide storage inventory is currently 15.5 Bcf higher year/year, largely due to boosted Aliso Canyon levels, so SoCalGas has a healthy amount of storage to rely on if needed.”

Prices retreated in West Texas, especially Transwestern, which gave up 16 cents to $1.93. Waha dropped 7 cents to $2.01.

Analysts with Jefferies LLC have been tracking widening basis differentials at Waha, where they noted forward prices trading around $1.30 less than Henry Hub futures for Summer 2019. The analysts also pointed to fourth quarter financial results from Cimarex Energy Co., “one of the more gas-leveraged” Permian Basin operators.

The producer’s hedging disclosure, released as part of its 4Q2017 earnings, revealed that it “had added 3Q2019 hedges at El Paso Permian with a floor/ceiling of $1.65/1.80, giving some insight into Cimarex’s view of future local gas pricing,” the Jefferies team noted.

Booming growth in U.S. natural gas production — around 7 Bcf/d year/year — “coupled with large Northeast pipeline projects coming into service has started to shake up natural gas basis markets across many parts of the country,” analysts with East Daley Capital said in a note Friday.

“In fact, when you map out basis across the country so far this year, you will note that roughly three quarters of the country is severely under water,” the East Daley analysts wrote. While this negatively impacts producers, it also “presents an opportunity for midstream providers looking to secure new contract commitments.”

The firm pointed to Waha and Western Oklahoma, where “basis declines have already led to two new large-scale pipeline projects reaching final investment decision status” in the Gulf Coast Express and the Midship pipelines.

East Daley expects “widespread basis pressure in most regions outside the Southeast” and Gulf Coast “over the next few years as increasing production struggles to find the right balance…This pressure will create opportunities for some long-haul pipelines to expand, reverse or build greenfield to relieve the pressure and get more gas into the Southeast.”

With demand not expected to linger through the holiday weekend, New England prices fell Friday. Genscape Inc. was calling for regional demand to fall from 3.5 Bcf/d Friday to 2.69 Bcf/d by Monday and 2.17 Bcf/d Tuesday.

Algonquin Citygate fell 40 cents to $2.63, while Iroquois Waddington gave up 8 cents to $2.53.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |