Markets | NGI All News Access | NGI Data

Natural Gas Futures Finish Near Even Again Despite Bullish Storage Stats

Natural gas futures moved less than a penny for the second straight day Thursday as a bullish government storage report couldn’t overcome lackluster winter weather and rising production. In the spot market, a few Northeast points rallied as SoCal Citygate eased off recent gains; the NGI National Spot Gas Average added 5 cents to $2.45/MMBtu.

The March contract went as high as $2.623 and as low as $2.530 before settling at $2.580, down 0.7 cents. That matches the 0.7-cent decline recorded on Wednesday. April settled at $2.620 Thursday, down a penny.

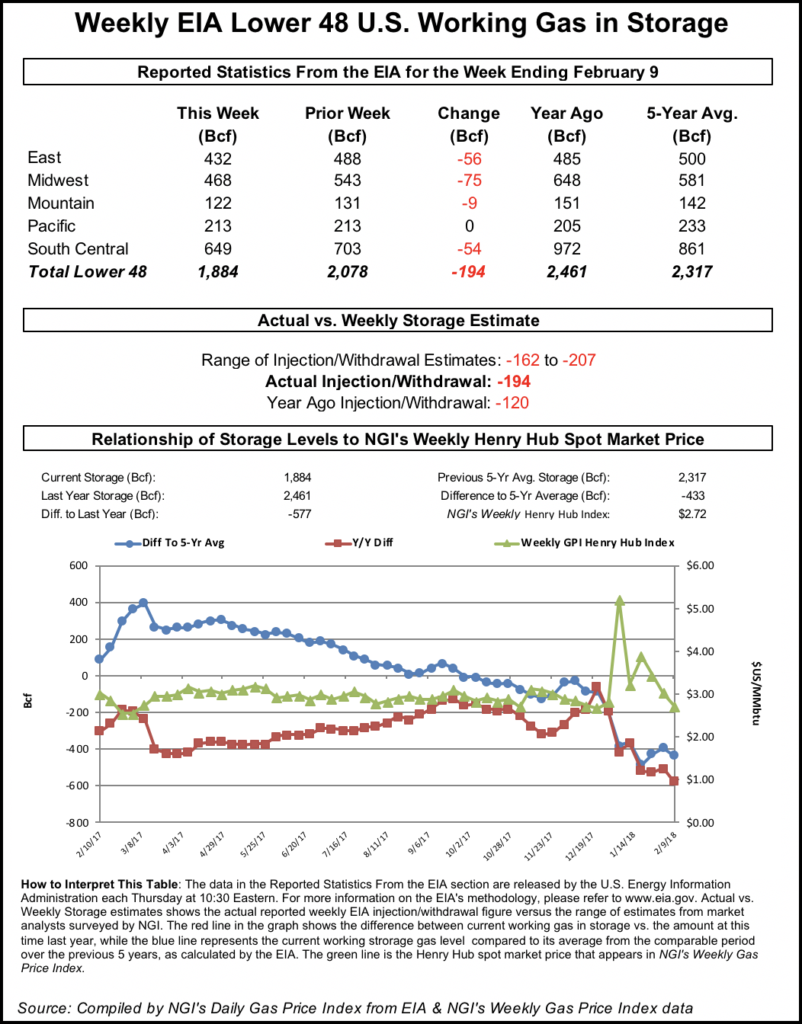

The Energy Information Administration (EIA) reported a net withdrawal of 194 Bcf from storage for the week ending Feb. 9, about 10 Bcf more than consensus estimates. Last year, 120 Bcf was withdrawn for the week, and the five-year average pull for the period is 154 Bcf.

In the minutes following the 10:30 a.m. EDT release, futures inched higher, with the March contract trading as high as $2.605 after hovering in the $2.555-2.565 earlier in the morning. By 11 a.m. EDT, March was trading around $2.583, near even with Wednesday’s settle.

Prior to Thursday’s report, the market had been looking for a withdrawal somewhat smaller than the actual figure.

A Reuters survey of traders and analysts on average had estimated a 183 Bcf withdrawal, with responses ranging from -162 Bcf to -207 Bcf. Stephen Smith Energy Associates had estimated a withdrawal of 183 Bcf, while PointLogic Energy had called for a withdrawal of 179 Bcf.

Kyle Cooper of ION Energy had estimated a withdrawal of 186 Bcf. Intercontinental Exchange futures for this week’s EIA report settled at -187 Bcf Wednesday.

“We see this print as very tight on a historical basis, as it is quite tight for similar gas weeks and even tight on a 10-week average basis,” Bespoke Weather Services said following the release of the final figure. “We see market tightness as at least temporarily counteracting bearish weather revisions overnight, with prices bouncing off the data release as expected.

“Production levels do remain elevated, and we will need more impressive weather to move up into the $2.70-2.75 level, meaning a rally above $2.62 may be ”fade-able’ for now, but it is clear that market tightness is putting in a floor for prices right around the $2.55 level.”

Total working gas in underground storage as of Feb. 9 stood at 1,884 Bcf, versus 2,461 Bcf a year ago and five-year average inventories of 2,317 Bcf, according to EIA. The current year-on-year deficit increased for the week from -503 Bcf to -577 Bcf, while the year-on-five-year deficit increased from -393 Bcf to -433 Bcf, EIA data show.

Analysts with Wells Fargo Securities LLC said they’re forecasting a cumulative withdrawal of 158 Bcf over the next two weeks based on their model and government weather data.

By region, the largest withdrawals came in the Midwest (-75 Bcf) and the East (-56 Bcf). The South Central saw a withdrawal of 54 Bcf, including 46 Bcf pulled from nonsalt and 6 Bcf pulled from salt. In the Mountain region, 9 Bcf was withdrawn, while the Pacific finished flat for the week.

Thursday’s storage number, “based on expectations, should have been bullish,” Price Futures Group senior analyst Phil Flynn told NGI Thursday. “We should have gotten a little bit of a rally. It was big draw.”

Instead, the recent record production numbers helped keep a lid on prices, he said.

“The biggest debate going forward is will demand, which is on the rise, be able to overcome record production?” Flynn said. “…The market is trying to decide how low is low, and looking for any signs that these low prices are going to perk up demand so we can worry less about the impending spring” and a potential supply glut.

Production has recovered in February after being curtailed by freeze-offs in January, analysts with Jefferies LLC wrote in a note to clients Thursday.

“After cold temperatures impacted early January dry gas production, growth has resumed in February,” with production averaging 77.4 Bcf/d through Thursday, “up 0.4 Bcf/d versus the recent monthly high in December of 77.0 Bcf/d,” Jefferies analysts wrote. Appalachia production averaged 27 Bcf/d through Thursday, “just below the December average of 27.2 Bcf/d, indicating that areas outside of Appalachia have driven the 2018 growth.”

The oil rig count has increased by 44 rigs year-to-date as the gas rig count has remained range-bound between 170-190, according to the Jefferies team.

“The Marcellus and Haynesville shales have added seven and four rigs, respectively, year-to-date, while the Utica Shale has lost five rigs over the same time period,” analysts said.

Meanwhile, U.S. natural gas exports to Mexico are on a record-setting pace for the month at an average 4.5 Bcf/d through Thursday versus around 4.4 Bcf/d for November 2017, the previous record month, according to Jefferies.

“Liquefied natural gas (LNG) feedgas flows are on pace to average over 3.2 Bcf/d for the first month on record in February, up around 170 MMcf/d versus the prior record in December 2017,” said Jefferies analysts.

As for the latest winter weather outlook, guidance earlier in the week that showed more potential for cold air to push into the East in late February, while early March was looking less bullish Thursday, according to NatGasWeather.com.

“What remains the focus is when the eastern U.S. ridge that sets up next week will finally weaken,” the firm told clients. “The early week data showed it having decent potential to weaken after Feb. 26-27” but the models have since backed off, “especially the overnight Global Forecast System model, which trended milder to better match the European. The onus is clearly on colder patterns returning across the eastern U.S. to end bearish weather sentiment.”

In the spot market Thursday, most regions recorded only small changes, while an anticipated uptick in demand heading into the weekend helped push spot prices higher in New England.

Weather Underground was calling for temperatures to drop down into the 20s overnight in Boston Friday. After setting a three-month low this week, Algonquin Citygate gained back 61 cents Thursday to average $3.03, while Dracut finished above $4. Tennessee Zone 6 200L added 52 cents to $3.46.

An emergent repair/force majeure on Tennessee Gas Pipeline’s (TGP) Segment 261 near the Massachusetts/Connecticut border that began earlier this month has been extended, Genscape Inc. noted Thursday. In an update posted to TGP’s electronic bulletin board Thursday, the pipeline said work was ongoing and “current estimates now expect a return to service date no later than Monday” (Feb. 19).

The outage impacts 125 MMcf/d of import capacity into the Boston area “but has not affected AGT Citygate or TGP Zone 6 200L prices, likely due to lower than average demand,” Genscape said. The outage, which began Feb. 5, “does correspond to increased imports via Algonquin Stony Point and slight increases from maritimes & Northeast at the northeastern end of the Algonquin system.

“Weather-driven demand is forecasted to remain low until Saturday, with Saturday and Sunday being the only day of overlap with substantial demand and restricted Segment 261 flows,” the firm added. “Between Friday and Saturday, demand is anticipated to climb 0.318 Bcf/d, maxing out at 3.325 Bcf/d.”

Further upstream, Appalachian prices enjoyed strong gains, including a 14-cent increase at Dominion South, which averaged $2.12. Tetco M3 Delivery added 11 cents to $2.30.

Marcellus producers got some potentially discouraging news Thursday as Williams CEO Alan Armstrong revealed during a conference call that the expected July start-up of greenfield compression services for the Transcontinental Gas Pipe Line Co. (Transco) Atlantic Sunrise expansion project may be delayed a few months.

Williams, however, is maintaining a 2018 in-service for the full 198-mile, 1.7 million Dth/d pipeline project, which is expected to open a path for constrained Marcellus gas to reach markets in the Southeast through the Transco system running along the Atlantic seaboard.

In the West, SoCal Citygate tumbled 85 cents to average $3.58, pulling back after several consecutive daily gains this week pushed prices there above $4.

Utility Southern California Gas was forecasting total system demand of 2.803 million Dth/d Friday after previously forecasting demand above 3 million Dth/d.

Genscape was calling for demand in the California/Nevada region to fall to 5.36 Bcf/d by Saturday after totaling 7.66 Bcf/d Thursday.

SoCal Border Average gave up 6 cents to $2.30.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |